Headlines came and went. Oil didn’t budge, but don’t be fooled. Beneath the calm surface, something important just happened: Trump–Putin finally sat down face to face in Alaska on August 15. And when two geopolitical giants talk, especially after years of icy silence, the ripple effect may be slower than a rate hike.

However, it could be way more explosive when it lands.

This isn’t just politics. It’s potentially the start of a pivot that could shape energy markets, global alliances, and even inflation expectations heading into 2026.

Trump-Putin Summit (Quietly) Moved the Needle

Unlike typical summits filled with headlines and dramatic soundbites, the Trump–Putin meetup was surprisingly low-key.

No peace deal, no breakthrough, no grand stage handshake with fireworks.

But that’s exactly why it matters.

For the first time in years, it looks like Washington and Moscow are finally talking again behind the scenes. And in the world of global commodities, communication is currency. Especially when the conflict in Ukraine is still unresolved.

Traders are now asking: Could this be the start of a de-escalation phase?

Why This Commodity Should Be on Your Radar

Let’s not beat around the barrel: it’s oil.

Despite the lack of immediate price action, traders know that peace, or even the first signs of it, could open up blocked supply routes. Sanctions may ease. The risk premium that’s been propping up oil since the Russia–Ukraine war could finally unwind. And that could reshape the entire energy market.

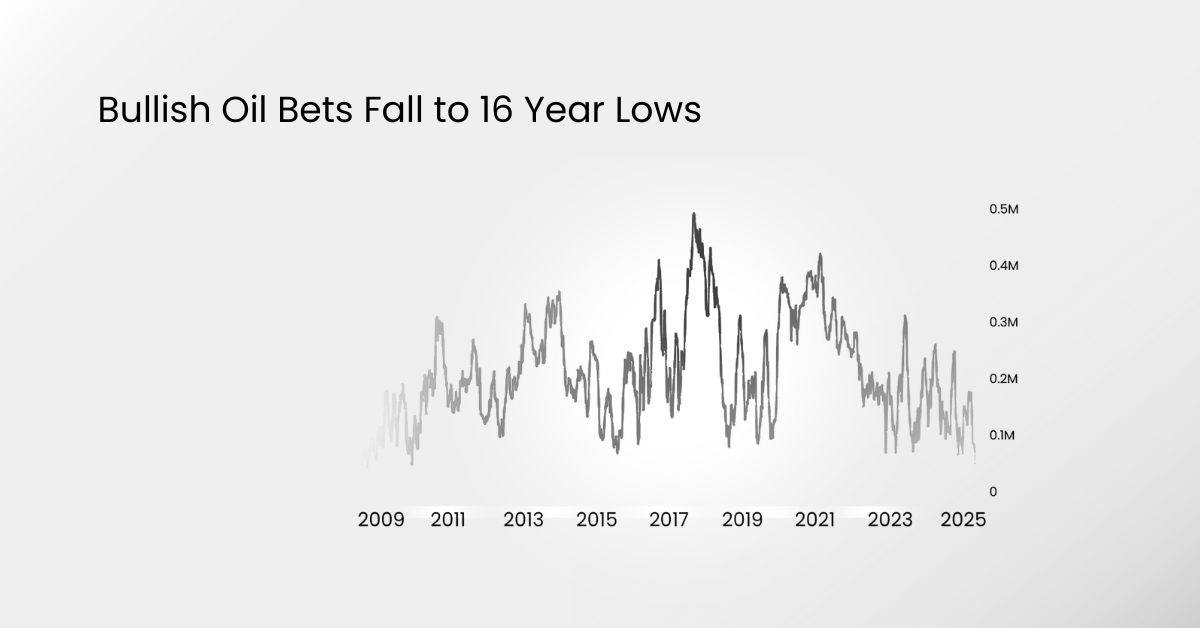

Speculative net-long positions in WTI crude have fallen to their lowest levels since 2009. According to the latest CFTC data, bullish bets have dropped a dramatic collapse in positioning that reflects deep skepticism about oil’s near-term upside.

When traders are this light on longs, it usually means the conviction isn’t there for a rally… at least not yet.

The Peace Premium on Oil

Oil prices tend to include what traders call a “conflict premium,” which is basically a bump in price that reflects the risk of war, supply cuts, or shipping issues when tensions rise.

Since Russia’s and Ukraine conflict, this premium has been elevated. Russia remains one of the world’s largest oil exporters, and sanctions on Russian crude have reshuffled global supply chains from Europe to Asia.

Now imagine what would happen if diplomatic efforts took a serious turn toward peace. Even without a formal deal, the market would begin pricing in the removal of that risk premium.

Charting the Trump-Putin Summit

The chart above paints the picture perfectly.

Despite escalating tensions in the Middle East, even the Iran–Israel war wasn’t enough to push crude oil above its long-standing bearish trendline.

The chart clearly shows how prices reacted or rather, didn’t. Each rally attempt has been rejected at the same descending resistance, confirming that sellers remain in control.

If a major geopolitical event can’t trigger a breakout, it’s a strong sign that the market is still fundamentally bearish. Until this trendline is broken convincingly, upside potential remains capped, and sentiment tilted to the downside.

