1. Forex Market Insight

EUR/USD

The euro fell by 0.73% against the dollar to 1.1325. The 1-month volatility touched a new yearly high of 5.685%.

Meanwhile, the euro was largely unaffected by data showing that German investor confidence hit a six-month high in January, and that confirmed cases of Covid-19 are expected to fall in early summer, allowing economic growth in Europe’s largest economy to accelerate.

Technical Analysis:

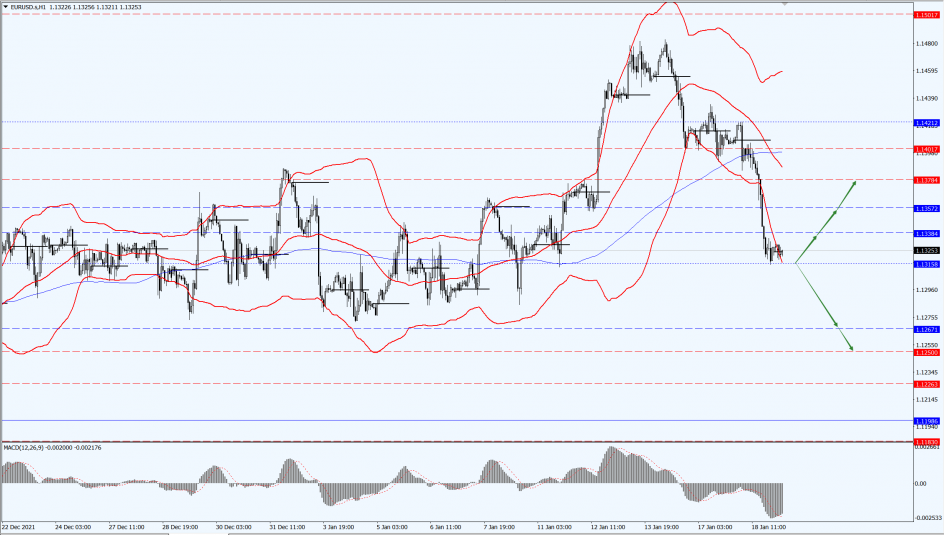

(EUR/USD 1-hour chart)

Execution Insight:

Today, focus on the support strength of the 1.1315-line. If the euro runs steadily above the 1.1315-line, then pay attention to the suppression strength of 1.1338 and 1.1378 above. If the euro strength breaks below the 1.1315-line, then pay attention to the support strength of the two positions of 1.1267 and 1.125.

GBP Intraday Trend Analysis

Fundamental Analysis:

The dollar index rose for the third day in a row, the longest streak since last November. The index rose by 0.53% to 95.75, the biggest gain since 3rd January 2022. As a result, the pound fell by 0.3% against the dollar to 1.360, the lowest in a week.

Technical Analysis:

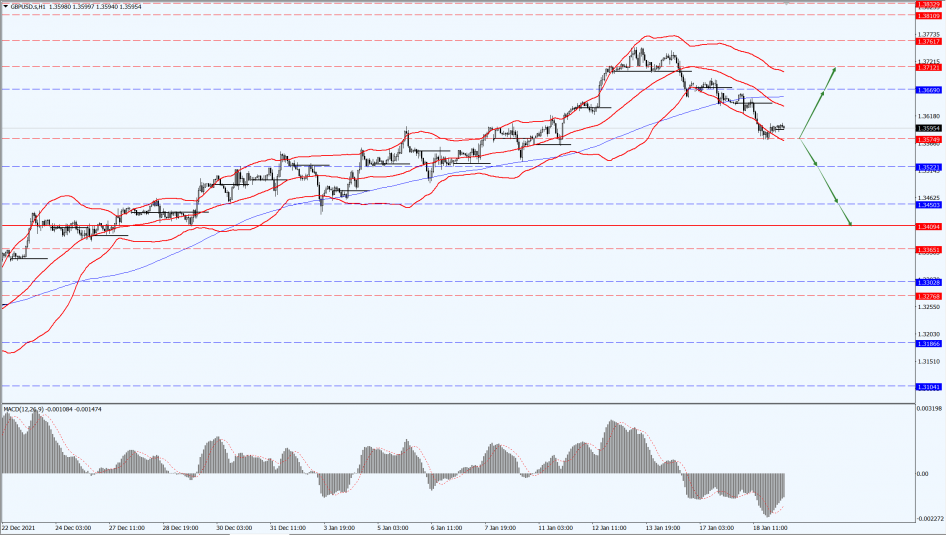

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3574-line today. If the pound runs above the 1.3574-line, it will focus on the suppression strength of the 1.3669 and 1.3712 positions. If the pound runs below the 1.3574-line, it will pay attention to the support strength of the 1.3522 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose slightly yesterday, 18th January 2022, as traders weighed the outlook for monetary policy against the threat posed by a new round of U.S. outbreaks.

