Good Morning.. Another mad day ahead in all likelihood and it will be interesting to see if all the pension fund rebalancing and the front running of that is nearly done now. Equities are lower and it is starting to feel rather nervous again for equities. Some easing in the credit and funding space is encouraging a lower USD and the Fed actions are simply massive. I continue to see the USD lower over time but this is no easy one-way bet. EU leaders failed to agree on what basically should be how a union works and this could be looked back upon as an existential moment for the EU. This is not good enough but highlights the reluctance of the wealthy helping the wounded in the family. Italy, Spain and the rest of the periphery, may never forgive them. I am still of the opinion that EURGBP can fall further and would look for a small bounce to sell into again around .9100 ish. I feel that .8500 cannot be ruled out in time. The USD move may just be starting looking at what the Fed are prepared to do. We have some spending/income and PCE data from the US later but it is for Feb. But it is month end so a choppy one is expected and it’s also a Friday so, “Be careful out there”…

Keep the Faith…

Data.. All Times GMT

09:00.. Italy Consumer confidence March Cons: 100.5 Prev 111.4

12:30.. US Personal Income Cons: 0.4% Prev: 0.6%

US Personal Spending mom Feb cons: 0.2% Prev0.2%

US PCE Core Feb m/m Cons: 0.2% Prev: 0.1%

US Core PCE yoy Feb Cons: 1.7% Prev 1.6%

14:00.. US Univ. of Michigan Confidence (Final) Cons: 90.0 Prev: 95.9

Details 27/03/20

The USD top is in:

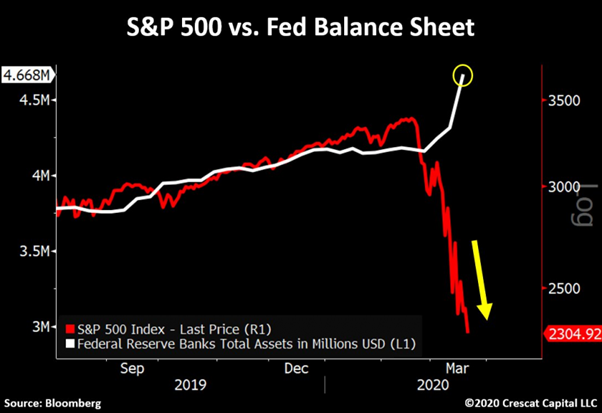

The USD has seen a steep fall since the Fed went all-in and to be honest I am not surprised at all and the break in the DXY at 101.15, the upside breakout of the range, suggests to me that a top is now in place. The break of 101.15 saw an acceleration to 99.32 in double time and it pushed lower overnight extending to a low of 98.84; That is a big move in one day. It was a pretty brutal move taking the broad USD a lot lower, EUR through 1.1000 and Cable above the 1.2130 resistance I had targeted (it pushed on to 1.2300). There is nothing wrong with bagging some profits in Cable up here above 1.2200 but I do still feel that on a macro basis, we may see Cable higher over time. To me the Fed has made a huge difference to the USD and this move is still in its infancy but don’t get me wrong, this is no easy, one-way bet. On a macro basis, I could even see Cable back close to 1.3000 in time. This is not going to be an easy trade to hold and for those still long, you should bring stops up to 1.2000.

