On September 5th, Birmingham, the UK’s second-largest city, issued a “Section 114 Notice” due to a financial gap of up to £87 million from addressing equal pay compensation claims.

This effectively declared Birmingham bankrupt, with the council ceasing new financial expenditures and focusing solely on essential public services and legal obligations.

In this article, we explore the causes and consequences of Birmingham’s bankruptcy, examine current challenges in the UK economy, and assess the potential impact on the pound’s performance.

Why Did Birmingham Declare Bankruptcy?

Birmingham, known as the heart of the Industrial Revolution, has a rich history of innovation and manufacturing. However, its journey into bankruptcy began with a landmark “equal pay for equal work” lawsuit 11 years ago.

In 2012, the UK Supreme Court ruled that Birmingham City Council had violated equal pay regulations, as 174 female employees were receiving lower salaries than their male counterparts for identical job positions.

The Labor Arbitration Tribunal found this to be discriminatory against hundreds of female workers. Consequently, Birmingham City Council lost the case and was ordered to pay approximately £1.1 billion in compensation.

Today, outstanding liabilities related to equal pay compensation range from £650 million to £760 million, increasing at a rate of £5 million to £14 million per month. The city council declared bankruptcy, citing insufficient funds to repay these debts.

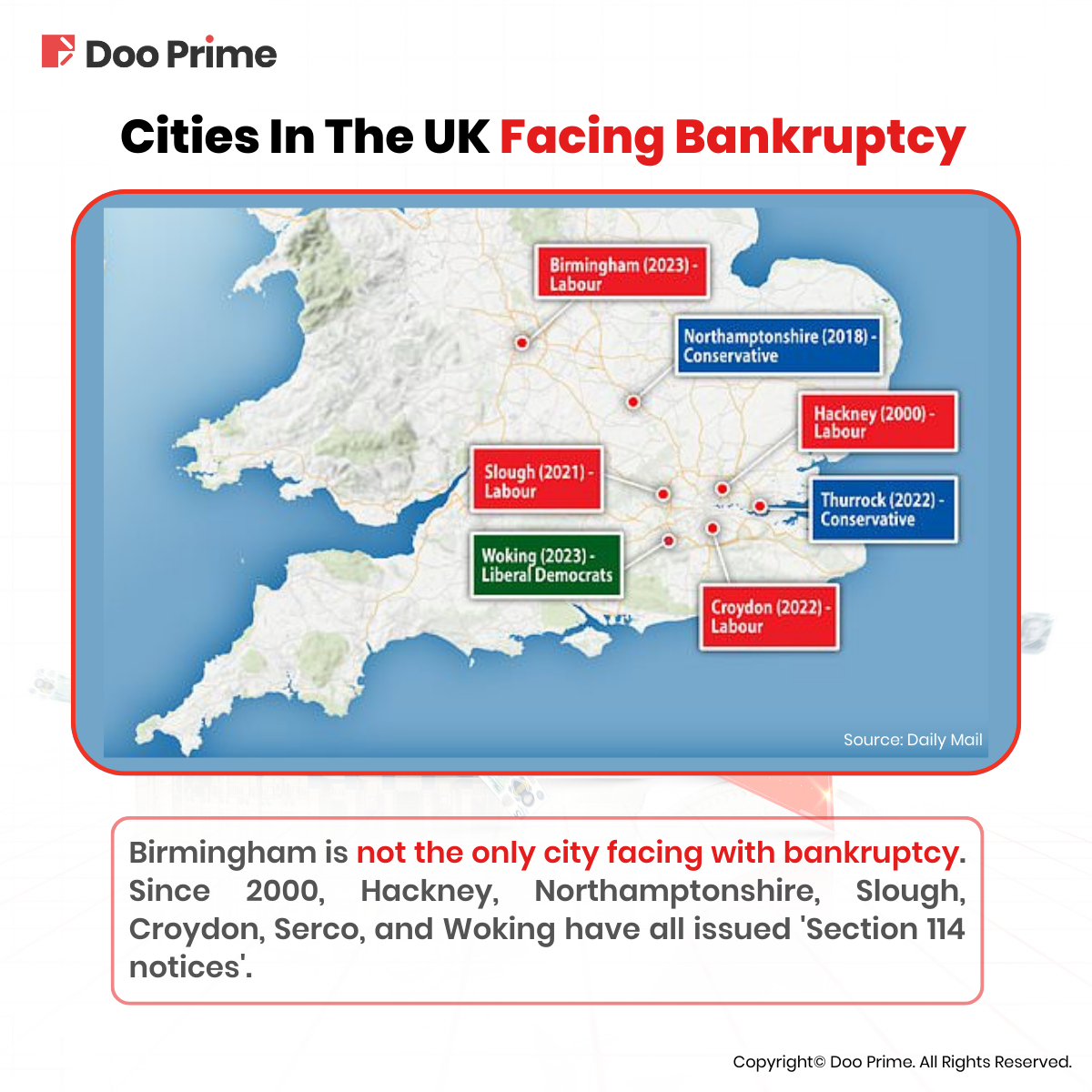

Notably, Birmingham is not alone in facing bankruptcy. Many UK local governments struggle with severe financial difficulties. Since 2000, cities like Hackney, Northamptonshire, Slough, Croydon, Serco, and Woking have declared bankruptcy. The core issue behind these bankruptcies is high expenditures and low revenues.

