Good Morning.. Japan and China were closed so thin trading conditions last night but stocks reacted to the weak close on Wall St Friday and I think this could continue. DAX and the EU stocks set to catch up (down actually) after being closed Friday. The AUD and EUR fell overnight and I think both could extend these moves and we saw JPY crosses all move lower which helped my AUDJPY short recommendation and I have added at 68.25 this morning. The EUR has a busy week with German Law makers ruling on QE, the 7yr budget to be agreed and the rescue package delivery. But I think equity investors are getting a little spooked by Trump playing the blame game with China and bringing up trade war talk again and this looks likely to go on. Commodity currencies remain weak and oil is lower this morning. Manufacturing PMI across the EU but for the major economies it is a final reading. But I think investors are starting to realise that even with peak virus possibly behind us, the chances of a V-shaped recovery are disappearing fast.

Keep the Faith..

Details 04/05/20

I think it is finally starting to dawn on equity investors that a V-shaped recovery is NOT what we are going to get: EUR seems high to me.

–

The S&P closed on Friday down 2.8% at 2830 and for me we are in danger of breaking down technically which would match my rather bearish fundamental view and for me at least, that is a decent reason for caution on risk. A break of the mid-Bollinger point on the daily at about 2813, could signal a move to the lower band and that looks rather likely to me but the bands are narrowing which suggests some sideways action first. We broke lower last night in thin trading with Japan and China closed for Golden Week.

But the fundamentals and a seeming shift in confidence keep me thinking that stocks are far too high and interestingly, investors like Buffet are not only not buying companies at present but announcing they have dumped airline shares; all of them! He, like me, feels that some things are going to remain “changed” for some time and that the definition of “cheap” is not yet applicable to many companies; some are certainly not going to survive this and the US Transportation index is likely to have a very nasty session later. If we are lucky, we may get something similar to a Nike Swoosh rather than a V and I have never been convinced of this rather euphoric equity rally based so much on hope and CB activity. Even with many nations seeing peak virus, the damage has been done and consumer sentiment damaged. An unlocking of economies is not going to see a rapid return to normal and we may yet be facing a “new normal” and who knows what that will look like?

The USD fell hard at month end and in some cases remained weak, especially against the EUR which held solid gains all through Friday, even as the likes of AUD and all the commodity currencies fell hard. The AUD was particularly singled out as Trump started taking shots at China and reminded investors of the on-going trade war and overnight we tested the mid-Bollinger range which held initially.

My AUDJPY short started yielding fruit and I remain bearish and as previously suggested, happy to add to shorts on a sustained break of 68.25 (here) but I am also not convinced by this EUR strength, even though the techs do support this move now. We have this week, the 6th May deadline for the EU leaders to agree to a 7year budget but also to agree on how to deliver the rescue package and that package on closer scrutiny looks less beneficial than the headline suggests. I still feel that any Euro bond is out of the question and for years I have suggested that no banking union or Euro bonds then no EU. That may yet still be the case and the EU is facing an existential moment here. Is EUR strength based on a belief that these idiots will do as they often do and find some fudge of a compromise at the 11th hour? To be honest, they have to or else a lot of things could start to move which may not be possible to reverse. The UK momentum to leave is a point of example. Can the EU set a 7yr budget that suits all 27 nations; rich and poor and the UK will no longer be putting into this bottomless hole? This rally in the EUR and indeed the whole USD sell-off may be a huge gift, especially if I am right and stocks do give up the ghost and fall.

Also, German Lawmakers are due to rule on the legality of the European Central Bank’s quantitative easing programme. I think most of us had forgotten about this but there is no guarantee that they will pass it as legal! The ECB is not subject to German law, but the Bundesbank is the largest shareholder in the ECB. A “No” ruling from court on Tuesday would therefore take the eurozone into legally uncharted territory. There is a general belief that while the Lawmakers may huff and puff, as indeed they have before, they will allow this but as I say, it is not 100% assured. Will they now want to rule on the PEPP as well, as some believe the PEPP does not obviously meet the legal criteria set in previous court rulings. Who knows what little surprises this may throw up? Mind you, the EU is adept at bending the rules as we all know and many interpretations of law could be seen to get round this.

There are already many nations within the EU that are flaunting EU rules on spending and deficits; deficit rule violation is across the board (at least Spain admits it!). Spain and a few others including Italy need so much more and remember that Italy has been in recession just about the whole of its life within the EU. In Spain, the Government anticipates a recession of 9.2% and an increase in unemployment to 19% and its deficit is expected to soar. I found this interesting and is in part how I see the slower recovery from all this as things will not be the same for a while. The Spanish government seems to agree and said that the government now maintains that the recovery will be asymmetric; in 2021 everything lost will not be recovered. I agree with that and it applies across the EU and the global economy. Italy is facing an even worse time. Otmar Issing (Remember him of the ECB) writing in FAZ, argues that this emergency was no excuse for law-breaking. He accuses the ECB of monetary financing and says that a mutualised Euro-bond is illegal unless formally accepted by national parliaments. He has a point and I think Germany and the Netherlands will stick to their guns on this.