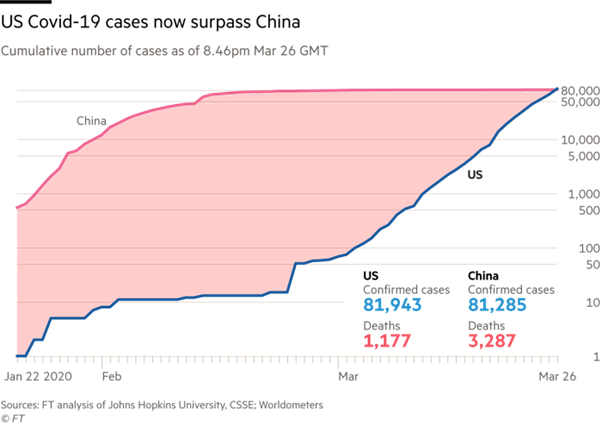

For those of a less macro view, take profits here above 1.2200 as I am sure you will get another chance to buy lower but for me the USD rally is over. Resistance in EUR is now all the way up at 1.1496 but I think EUR may lag the GBP move and EURGBP could eventually hit .8500. I am looking to short EURGBP if we bounce back to 9100. With regard to US stocks, I still think a lot of the euphoria is based on Pension fund rebalancing which may last through today but a lot must have been done now surely and the reality of the crisis facing US firms is realised as the virus count mounts and surpasses those if Italy and China with 81,943 Americans now testing positive for Covid-19.

The ECB, Fed, BoE and many others have gone all-in to add whatever they can regardless of cost (EU bonds rocketed higher yesterday in a joyful burst of front running the ECB). Whether this is enough to counter the dramatic and tragic stats still to come from those not at peak virus yet, remains to be seen. You won’t see a chart like this for a while:

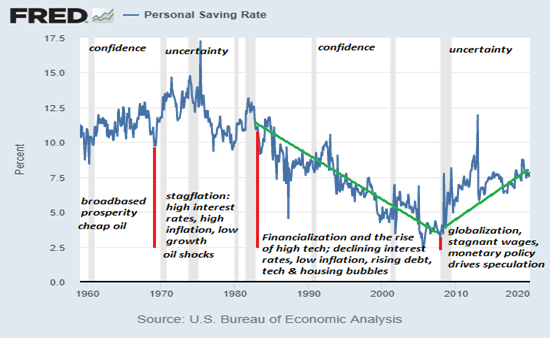

I will be interested to see how stocks fare into the month of April. But the damage is becoming apparent in the data, as US weekly Jobless claims surge 3.28mln; a record by some margin. To be honest, I am not sure what to make of that data and wonder if it really matters in the long run; but lives are changing for many across the globe and sentiment and confidence may be beyond repair. In times of uncertainty, people save more than spend and there is an obvious feedback loop here: if people feel confident about their future prospects and have a measure of certainty about the general economic trend, they spend more, borrow more and speculate more, all of which feed the expansive mood that then encourages further spending, borrowing and speculating. We are in the reverse of that and it may take time to heal.

Consumers are battening down the hatches and are to some extent scared. This is one reason why monetary policy extremes won’t revive growth, real or fictitious: the uncertainty that was launched in 2009 is only deepening; the wound has cut deep.

I have had a beef about the rating agencies for a while; but man have they been busy and rightly so to be honest. They have unceremoniously chucked a load of established businesses in the Junk bin and rightly so and I am not sure at all they have finished. The risk is still in the credit space but the Fed is providing huge liquidity directly now so it will be interesting to see if this eases some pressure in credit and the stress in the funding space. Ford became the biggest fallen angel in the current cycle (and second largest ever) when S&P downgraded the auto giant to junk. BofA calculates, net downgrades (downgrades less upgrades) so far in March have totalled $284BN, with the Energy sector leading ($85bn, or 30% of the total), followed by Autos following Wednesday’s downgrade by both Moody’s and S&P ($81bn) and Aerospace/Défense ($33bn). Companies are not what they used to be and the fragility of many is laid bare. In terms of actual rating events, S&P has already done 565 downgrades this quarter, up from 351 in 4Q and 281 in 1Q last year. Watch this space.

