1. Forex Market Insight

EUR/USD

In the current market environment, the euro’s role as a financing currency appears to be inhibiting the upside of EUR/USD as investors resume betting on risk. With restrictions in Germany and other eurozone countries already weighing somewhat on the eurozone’s growth prospects and the ECB sticking to a generally moderate tone, the euro may come under more pressure regardless of the popularity associated with the Omicron variant.

Technical Analysis:

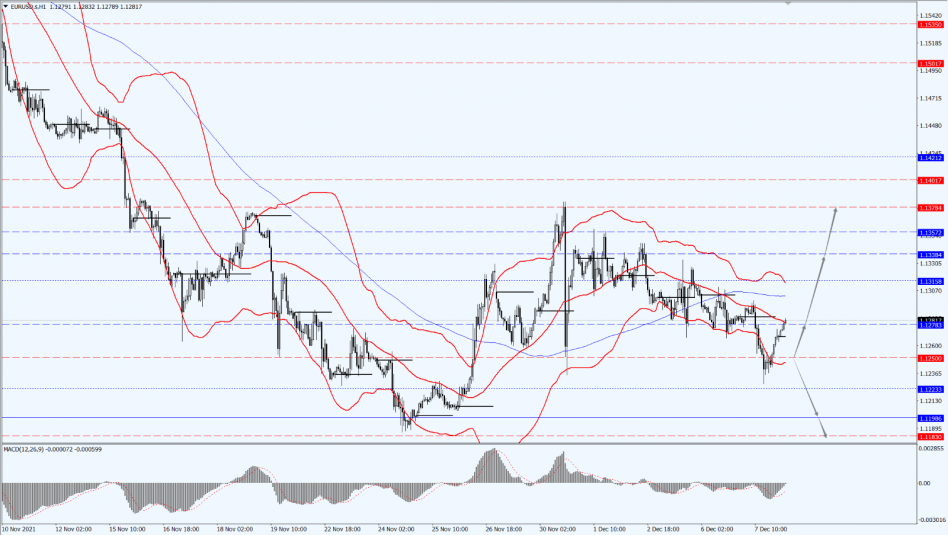

(EUR/USD 1-hour chart)

Execution Insight:

Today, we are still paying attention to the 1.1250-line. If the euro runs stably above the 1.1250-line, we will see the continuity of the euro’s rebound strength. At that time, we will pay attention to the suppression of the top 1.1338 and 1.1378 positions. If the euro strength drops below the 1.1250-line, then we will pay attention to the support strength of the two positions of 1.1198 and 1.1183.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell by 0.15% against the dollar to 1.3244; held near 2021 lows on rising expectations that the Bank of England will keep interest rates unchanged next week.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is still mainly focused on the 1.3409-line today. If the pound runs below the 1.3409-line, pay attention to the support of the 1.3186-line. If the pound strength rises above the 1.3409-line, then pay attention to the suppression at the 1.3450 and 1.3522 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose slightly yesterday, supported mainly by inflation expectations and geopolitical concerns, as investors focused their attention on U.S. inflation data due out this week, which could influence the pace of Fed rate hikes.

However, higher risk-taking sentiment and rising U.S. bond yields have deterred bulls from betting big. The main focus during the day will be on the U.S. October JOLTs job openings and the Canadian interest rate resolution.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold still pays attention to the 1784-line today. If the price of gold runs below the 1784-line, then pay attention to the support of the 1768 and 1760 positions. If the gold price rebounds above the 1784-line again, it will open up further room for rebound. At that time, pay attention to the suppressive strength in the two positions of 1804 and 1812.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose nearly 2.5% on Tuesday, as market concerns about the impact of the mutated strain of Omicron on global fuel demand eased further, and the lack of optimism in the Iranian nuclear talks provided momentum for gains.

Intraday focus on the U.S. JOLTs job openings in October, the U.S. EIA crude oil inventory changes for the week ended December 3, and news related to the Iranian nuclear negotiations.

Technical Analysis:

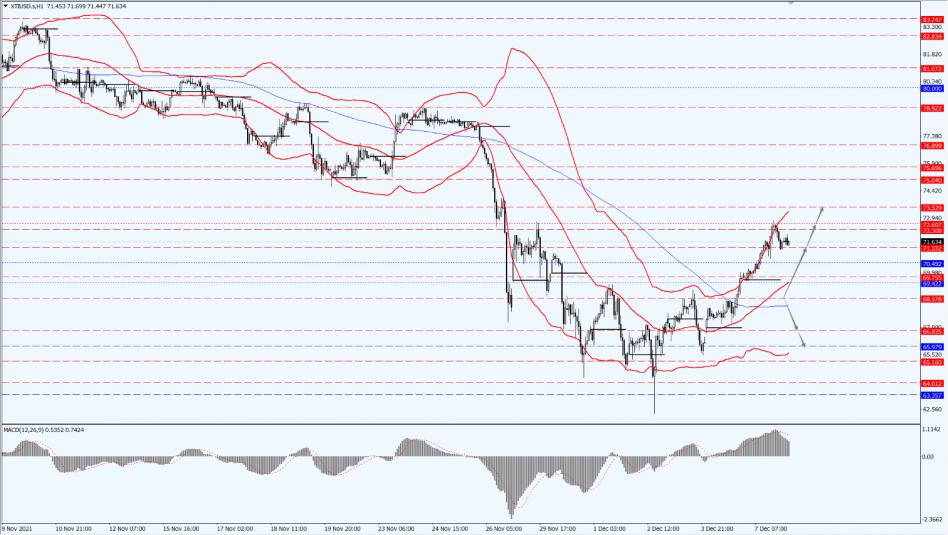

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 68.57-line. If oil prices run above the 68.57-line, the pressures at 72.60 and 73.52 will be followed in turn. If the oil price drops below 68.57, further downside space will be opened. At that time, we will pay attention to the strength of support at 66.83 and 65.97 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home