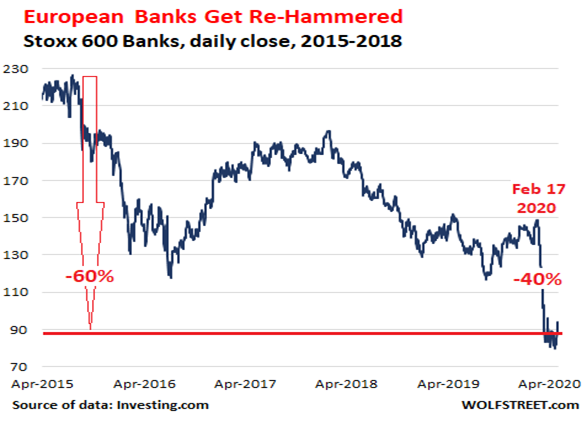

A huge political battle is brewing, as Spain wants another bailout and Eurobonds; Germany wants neither. Italy needs a huge rescue which no one can afford! Don’t get me wrong as there is some solidarity in the EU but with Spain and Italy against Germany and the Netherlands and there lies the problem. Are these differences surmountable? Only if someone is prepared to break but never waste a good crisis is a mantra that may spur Italy and Spain to fight harder. I can only assume that there are risks here and thus this EUR rally to 1.100 looks a bit strange unless someone knows something! Again, the one thing that the EU leaders or the ECB cannot deal with is a shift in politics and here we are starting to see some early warning signs. I note with interest that Fabio Rampelli (Vice President of the Chamber of Deputies of Italy since 2018) removed the EU flag from his chambers and replaced it with the national one. Italy has rarely had a stable government and many voters may be very frustrated with the EU. Could a politician offer a referendum as part of a campaign soon? I think it is more possible now than ever before but the problem is, would either Italy of Spain be better off out? It would certainly be painful for all involved not least local banks who hold so much local debt but as the UK found, political momentum can run and run. I addition, EU banks have not fully recovered from 2008 and many still have toxic derivatives on debt-stuffed balance sheets. Italian banks have been huge buyers of Italian debt; front running the ECB.

The EU banks have started reporting earnings and all are having to provision for huge losses on corporate defaults. Many asset managers have piled into EU banks thinking they were cheap; they were cheap for a good reason.

Unlike the US and the Fed, the ECB couldn’t care less about bank stocks, as long as the banks themselves don’t collapse. The ECB’s primary focus is on keeping the Eurozone together, a task that is growing more difficult by the day. The numbers being put aside to battle the Tsunami of corporate defaults is huge and the banks are massively exposed but non-bank lenders may be even more so. After all the free money the ECB is shoving at the banks, it is worrying they are still down here. Do we have a banking crisis coming in the EU? All the big EU banks have the same trades on and one of the biggest was short Vol! Have they learnt nothing from 2008 and yet the ECB bails them out time and time again?

That’s what happens when CBs remove price discovery and send all the wrong moral hazard messages. Central banks are destroying capitalism as we know it as how can you have capitalism with socialised markets that tell us nothing and where there is no price discovery or sensible risk pricing of high-risk assets? As we head into a recession, the central banks can hardly cut rates any further. Things are supposed to break, repair and be reborn stronger and adapted to modern times but the Fed wants to keep everybody that has overleveraged, taken massive risks and borrowed up to their eyeballs alive. To my mind and despite all this, we may see the USD start to climb again if the global outlook sours. The trouble with a stronger USD is that the EM space collapses and contagion spreads like a virus across the global economy. One virus is enough thanks and I am very concerned about how we are now following Japan down a dead-end. BoJ policy, for all its size, has not managed to fix Japan’s problems. Why would it be different for the rest of us and our demographics are not that dissimilar now. I can’t see how this ends but we need a reset but the cost of that seems too much for the central banks and the politicians that need to stay in power. To dwell on that is enough to keep one awake at night.

Trump is clearly looking to deflect any blame from himself for this hit to the US economy and he has chosen China to take the hit. This is not good news for anyone and a resurgence of the trade war could cripple investors and the global economy further. Could there be a worse time for this? We have seen the fall in commodity currencies and we may see more but this is also bad news for the EU with such exposure to China. But those exposed to China and China itself have another problem with the very real threat that we may be passing peak globalisation. That gives China a massive problem coming up and I am not sure they can prop up the whole economy for long. There is a real threat that after such an impact that the reliance on China is at the very least diluted somewhat and many nations are turning politically more inward or insular, especially Trump. Businesses will be moved and supply chains re-jigged by many major nations. More of a spread of exposure as it were.

Those so reliant on China like Oz and the EU may be in for a shock and this could stifle growth. European Union trade commissioner Phil Hogan has called on companies to consider moving away from China; US President Donald Trump’s top economic adviser Larry Kudlow has said the government should pay the costs of American firms moving manufacturing back from China onto US soil; and Tokyo has unveiled a US$2.2 billion fund to tempt Japanese manufacturers back to Japan or even to Southeast Asia. But conventional wisdom suggests globalisation makes the world a better place to live as a whole, as free trade generally promotes global economic growth. Economic liberalisation creates jobs, makes companies more competitive, and lowers prices for consumers. Advances in technology and communications have made it easier than ever for people and businesses to stay connected. This could be a negative impact for global growth for some years.

—————————————————————————————————————-

Strategy:

Macro:.

Long USDCAD 1.4140. Stop 1.3850ish.

Short AUDJPY @ 69.25 added at 68.25 and Stop at 70.25 recent high.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Home

Home