Since the beginning of 2023, AI stocks in the U.S. have been rallying over 30%, pushing the NASDAQ Index to new yearly highs, ending the 2022 bear market. While on the other hand, the HSTECH Index, which tracks Chinese tech stocks, has been heading in the complete opposite direction.

This has baffled many investors, who are wondering where is the Chinese AI frenzy.

Is the U.S. already winning the AI race? Or do the Chinese have something up in their sleeve?

In this article, we will go in-depth exploring and analyzing some important charts and data that will clear up some uncertainties and help us properly assess the U.S.-China AI race. Additionally, we will go over some important economic figures, market and public sentiment data, and recent news on monetary policy, which could have a big impact on the market. And finally, we will identify the current most important Chinese AI stocks that investors need to watch.

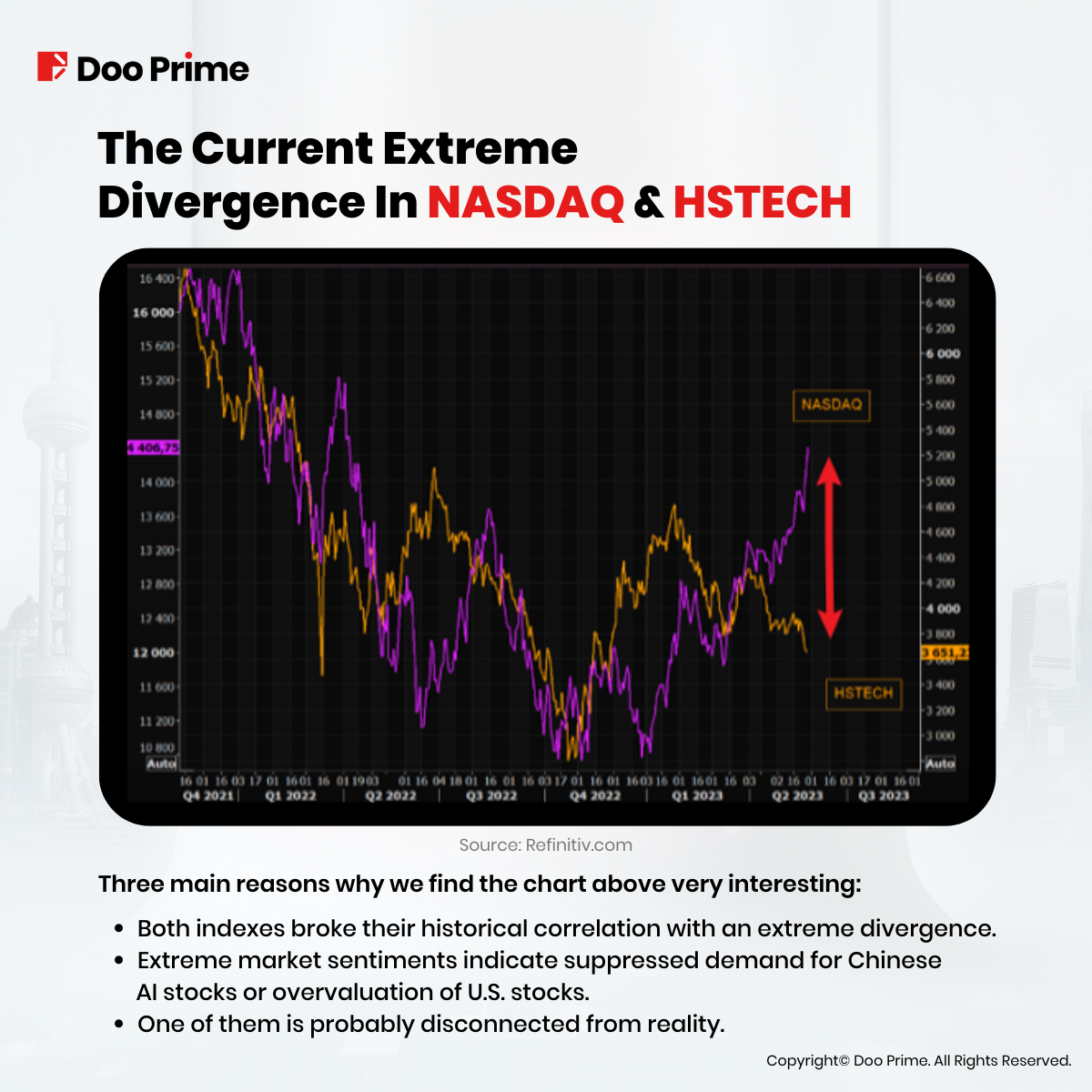

The Current Extreme Divergence In NASDAQ & HSTECH

Three main reasons why we find the chart above very interesting:

- Both indexes broke their historical correlation with an extreme divergence.