With people locked into their homes, a lot of businesses simply cannot function and nor can the property market and, in the UK, banks are pressing for a full suspension of the housing market after the UK government told buyers and sellers to delay transactions because of the coronavirus outbreak. Banks are also clearly concerned about granting credit when the economy is in freefall, according to senior bankers. Properties can no longer be valued or visited by potential buyers and I would think lenders are worried about a house price collapse and are not keen on lending at all. A number of banks and specialist lenders have already withdrawn new mortgages to focus on existing customers and reduce pressure on call centres that are low on staff. I would think any lending would need to have a huge deposit of about 40% to make a lender comfortable but it makes sense to suspend moving all together for a while at least. But lending to any borrower, whether it be a personal loan, or a business loan is now high risk.

Meanwhile EU leaders “Fiddle while Rome burns” and still cannot agree on how to tackle this issue. This is an existential moment for the EU and is part of why I think EURGBP may fall further. I have been saying for years that without a banking and bond union, the entire dream is in danger of imploding as the rich nations like Germany do not want, and have never wanted, a wealth transfer system that bleeds them dry bailing out the weak. EU member states clashed over the extent to which they should pool their resources in the fight against the economic fallout from coronavirus, as Germany and other northern states rejected calls for the introduction of joint bonds. The peripheral nations may never forgive them. A post-meeting statement mandated the Eurogroup to report back in two weeks with proposals for a joint response, but leaders did not lay down any preferred options. That is simply NOT good enough and this is supposed to be a union where they work together, for each other; clearly it is NOT. They have been tested and failed.

The reality is clearly something different and the EU is about to be tested like never before and it is politics that could now destroy the dream. I can see a rise in populist parties that now actively stand against the EU. According to a French Official: Pres Macron told to the EU Leader Block the virus is risking the “death of Schengen”; it’s risking more than that M. Macron. They need to sort this out now but there is clearly a deep divide. Meanwhile a number of EU states want the bloc to go much further. On the eve of the summit, an alliance of nine member states wrote to Charles Michel, the European Council president, calling for the creation of a common debt instrument. The signatories, which included France, Italy and Spain, wanted the new bonds to be of “sufficient size” and a “long maturity” to bankroll spending on healthcare and post-corona economic reconstruction. Belgium, Ireland and Portugal were among the other countries backing the push. The idea was quickly shot down by northern member states, however, which have long resisted the idea of joint debt issuance. Following Thursday’s summit, Dutch prime minister Mark Rutte said there were “no circumstances” in which the Netherlands would accept Eurobonds. There you have it; so much for a union.

Elsewhere the worlds governments act and in Australia last night, Prime Minister Scott Morrison has announced a plan to “hibernate Australian business” during the coronavirus crisis, highlighting there is a “burden to share” on all Australians as the economy suffers. Stocks got battered 9% at one point. “You can’t run a country without an economy. We are doing everything we can to ensure we maintain as much of that economy as we can through this crisis, to support all of the essential services that are so necessary at a time like this.” Maybe the EU leaders need to realise that! The exact details of the hibernation plan haven’t been fleshed out, but it’s expected to include rental issues that have been bubbling away in the background of the crisis. Is this action enough? Many doubt it, which is why stocks got hammered. The government stand accused of doing too little too late. “The idea is simple – there are businesses which will have to close their doors. They will have to keep them closed either because we have made it necessary for them to do so, or simply there is just not the business to keep their doors open,” Mr Morrison said.

Having said that, the US appears to be something of an exception and Trump looks likely to gamble. The US is the only nation whose leader explicitly questions the trade-off between economic growth and saving lives. Second, America is unique in lacking a clear policy. It seems his quest to get re-elected trumps (excuse the pun) all else, including thousands of lives. Politics is still the game in the US and not the fight against this dangerous, debilitating virus. Some states, such as New York, California, Washington and Connecticut, are enforcing lockdowns. Most are Democratic. Exceptions include Ohio and Maryland, whose governors are Republican. Quite how Trump’s rating are still up here is mind-boggling. The US is now the epicentre of the problem and the economy is going to feel it whether he locks it down or not. Companies will shutter and people will lose their jobs in their millions. They may never forgive Trump.

