For weeks, markets have been running on fumes.

The US shutdown froze critical data, including the all-important Non-Farm Payrolls (NFP) report.

Now, with odds rising for a reopening this week, traders are staring down a potential triple release of delayed data that could shake everything from gold to the dollar.

No NFPs, no CPI, no guidance, just silence.

That’s why the next data drop could be the loudest one this year.

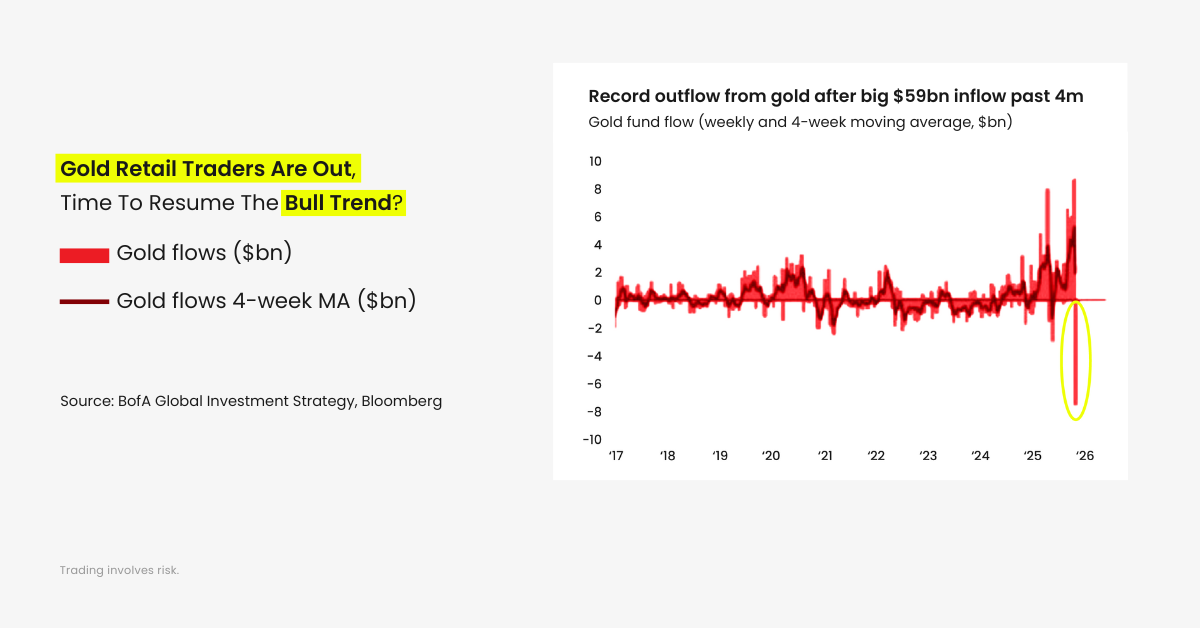

Gold’s “Tourists” Just Got Washed Out

Take a look at this chart from BofA Global Research:

It shows record outflows from gold funds, roughly $59 billion in the past four months.

Meanwhile, in trading slang, this is when the “tourists” leave the market. The short-term, trend-chasing crowd that panics at every pullback.

Historically, that’s exactly when professionals start buying back in.

And that’s what could be happening now: gold prices are stabilizing and pushing higher again as weak-data expectations return to center stage.

Why Weak Jobs Data Could be Bullish for Gold and Stocks

Here’s what traders are thinking:

- If the upcoming NFP report shows slower job growth, it may hint that the economy is cooling.

- That could lead investors to rethink the Fed’s next move, possibly expecting higher rate cuts soon.

- When that happens, bond yields often shift, and attention tends to move back toward assets like gold or equities.

- These changes could also impact negatively the US dollar.

In short: bad news could be good news again.

When Will the Delayed Data Drop?

Once the US shutdown ends and government reopens, federal agencies will scramble to catch up.

We’re looking at roughly six weeks of economic reports waiting to hit the tape.

The September jobs report, originally due on October 3, should come out within days of reopening, offering the first look at how the labor market held up through late summer.

But it won’t end there.

The Labor Department is still weeks behind on October’s employment and inflation figures, meaning the next payrolls release could come about two weeks later.

Surveys like unemployment and consumer prices may take even longer, potentially leaving the Fed without fresh inflation data ahead of its December 10 meeting.

In short: once US shutdown ends, expect a flurry of delayed data that could send markets into overdrive.