- Extreme divergence leads to extreme market sentiments. It could either mean a lot of repressed demand for Chinese AI stocks or a lot of euphoric valuations regarding the U.S. stocks.

- One of them is probably disconnected from reality.

This raises speculation that a possible reversal could be on the cards in the near future. If this happens, it could either lead to significant gains for Chinese AI stocks, or huge losses in the NASDAQ.

But the ultimate question remains: which market is the “wrong” one?

Is the NASDAQ Index in a euphoric state? Or is the HSTECH Index significantly undervalued?

To answer these questions, we must analyze the data below to have a better understanding.

The U.S.-China AI Race Is Far From Over…

Since 2020, Chinese tech giants, including Alibaba, Baidu, and Tencent, have been at the forefront of this AI revolution. They have invested in more than 79 AI large language models and poured resources into cutting-edge technologies and innovation.

China is investing heavily in research and development, and it is creating a more favorable environment for tech companies. As a result, we can expect to see the gap between U.S. and Chinese tech continue to narrow in the coming years.

Alibaba recently began rolling out its ChatGPT-style technology which features very similar to its rival and in some aspects even more enhanced.

Baidu’s Ernie is another rival to ChatGPT. The company has recently invested USD 145 million in AI research and development. This investment is a sign that Baidu is serious about competing in the AI race with the potential of making significant advances in the coming years.

Tencent is also investing USD 250 million in a Chinese startup MiniMax, working on AI solutions like the Microsoft-backed ChatGPT.

All of them are working towards one common goal, which is to be the best AI innovator in the market.