Birmingham, aside from high equal pay claims, also contends with challenges such as rising healthcare costs, soaring inflation, and declining output, raising questions about whether local government finances mirror the broader national economic condition.

Does Birmingham’s Bankruptcy Reflect The UK’s Economic Woes?

While central and local governments in the UK manage their finances independently, Birmingham’s bankruptcy indirectly sheds light on the risks the UK economy currently faces: high debt, high inflation, and low output.

High Debt:

DBRS Morningstar, one of the world’s top four credit rating agencies, noted that only 25% of Birmingham’s debt comes from private creditors, with 65% coming from the UK Treasury, and the rest from other local governments.

The ability of Birmingham City Council to repay its private debtors largely depends on the support from the UK government and actions by other local governments, according to a senior vice president at the agency.

While UK Prime Minister Rishi Sunak has stated that the government is not responsible for rescuing poorly managed local councils, an official spokesperson stated that they recognize the pressure on local governments and have intervened to provide support.

The UK government will provide an additional £5.1 billion to Birmingham City between 2023 and 2024, increasing the city council’s funding by 9%.

However, Birmingham’s largest creditor is the UK government itself, which is also grappling with high debt.

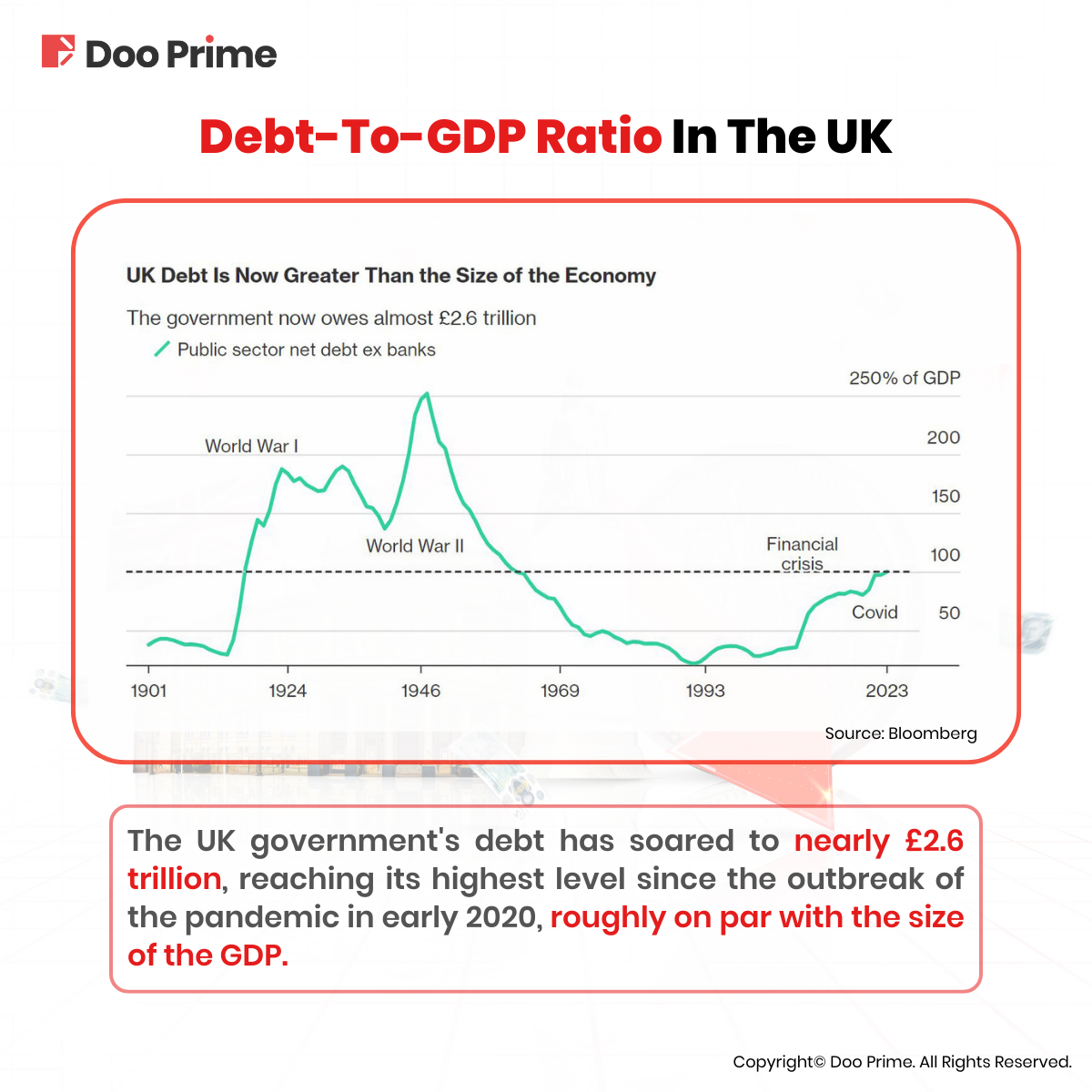

Currently, UK government debt has reached nearly £2.6 trillion, the highest level since the outbreak of the pandemic in early 2020, roughly equivalent to the annual Gross Domestic Product (GDP).

