1. Forex Market Insight

EUR/USD

A weaker dollar and cooling market concerns over the Asian outbreak boosted the euro to a 1.15% gain against the dollar Thursday, 1st December 2022 closing at 1.0525.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0529 line today. If the EUR runs below the 1.0529 line, then pay attention to the support strength of the two positions of 1.0440 and 1.0275. If the strength of EUR rises over the 1.0529 line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, jumped 0.8% in October, in line with economists’ expectations, data released Thursday 1st December 2022 showed.

The September reading was confirmed as a 0.6% increase. The personal consumption expenditures (PCE) price index rose 0.3% in October, matching September’s gain. In the 12 months to October, the PCE price index rose 6.0%.

Other data showed that U.S. manufacturing activity contracted in November for the first time in two and a half years, and U.S. construction spending fell in October. November employment data due out on Friday is the next major concern for the U.S. economy.

The decline in the dollar led to gains in non-U.S. currencies, with the pound rising 1.64% against the dollar on Thursday, topping the key 200-day SMA around 1.2147 to close at 1.2253, hitting an intraday high of 1.2310, the highest since June 27.

Technical Analysis:

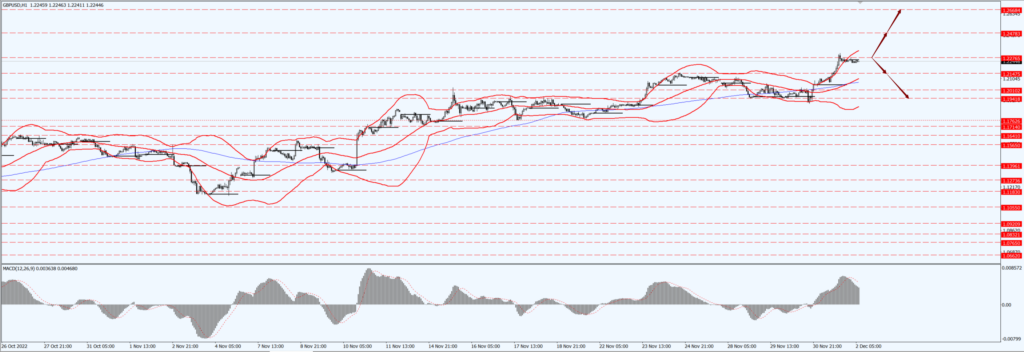

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1941-linGBP is mainly focused on the 1.2276-line today. If GBP runs below the 1.2276-line, it will pay attention to the suppression strength of the two positions of 1.2147 and 1.1941. If GBP runs above the 1.2276-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose 2% Thursday, 1st December 2022 rising through the key $1,800 an ounce level, as the prospect of a slower pace of interest rate hikes by the Federal Reserve and signs of cooling U.S. inflation pushed the dollar weaker. Spot gold climbed 1.8% to $1,800.69 an ounce, having earlier touched the highest since Aug. 10 at $1,803.94.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1768-line today. If the gold price runs below the 1768-line, then it will pay attention to the support strength of the 1747 and 1727 positions. If the gold price breaks above the 1768-line, then pay attention to the suppression strength of the two positions of 1783 and 1793.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled mixed Thursday, 1st December 2022 trading stuck in a narrow range after rallying earlier in the session on the back of a weaker dollar and hopes for improved fuel demand.

After three consecutive weeks of declines, the two major indicator crude futures remain on track for weekly gains this week. Brent touched $80.61 on Monday, 28th November 2022 the lowest since Jan. 4. The dollar touched its lowest since August, which brought support to oil prices for most of Thursday after Federal Reserve Chairman Jerome Powell said the pace of interest rate hikes could slow this month.

The prospect of a lower price ceiling for Russian oil is also providing support. EU governments on Thursday tentatively agreed to set a cap of $60 a barrel on Russian seaborne oil and to establish an adjustment mechanism to keep the cap at 5% below market prices, an EU diplomat said. The Organization of Petroleum Exporting Countries (OPEC) and the allied OPEC+ coalition of oil producers will meet online on Dec. 4, and a policy change is considered unlikely.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil Oil prices focus on the 82.78- line today. If the oil price runs above the 82.78 -line, then focus on the suppression strength of the two positions of 84.06 and 85.47. If the oil price runs below the 82.78 -line, then pay attention to the support strength of the two positions of 80.13 and 79.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home