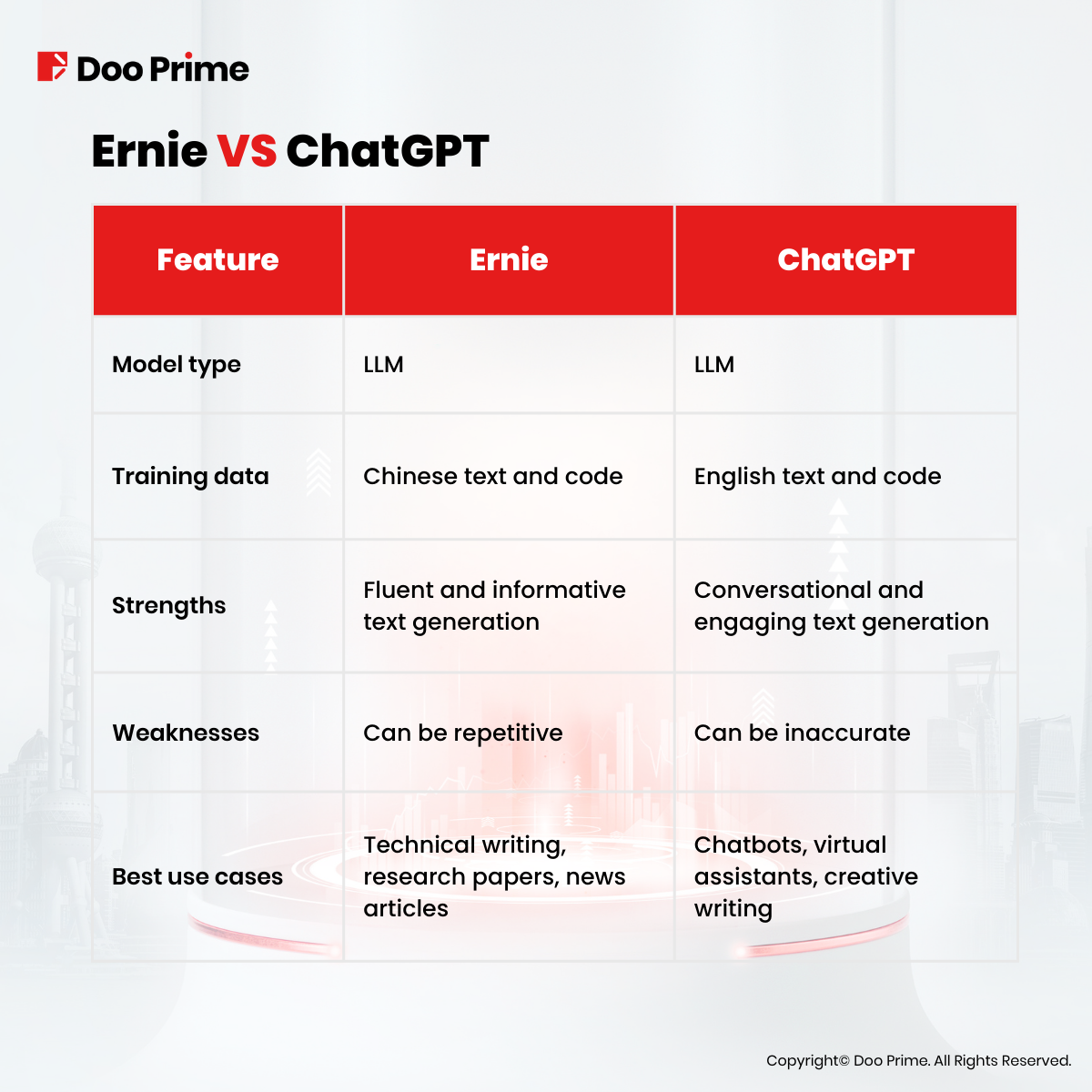

Ernie VS ChatGPT

The question is not about which AI language-model is better? The real question investors need to ask is whether Ernie or any other Chinese AI language-model can rival ChatGPT?

The following table summarizes the key differences between the two models:

Both of these language models are still in the early stages of development. Each model has its own strengths and weaknesses. It is difficult to say which one is certainly better, and perhaps even unnecessary. But can they rival each other? Absolutely yes!

Combining all these facts together, we can conclude that the Chinese AI industry has the potential to compete with the U.S.-made ones. Making things clear that the U.S.-China AI Race is just beginning…