In addition, gold prices were supported by tensions in the Middle East and a slow economic recovery. The focus during the day will be on the Bank of Japan’s interest rate resolution.

Technical Analysis:

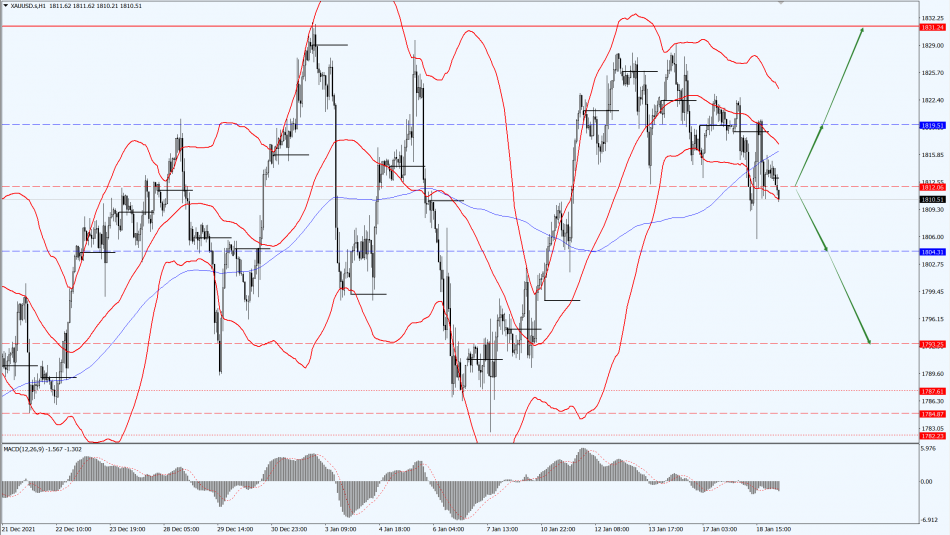

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1812-line today. If the price of gold runs steadily below the 1812-line, then it will pay attention to the support strength of the two positions of 1793 and 1804. If the gold price breaks above the 1812-line, it will open up further upward space. At that time, pay attention to the suppression of 1831-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices extended their gains yesterday, with the main U.S. crude oil contract rising to its highest level since October 2014 at $86.31/barrel and the February futures contract touching a high of $86.97/barrel.

Supply concerns were exacerbated by geopolitical tensions in the Middle East against a backdrop of strong demand and tight supply, in addition to OPEC’s optimism about demand in 2022 fueling oil price gains.

Technical Analysis:

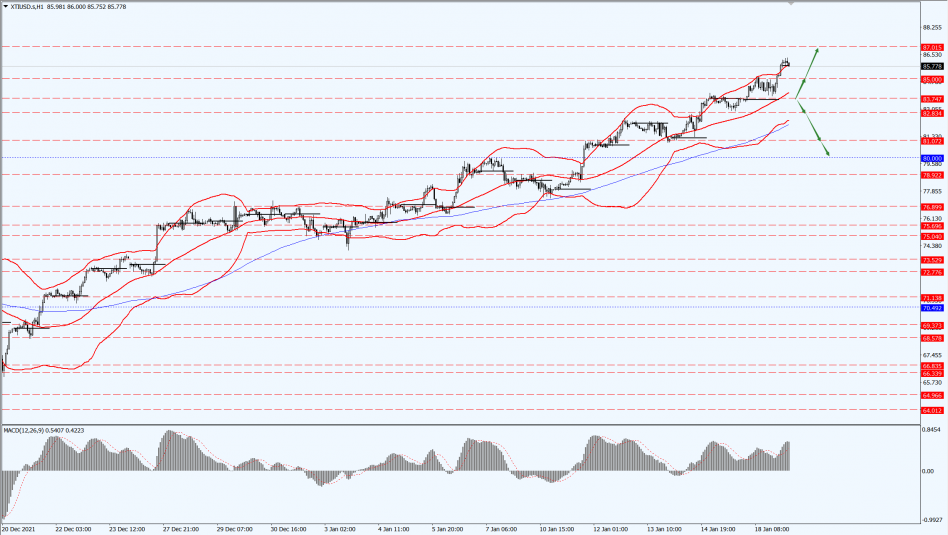

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices extended their gains yesterday, with the main U.S. crude oil contract rising to its highest level since October 2014 at $86.31/barrel and the February futures contract touching a high of $86.97/barrel.

Supply concerns were exacerbated by geopolitical tensions in the Middle East against a backdrop of strong demand and tight supply, in addition to OPEC’s optimism about demand in 2022 fueling oil price gains.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home