What Would a Real Breakthrough Mean?

Here’s the setup traders are watching:

- Increased Russian crude exports

Sanctions may loosen or shift, reintroducing Russian oil into broader markets.

- Price normalization in European energy markets

Europe’s energy imports could stabilize, lowering their inflation and growth fears.

- OPEC+ recalibration

Russia is a key OPEC+ player. Any major policy change affects cartel strategy.

All of these outcomes lean one way: downward pressure on oil prices, or at least major shifts in flows and positioning.

Why the Market Didn’t React (Yet)

If all this sounds so potentially impactful, why didn’t crude jump or drop after the Trump-Putin summit?

Simple: Markets need more than a handshake. They need policy follow-through, not just diplomacy. So far, this Trump-Putin meeting is a signal, not a decision.

But signals matter.

In fact, smart money often positions itself before the story becomes front-page news. That’s why traders should view this meeting as a trigger point, not the main event, but the spark that could lead to the fire.

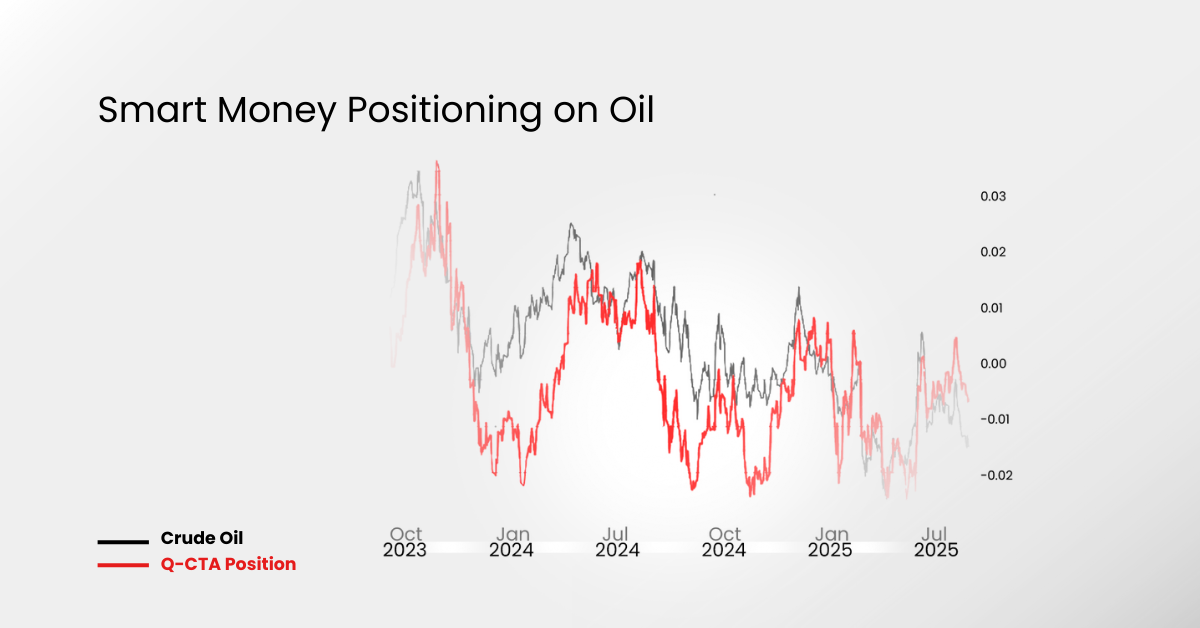

While headlines focused on diplomacy, positioning data from trend-following hedge funds tells another story.

As of August 15, crude oil prices have slid alongside CTA (Commodity Trading Advisor) positioning, a proxy for how big players are leaning. These funds, which often ride strong trends, are currently pulling back their exposure. In simple terms: smart money could be siding with the bears.

Other Markets Are Watching Too

Let’s not forget: oil doesn’t move in isolation. A change in energy dynamics affects inflation, interest rates, and even currency pairs like USD/RUB or EUR/USD. U.S. energy stocks, especially oil majors, could also respond in advance of actual peace deals.

If tensions ease, defensive plays may unwind, and risk-on assets could shine or rotate, depending on how oil behaves.

That’s why understanding these diplomatic shifts can give traders an edge, not just in crude, but across global macro.

Key Takeaways from Trump-Putin Summit

The Trump–Putin summit may have seemed like just another meeting. No fireworks, no deals, and no charts flying off the screen.

But if you’re paying attention, it’s the first domino in a very large row.

If you’re watching commodities right now, don’t just look at gold, crypto, or copper.

Oil is the quiet giant. And it might not stay quiet for long.

Smart money will be watching oil. You should too.

Risk Disclosure

Trading in securities, futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases and other unforeseen circumstances. You may sustain substantial losses, including losses exceeding your initial investment within a short period of time. You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before you begin to trade or engage in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

The information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at any time without notice and does not consider any specific recipient’s investment objectives or financial situation. Past performance is not an indicator of future performance and D Prime and its affiliates give no assurance that any views, projections or forecasts will materialize. D Prime and its affiliated entities make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.