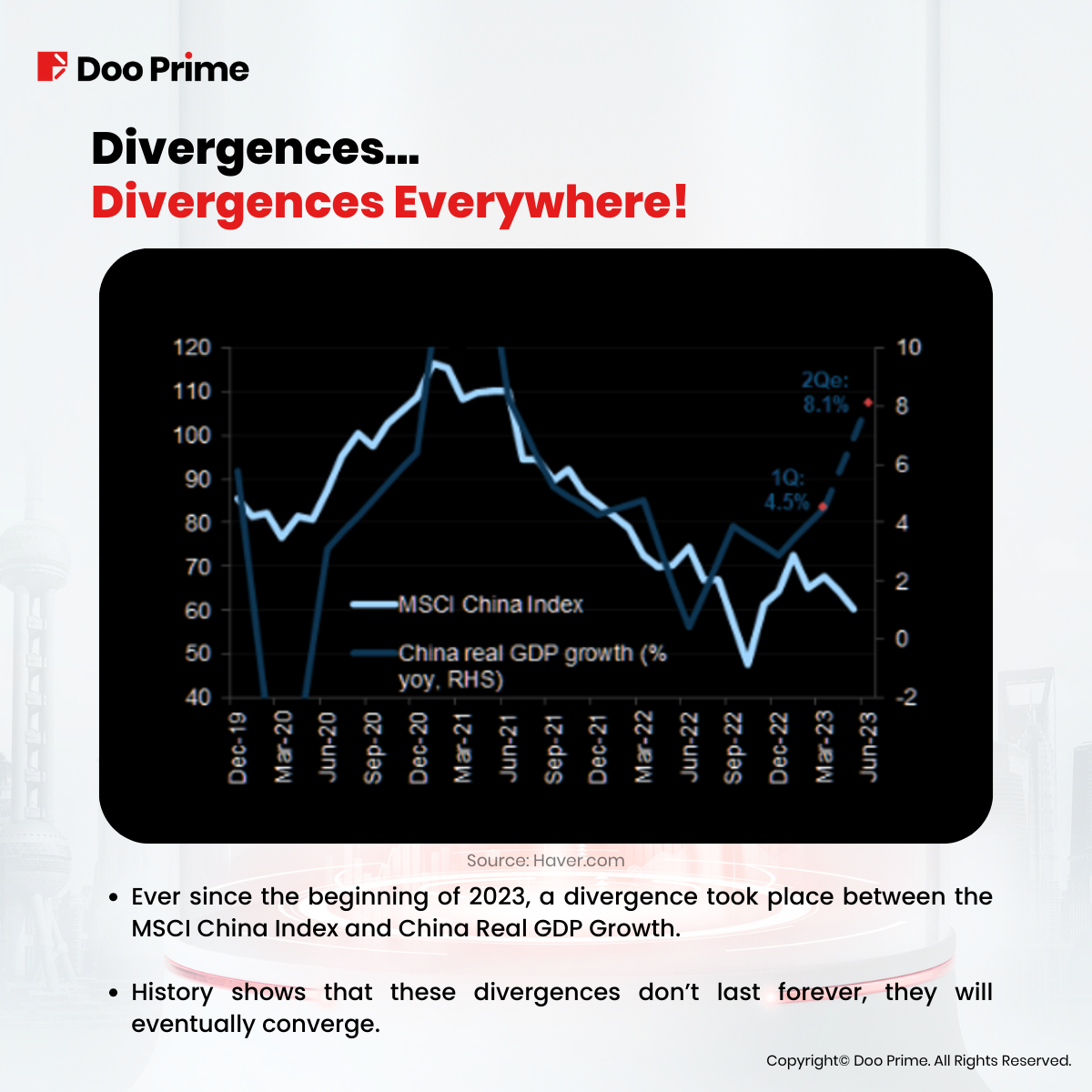

Divergences… Divergences Everywhere!

Source: Haver.com

- Ever since the beginning of 2023, a divergence took place between the MSCI China Index and China’s Real GDP Growth.

- History shows that these divergences don’t last forever, they will eventually converge.

Despite the falling stock market, the Chinese economy is showing signs of recovery. On the above chart, we can see the real GDP growth is setting up for a potential reversal higher, with a projection of continued growth towards 8.1% in the second quarter of 2023.

Goldman Sachs also shares the same sentiment with this forecast, revising their own projection to 6%. If these economic figures materialize and the GDP goes to higher levels, it could instill a renewed sense of confidence among investors in the China market. As a result, this will potentially lead the MSCI China Index to regain momentum and catch up with the GDP growth.

