Good morning.. US stocks surge in front of the Powell speech later today and bonds have seen a sizeable move over the last few days too (interestingly higher yields). Tech stocks were in huge demand and it seems the Retail market is leveraging up by buying calls in a record breaking rally (the call/put ratio signalling no fear). I guess we have to wait to hear what he says but one thing is clear now; markets will not be here when he is done talking. Before he starts, we have weekly Jobless and continuing claims data to consider and another rise from expectations could see some volatility in many assets. But a quiet one till the claims data.. I am keeping the long gold and long EUR trade recommendations looking to add. With this policy review, it seems to me that the Fed is looking for cover to continue its constant quantitative easing (money printing) campaign. If it says it is going to let inflation run hot, it has that cover/excuse it is looking for to keep rates here or lower. Stocks may love that !!! But it also suggests the Fed will continue to debase the USD. They should be pulling back as the fiscal process takes over. Maybe that is the reason; that the government is doing FAR too little, too late.

Keep the Faith.

Details 27/08/20

US stocks surge again in front of the Powell speech:

–

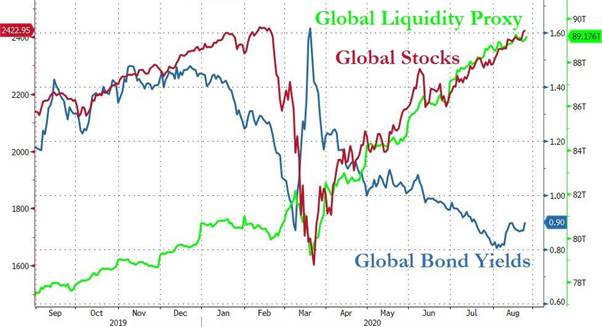

I am not sure if it was the retail demand (Robin Hood) for tech stocks or asset managers but it seems the US markets at least, feel Powell is going to be rather dovish later today. The demand for tech stocks yesterday was incredible, especially for FAANGS. Although Asian stocks last night were very mixed with Nikkei, HK and Kospi all lower and Shanghai, Oz and NZ higher, in front of Powell’s speech, global markets made new highs.

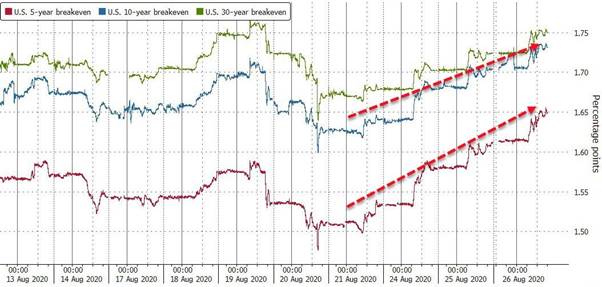

This seems rather strange at a time when global yields are lifting off the lows. No one knows what we will get from Powell but in thin, summer markets, this demand had a big impact. It seems many retail accounts walk in every day and leverage up and buy tech stocks and it is working well for them so far. Interestingly, US breakevens are on the rise too after a very strong 5yr auction which suggests no inflation fears among the buyers.

Breakevens back to pre-Covid.

This move sent real yields a tad lower again; gold rallied and the USD fell again. It seems to me that some of these markets have decided what Powell is going to come up with, which suggests some danger of disappointment and no matter what he says, US bonds are NOT staying here. More rotation was seen in US stocks with tech outperforming small caps by some margin. Of note, the NASDAQ is now 28% above its 200 DMA, the widest spread since 2000. Salesforce was up 26% yesterday alone! But the difference between now and back in 2000 is that the Tech companies that are in such demand are strong and viable companies with huge cash flow, when in 200, the demand for worthless companies was total madness.

I guess if we get a hint that the new policy review recommends lower rates for longer, then stocks will fly and the USD will probably take out recent lows. That will send commodities and precious metals screaming higher. Is this what the Fed hope for? Looking at the option structures in the US stock markets (Call/Put ratios) it seems there is a lack of downside protection as “investors” are buying more calls than puts which I find rather concerning. It is widely believed that the Fed is going to suggest a new way of looking at inflation targeting in his speech or at the next FOMC meeting next month. The trouble is that many economists believe that the way they read inflation in the likes of CPI and PCE, do not tell the real story of what consumers actually experience with inflation. The Federal Government statistical branches publish several measures of inflation. Among the most important are the consumer price index (CPI) and the personal consumption deflator (PCE). Accuracy is the most important criterion of inflation measurement, and both the CPI and PCE fail badly on this basic principle.