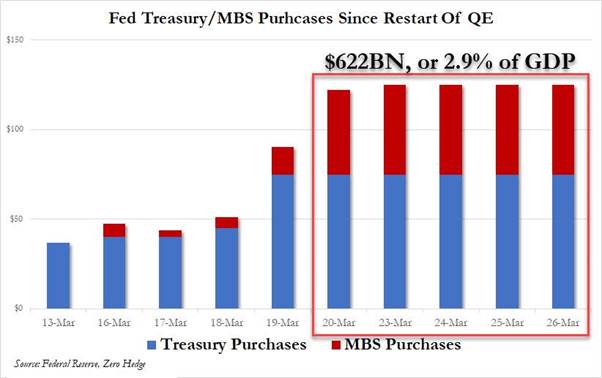

Meanwhile the central banks have gone further then most would have expected and the Fed particularly so; with the Fed buying $622 billion in Treasury and MBS, a staggering 2.9% of US GDP in just the past five days. This is why I remain bearish the USD. It won’t move in a straight line but it is going down, which may actually help the battered global economy. But there is still some stress in funding markets which will create some pockets of strength.

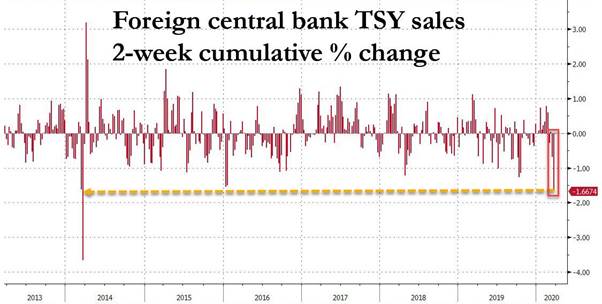

The Fed has unleashed an unprecedented debt (and deficit) monetization program, one which is there to ensure that the trillions in new debt the US Treasury has to issue in the coming year to pay for the $2 (or is that $6) trillion stimulus package find a buyer, which with foreign central banks suddenly dumping US Treasuries may not be possible.

Bloomberg made a good point yesterday; “core investor tenets such as what constitutes a safe asset, the value of bonds as a portfolio hedge, and expectations for returns over the next decade are all being thrown out as governments and central banks strive to avert a global depression”. The problem for bond investors is that all this stimulus and a supply shock, could see inflation strike in the future. It seems an extreme thought now but I am sure it is possible and bonds are forward looking.

Bond investors don’t know which way to turn with the Fed so active. You have enormous buyers of debt meeting massive coordinated fiscal stimulus by governments across the globe. For bond investors, you’re caught between a rock and a hard place. Powell said Thursday the central bank will maintain its efforts “aggressively and forthrightly” saying in an interview that the Fed will not “run out of ammunition” after promising unlimited bond purchases. His comments came hours after the European Central Bank scrapped most of the bond-buying limits in its own program. This is massive and the full impact of this is yet to be seen. I am not sure at all that the fall in the USD has finished. It may just be starting. Behind all this intervention lies a couple of problems. The irony is that the more securities the Fed soaks up, be they Treasuries, MBS, Corporate bonds, ETFs or stocks, the worse the liquidity will get, as the BOJ is finding out the hard way, as virtually nobody wants to sell their bonds to the central bank. Then what? I have said that CBs would end up copying the BoJ with YCC and in a roundabout way the Fed is doing just that. Normally the prospect of a multi-trillion-dollar government spending surge globally, ought to send borrowing costs soaring. But central bank purchases are now reshaping rates markets – emulating the Bank of Japan’s yield-curve control policy starting in 2016 – and quashing these latest volatility spikes. The Japanese template is being adhered to. Equity buying next?

—————————————————————————————————————-

Strategy:

Macro:.

Long Cable at 1.1675.. Stop Moved to 1.2000..

Looking to sell EURGBP on a rally back above 91.00.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.