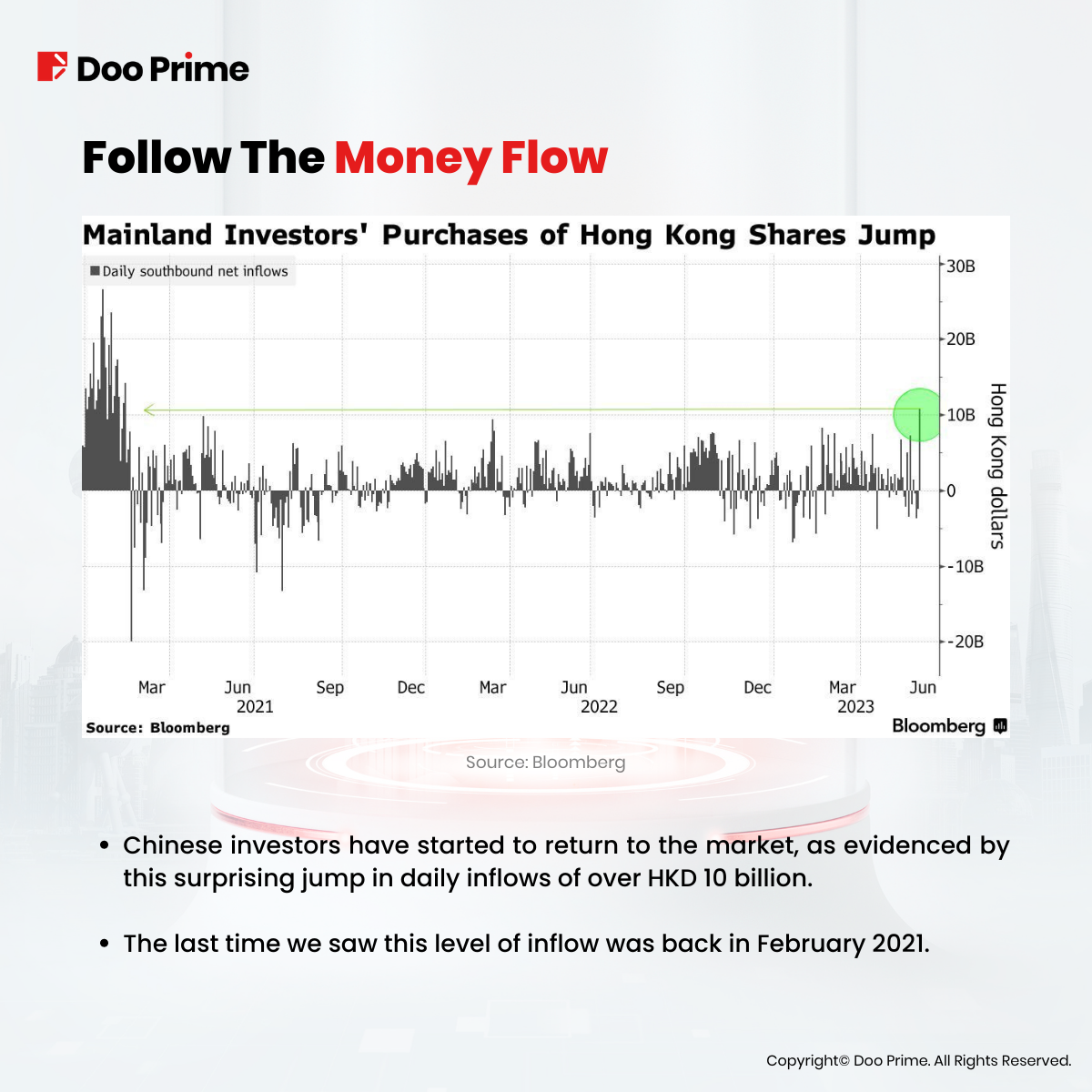

Follow The Money Flow

- Chinese investors have started to return to the market, as evidenced by this surprising jump in daily inflows of over HKD 10 billion.

- The last time we saw this level of inflow was back in February 2021.

To understand the real underlying reason behind this sudden inflow, we need to investigate it further and find out what could be the fundamental catalyst behind this event.

Around the same period of this inflow, reports have started to circulate suggesting that Chinese rate-cut expectations are growing, and some economists are estimating that People’s Bank of China will cut key rates for the third time this year as soon as next week. Any policy easing will be a sign that the government is committed to reaccelerate economic and potentially stock market growth in Q3.

It feels like the Chinese stock market needed a fundamental nudge to kickstart this possible move to the upside. If this is true, then HSTECH has a lot of catching up to do.

Additionally, as the gap between these two extreme sentiments grows, low value stocks naturally become more attractive for long-term value seekers. According to Bloomberg reports, JPMorgan recently added more Chinese shares to its portfolio saying, ‘stocks are too cheap to ignore’.

If other investment banks follow JPMorgan’s lead, it is likely that the Chinese AI market will see further growth.