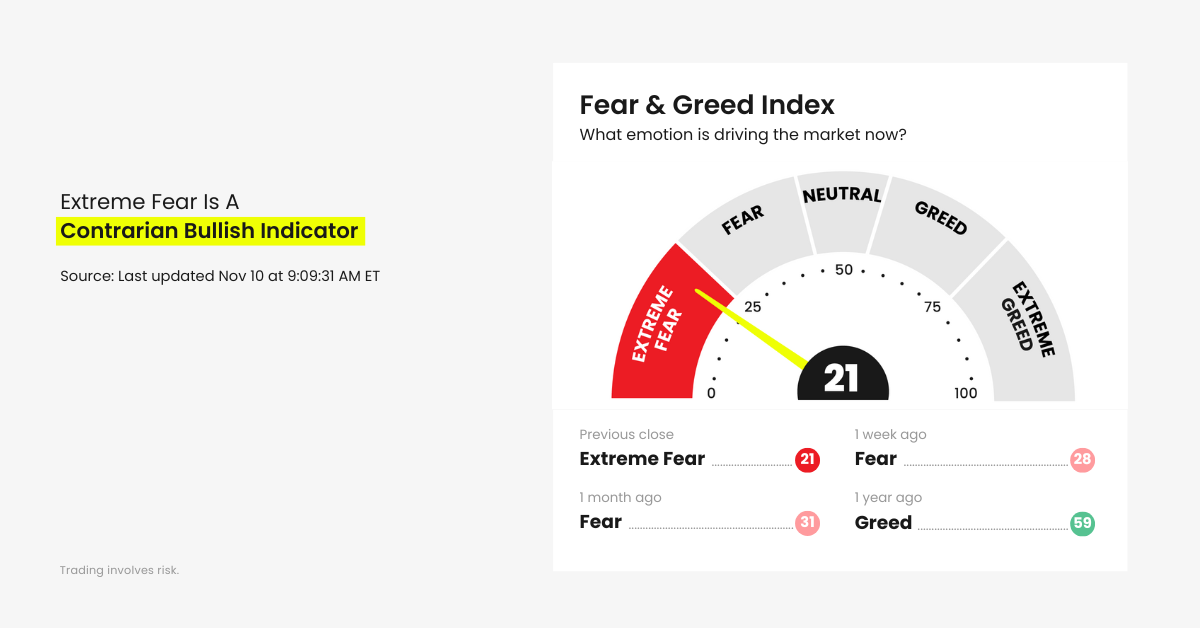

Extreme Fear is a Contrarian Signal

According to CNN’s Fear & Greed Index, the market is currently deep in “Extreme Fear” territory, scoring 21 out of 100.

Historically, extreme fear is a contrarian indicator; it often marks the point where selling exhaustion peaks and smart money starts to buy.

As Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.”

With sentiment this depressed, any positive catalyst, like easing job data or dovish Fed hints, could spark a sharp relief rally once the data blackout ends.

US Shutdown Starved the Market of Data

Without the NFP, markets have been trading on speculation.

Traders can’t price in what they can’t measure, and that’s why volatility has been compressed for weeks.

Once the US shutdown ends, there’s a strong chance of:

- Sharp currency swings in the USD pairs

- Bond yield recalibration based on job strength or weakness

- Sector rotations in equities as rate expectations shift

When the first batch of jobs data hits, expect algo-driven chaos, followed by a new trend forming once dust settles.

Why This US Shutdown Could Be Bigger

This isn’t just about one NFP report.

It’s about months of pent-up market positioning being released in one go.

A synchronized drop of September, October, and November data would mean traders suddenly get a three-month reality check on the US economy in a single week.

That’s the definition of a volatility catalyst.

Possible Market Scenarios after the US Shutdown Ends

| Scenario | NFP Result |

| Weaker Jobs Growth | Confirms slowdown |

| Stronger Jobs Growth | Delays rate cuts |

| Mixed Data | Unclear Fed outlook |

Either way, trading volume will surge, and “safe-haven” assets like gold and silver could dominate headlines.

The Calm Before the Data Storm

Record outflows in gold.

Extreme fear in equities.

And a flood of delayed data ready to hit the tape.

The chart tells the story. “Tourists” have been flushed out of gold, but smart money is already positioning for the rebound.

With the US economy facing delayed data shocks and the Fed ready to pivot at the first sign of weakness, the stage is set for a gold and equity breakout once Washington turns the lights back on.

So buckle up.

When the shutdown ends, the data storm begins, and markets won’t stay quiet for long.

Risk Disclosure

Trading Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.