Good Morning… A lot of chatter regarding month-end USD selling and I guess if true, quite a bit was done yesterday. But the DXY is breaking down now through 98.90support and now below the 200dma. I think this could continue but I do see GBP struggling to stay with the pack as final Brexit talks loom large and AUD too, as we have Trump’s press conference on China today. I do NOT think markets are pricing in the souring of US/China relations and they may get a shock, especially if Trump suggests sanctions or tariffs on HK or China. Could we see capital flight from HK? That may impact the peg. There is quite a bit that markets seem to be blinkered to right now and any whiff of a return to trade sanctions and stocks could be in for a very bad time as there is so much speculative euphoria in stocks. China is starting to have battles all over the place and keep an eye on the joint China/India border skirmish going on and comments from China on Taiwan. These are serious geopolitical events in the making and no one is looking. US Trade balance, personal spending and income along with Core PCE all due later so could be a choppy day and it’s a Friday so, “Be careful out there”..

Keep the Faith..

Details 29/05/20

Markets fall as Trump plans to hold a news conference Friday on China: Month end:

–

Something of a rare sight was seen last night; US equities closed lower. It’s been a while since I have said that and we even saw further losses overnight in Asia. I think some of this at least is the fact that Trump has scheduled a press conference to update us on his plans for China after the HK law issue. This should unnerve investors as again this is pitching the two big super-powers against each other and relations are souring badly. Into the US election, I can only see this worsening and I am never quite sure how far Trump may go with this. Yesterday and to a lesser degree overnight, we have seen some steep losses on the USD and there is a danger that month-end distortions press hard again today on the USD as models suggest bond buying and USD selling, I am told. However with such a big move yesterday, I just wonder how much has already been done.

Regarding equities, it has been an interesting month as we have seen outperformance in European stocks. In fact, a huge gap opened up between European and US equity performance this month (DAX up 8%, USA up around 4.4%), which may impact. Traders made decent money last month with the knowledge that USD selling was required at month end and we may see more of that today but clearly some of this was done yesterday. The DXY broke 98.90 support yesterday and never looked back; breaking below the 200 dma! The widening Bollinger bands suggesting this move could extend and I think it may.

Again this brings the AUD short into some danger but the stop has held so far and with Trump talking China today, we may see a reaction in AUD. Within this USD sell-off, I still think GBP may underperform and EURGBP looks set to test and break .9000 and begin a new leg higher in my view as the UK enters final rounds of talks with the EU next week. On the data side of things, we saw the Lloyds monthly business barometer fall to -33, matching a historic low back in December 2008. I would think tough rhetoric from both sides into these meetings may see investors start to fear a hard exit, even if this may be the “art of the deal”. But the clock is ticking for both sides.

I really do not think investors are pricing in the potential fall-out from Trump “upping the ante” with China. This has global implications which could easily spill into asset markets. There is a danger that Trump starts focusing back on sanctions or tariffs which, as we all know, is very bad for global trade (and impacts the likes of AUD) at a time when global economies are already very weak. HK sent a clear message (indirectly straight from China) to keep out of the internal debate over new national security laws being imposed by China and warned that withdrawal of the financial hub’s special status under U.S. law could backfire on the U.S. economy. HK alluded to the fact that from 2009 to 2018, the U.S. trade surplus of $297 billion with Hong Kong was the biggest among all Washington’s trading partners, and 1,300 U.S. firms were based in the city. A veiled threat? It is very interesting and rather worrying to see how far foreign democracies will go to support HK residents who clearly feel HK is being engulfed fully by China and may become just another Chinese City. To be honest, this process started some time ago but the inevitable may have caught up with HK now.

There are a couple of things to consider here and one is what this move does to capital in HK and whether it starts to fly out looking for a safer haven and what that may do to the peg. The other issue is how far the US and China will go in protecting it. What will Trump use to show his dissatisfaction and what will the response be from China? We are already seeing a weakening CNH. But any whiff of a return to trade sanctions and stocks could be in for a very bad time as there is so much speculative euphoria in stocks now. Today could be a pivotal point for global markets if Trump is prepared to play hard ball over this. The response from China may not be targeted just on the US as the security legislation was condemned also by Britain, Australia, Canada and others. Japan said it was “seriously concerned”. Britain said it would give greater visa rights to British national overseas passport holders from Hong Kong unless China suspends its plans. Rather worryingly, Kudlow said: “If need be, Hong Kong now may have to be treated the same way as China is treated, and that has implications for tariffs and that has implications for financial transparency and stock market listings, and related matters.” That is not priced! If that is where the US administration is headed, then look out.