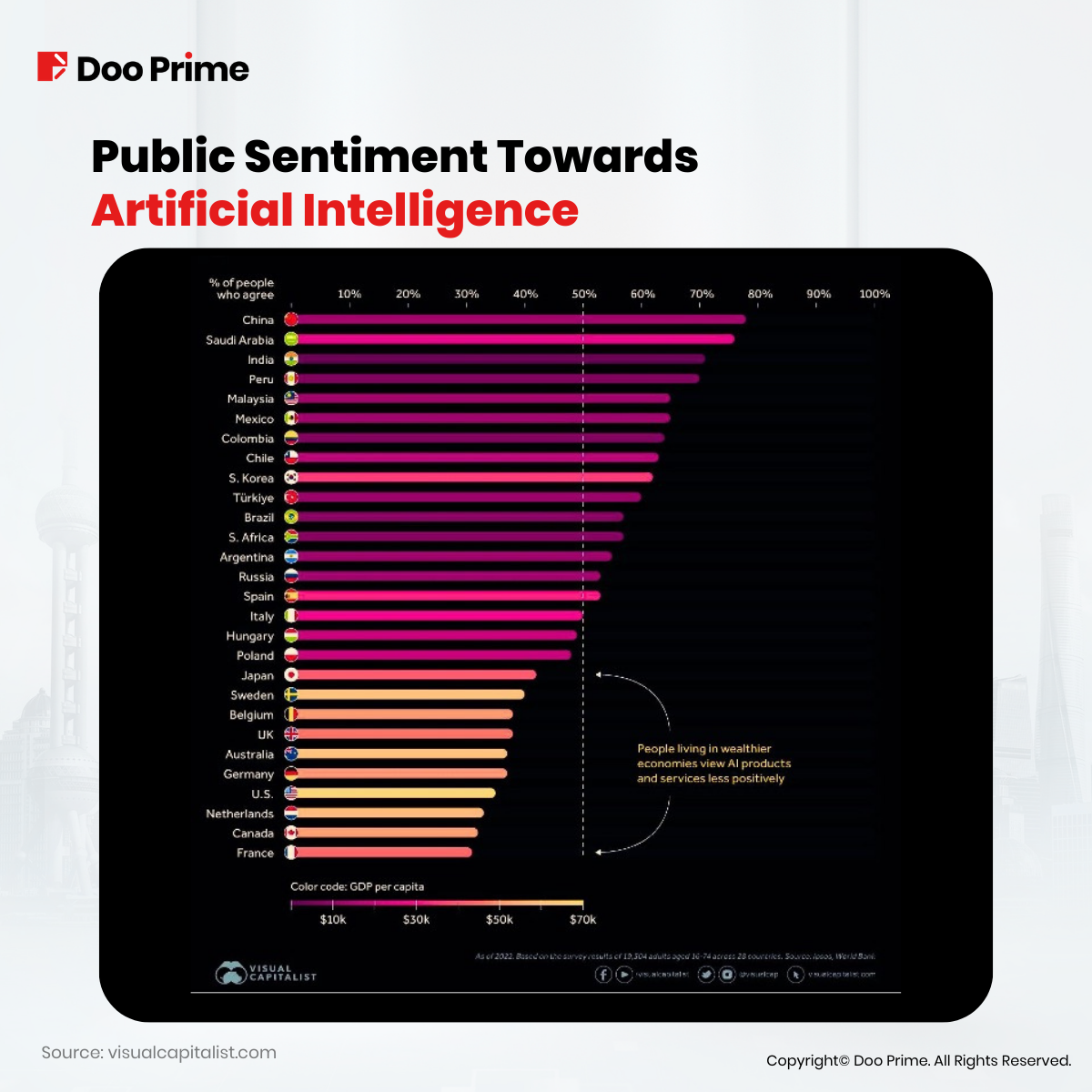

Public Sentiment Towards Artificial Intelligence

A recent survey done by Ipsos on 19,504 adults from 28 different countries, asked them the following question:

“Do products and services using AI have more benefits than drawbacks?”

China was the most optimistic country among them all with a close to 80% of people seeing AI having with more benefits than actual drawbacks.

The U.S. was surprisingly towards the bottom of the list with only 40% of the people viewing AI as a positive force in the economy.

Source: visualcapitalist.com

The public in China looks readier to accept AI being integrated in their lives and much more optimistic than the U.S.