The use of non-market prices creates accuracy problems for both measures. Both measures base their estimates of housing inflation on what people would pay to rent their house, and not based on actual transaction prices. But the PCE, which gets 70% of its prices from the CPI, also includes items or services provided to people by business and government. That creates another measurement issue because these items are not “sold” to the consumer. For years, there have been calls to restructure how inflation data is gathered but the US authorities have always refused to do so. It seems to me that this may be deliberate but I am not sure why. The whole process looks flawed for something taken so seriously which drives monetary policy. The Fed has got no where near their 2% target for PCE for years. Talk to the man on the street and he will tell you a very different story and surely that is what matters. It raises the idea that the Fed is setting policy on poor data. But if the Fed decides that policy should be tied to average inflation and maybe “Full employment” also, then this would send a very clear message to markets that rates will be here or lower for a very, very long time. Stocks will love it and the USD debasement will continue to erode the value of the USD’s purchasing power.

The Fed’s announcement on March 23rd that it would start buying corporate bonds and bond ETFs set off a huge rally in the bond market, including in the junk-bond market. The rally started before the Fed ever actually bought the first bond which is what the Fed probably wanted, as the Fed actually hardly bought anything by Fed standards. But the announcement was enough to trigger the biggest junk-debt chase in the shortest amount of time the world has likely ever seen. And it kept the zombies walking, and it generated a whole new generation of zombies too and many are being kept afloat (again excuse the pun attached to the following but I couldn’t help myself). Carnival, the largest cruise-ship operator, with a deep-junk credit rating of triple-C, and whose revenues collapsed to near nothing as all its cruises have been cancelled, while the restart of its cruises gets pushed out further and further. Well, in early August, it sold its third bond issue since the Pandemic: $900 million in junk bonds, with a yield of nearly 10%. Royal Caribbean, the second-largest cruise-ship operator, issued $3.3 billion in junk bonds in May.

So, I ask myself, what is the collateral for these cruise-line bonds? Cruise ships, among other things. But the value of these cruise ships today is very hard to ascertain, beyond scrap value, because until cruises are back in full swing, whenever that may be, if ever, cruise ships are just a huge expense; leaking cash on a daily basis. But no worries the Fed has your back; right? The point I am making is that Zombies are over-leveraged, very risky companies with a business model that is not self-sustaining – meaning it needs to constantly raise new money from new creditors to pay existing creditors. How is that sustainable and how can it end well? Some junk-rated companies have been able to issue bonds in the United States in recent weeks at yields below 3%. These companies have a relatively high probability of default, and they will need to borrow more money in the future, or else they will default, and investors are lending them money at record low yields that for now, barely beat inflation, and leaves almost nothing to compensate them for credit risk. The Fed is fiddling with how capitalism is supposed to work. Without this self-cleansing process, capitalism can no longer function. Risky things need to be allowed to blow up, investors need to be allowed to take losses, and yes, markets need to be allowed to go wild, which reminds investors in the future to be more prudent. Alas, it seems the Fed will not allow that; but can they stop it? That is the huge question.

Why is the Fed so keen to keep rates so dangerously low and the balance sheet expanding? With this policy review, it seems to me that the Fed is looking for cover to continue its constant quantitative easing (money printing) campaign. If it says it is going to let inflation run hot, it has that cover/excuse it is looking for to keep rates here or lower. It is always about lower for longer and it is always about keeping the printing press running 24/7. But the only inflation we have now is in asset prices and Housing in the US. They should be pulling back as the fiscal process takes over. Maybe that is the reason; that the government is doing FAR too little, too late. The concentration of the seven largest stocks is now $8 trillion. That is larger than most countries, by the way. Without them, the S&P 500, the broadest benchmark stock index in the country, would be down. Main St is still being left far behind Wall St and this wealth divide does have serious implications which are being borne out on the streets of major cities.

The reason you have seen as much interest as you have in gold, comes down to something very simple. We are in a speculative bubble right now. Whether you are talking about junk bonds or the stock market, everything has gone completely haywire. But for a hedge against that and the continued debasement of the dollar, gold is a very viable vehicle. Looking at what the Fed seems to be preparing for us, I can only assume that gold looks rather cheap still. The USD is also about to react to the new policy from the Fed if indeed they do take the route of average inflation targeting. (All Fed speakers seem to agree a change is required and running inflation hot is OK now). But the Fed realises surely, that all their policies now, with rates close to zero, have little impact on the economy. The real economy needs fiscal stimulus but the Fed can’t stop pumping more and more into asset markets via the banks. This is just wrong and as the Japanese have found out, becomes impossible to reverse. The governments are partly to blame for being slow and miserly with fiscal responses sooner but what the Fed is creating here is scary in my view and will be socially very damaging.

Positions. A nice dip in EUR yesterday and I hope some of you added to your longs. I think the stop is in the right place on the technical side of things as we do not know exactly what Powell will tell us today. I remain bullish on Gold and we have a stop at level anyway. I will let the dust settle for a while before commenting on what Powell says but one thing is for sure as markets have moved quite a bit into his speech and that is most markets will not be here afterwards.

—————————————————————————————————————-

Strategy:

Macro:.

Long Gold @ $1875 Stop at $1875

Long EUR @ 1.1805 look to add lower with stop at 1.1690.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Home

Home