Just to add a little spice to the background music, China said on Friday that “one country, two systems” and “peaceful reunification” is the best way to bring China and Taiwan together. Outside attempts by foreign forces to interfere in “reunification” will fail. This is interesting as the US is making plans to sell arms to Taiwan and has upset China with this. China is making veiled threats in a few places now including on one of India’s borders (keep an eye on this). International relations with China are souring and the last thing a fragile global economy needs are the US and China becoming nationalistic and protectionist. That is very damaging and I have been banging this drum for a while as the impact is global and will hit global asset markets in time. I am thinking downside options in global equities of your choice may be needed now in the portfolio. At least hedge as I am getting very concerned about the blinkered approach to investing right now. There appears to me to be a very large disconnect between stock-market valuations across the globe and underlying geopolitical concerns and company fundamentals looking forwards. I just cannot see how stocks hold up in all this, especially if Trump does announce something on trade. The recovery was going to be fragile at best without all this going on.

I am also concerned with the ugly scenes in Minneapolis which are, to put it mildly, worrying. The danger here is that social unrest starts to spread as the poor still see no benefit from Fed and government policies and the wealth divide is starting to matter. Keep an eye on this if this starts to spread. The issue for me is that markets may love seeing central banks pump markets with liquidity but in all honesty, they are fixing the things that don’t matter at the cost of the things that do. The job losses hitting the US are going to hit the poor the hardest and I think a lot of them may have had enough. It is not a market thing yet; but it could be a cancer that grows within the US. Talking of pointless liquidity pumping, it appears that CBs are prepared to embrace the template used by the BoJ. This is nuts. Lets just look at where it has got Japan as we had some data last night. Japan Apr Ind Prod: -9.1% m/m vs -5.1% cons-Japan Apr Retail sales -13.7% y/y vs -11.5% cons-Japan Apr Unemployment rate: 2.6% vs 2.7% cons-Japan Apr Housing Starts: -12.9% y/y vs -12.15 cons. Great work and this with massive QE, YCC and ETF buying and now the world’s central bankers are blindly following this mad policy which will only juice the stock markets and not help those that need it. Pretty shameful really.

Meanwhile, all that seems to matter is that valuation multiples have persistently moved higher. With 1Q just about done, using 2020 estimates, the operating P/E for large-, mid- and small-caps are currently 27.5x, 28.3x and 95.6x (no typo). Earnings estimates are as of Wednesday last week likely heading a lot lower. This all of course, due to the Fed as money continues to be printed and stuffed firmly into equity markets. The retail buying has been huge and the Fed will be responsible if this destroys them eventually. But the Fed is talking of doing more and it seems the balance sheet knows no bounds and YCC is being touted by a few Fed speakers now. All central banks seem on the same path as the BoJ. It got them nowhere for goodness sake. There is moral hazard everywhere I look created by Fed policies. Japan’s Finance Minister Aso said; the country’s fiscal position will get worse, aiming for tax revenue to increase by reviving the economy rather than increasing tax rates. What? Good luck with that Aso San. More QE needed (ha). Monetary policies seem no longer targeted at the economy but the stock markets and that is simply wrong, as we can see in places like Minneapolis.

The bear facts of what is happening in the US right now is that what we are dealing with today is an economic disruption, the proportions of which are historically unprecedented. That means an unfathomable number of workers are not getting paid and therefore consumers are not spending, businesses don’t collect that revenue which destroys their profit levels. Business investment drops hard and on top of that both consumers and businesses are far more likely to save and act differently than before. Fed pumping liquidity into the system is not going to change that and they cannot fix a solvency issue. The stock market, like many commentators are saying the government’s done more than enough, perhaps too much (inflation). That all depends first upon the scale of the hole and no one knows how deep it is yet. It could be the abyss we are looking into!

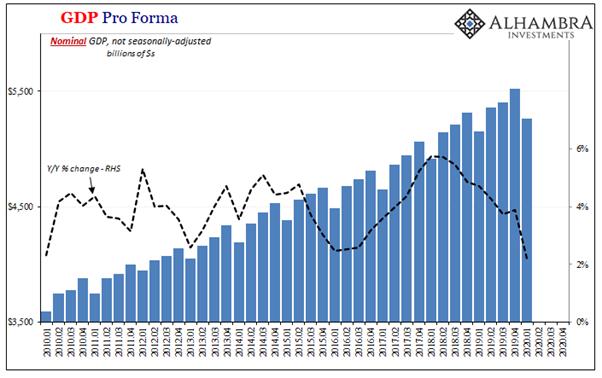

As you can see above, the trend in US output was unfavourable to begin with. The American economy, like the rest of the world, slowing down considerably before the end of 2019. If everything goes just perfectly, including the best economic “growth” ever seen in Q3, we’ll be lucky if it totals up to be a repeat of the 2008 and early 2009 experience in the economy.

That’s not a “V” and just the scale of these numbers were a big reason why the Great “Recession” didn’t produce one, either. The money the Fed keeps printing never finds its way to the people who need it most; don’t they get that? I think they probably do but seem to think a buoyant stock market can prevent economic chaos; good luck with that idea.

—————————————————————————————————————-

Strategy:

Macro:.

Short AUD @ .6550. Stop @ .6685.

Short GBPJPY @ 131.95 Stop at 133.20

Long EURGBP @.8978 looking to add @ .8940.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.