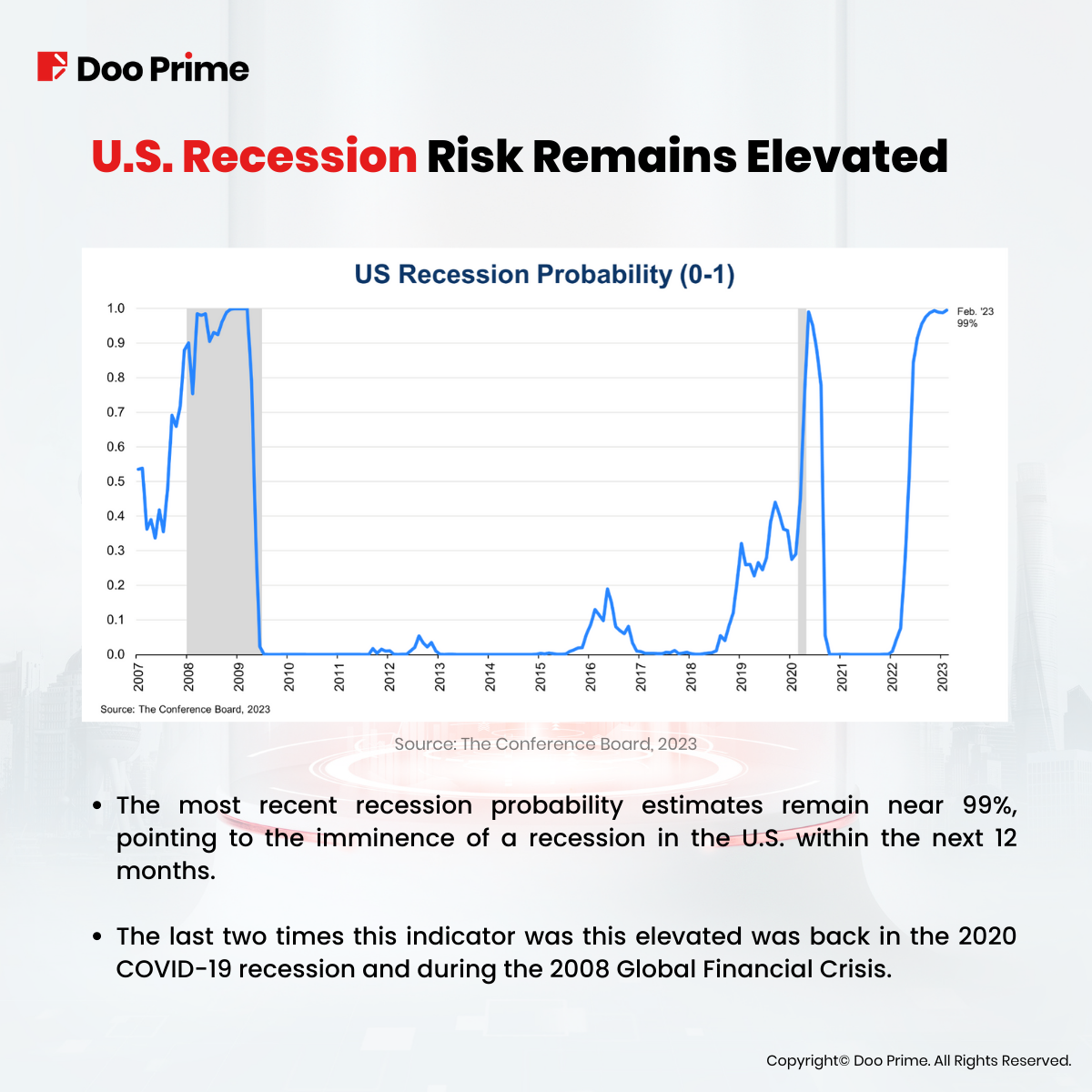

U.S. Recession Risk Remains Elevated

Having said all of that, investors need to remember not to get overly excited about any kind of move the market presents. We need to remember that despite the recent AI fever, there is still a very high probability of a deeper recession sometime in the future.

U.S. Recession Probability is Extremely High!

- The most recent recession probability estimates remain near 99%, pointing to the imminence of a recession in the U.S. within the next 12 months.

- The last two times this indicator was this elevated was back in the 2020 COVID-19 recession and during the 2008 Global Financial Crisis.

For that reason, investors need to remain objective at all times and avoid getting attached emotionally to their investments in order to navigate safely in this highly uncertain market environment.

As the famous saying goes, don’t get married to your trades/investments.

Can China Make A Comeback And Compete In This AI Race?

While the U.S. currently appears to have the upper hand, China on the other hand, is more than capable to make a comeback and compete in the AI race.

Based on the data addressed in this article, the recent low AI stock valuations are not reflecting the true potential of the Chinese AI industry. A lot of the data suggests that the Chinese AI stocks are currently extremely undervalued. Therefore, investors need to apply one of the most important skills, which is patience, before reaping the rewards.

The Best Undervalued AI Stocks To Have On Watch:

- Alibaba (BABA)

- Tencent Holdings (TME)

- Baidu (BIDU)

- JD.com Inc. (JD)

- IFlytek Co.

|About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.