Due to the proportionally higher debt servicing costs compared to government revenue, leading credit rating agency Fitch Ratings designated the UK’s rating outlook as negative in June due to its “sustained increase in debt” and uncertainty surrounding its financial prospects.

High Inflation:

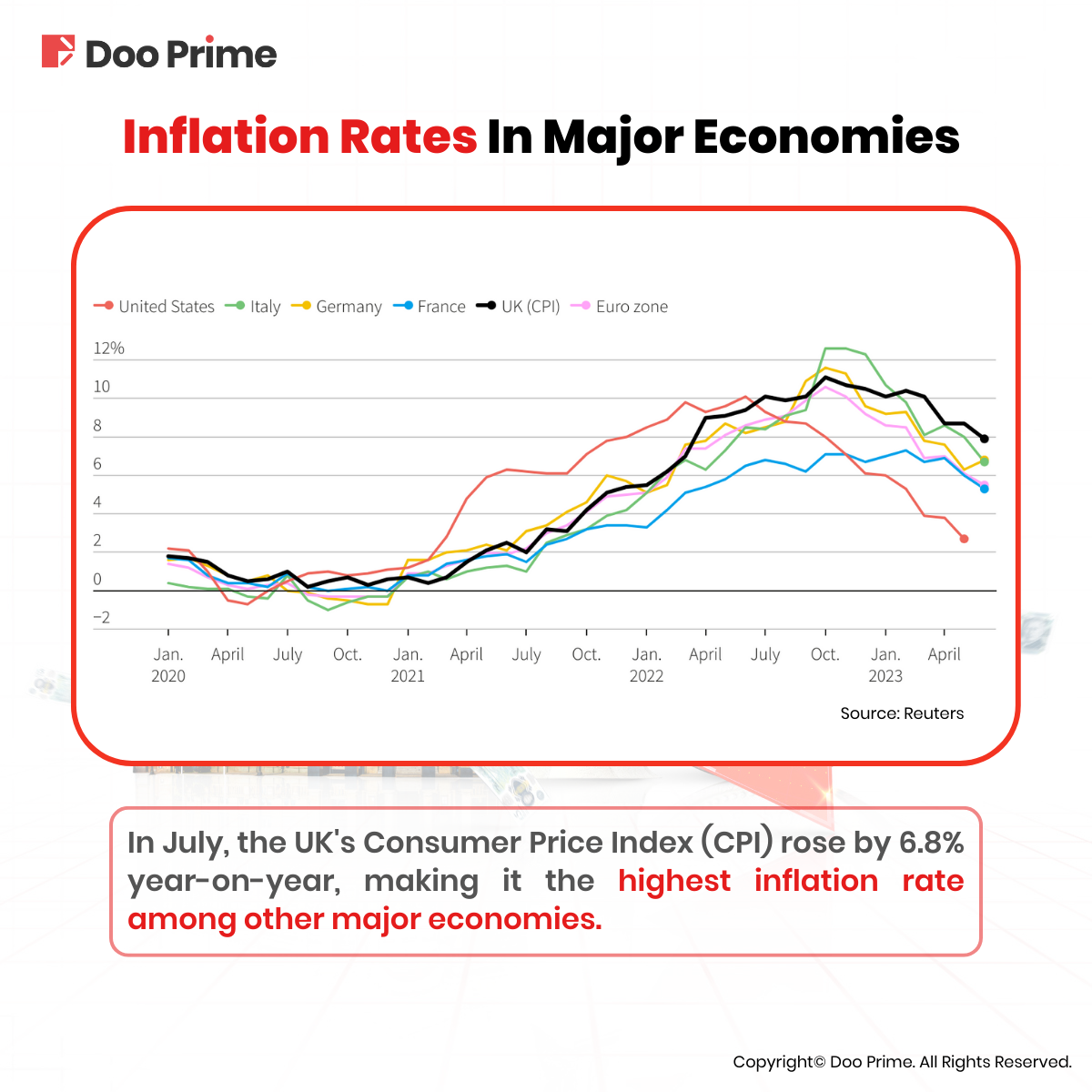

The UK faces the highest inflation rate compared to other major economies. In July, the UK Consumer Price Index (CPI) rose by 6.8% year-on-year, more than three times the 2% target. This contrasts with the Eurozone’s July inflation rate of 5.3% and the U.S. CPI’s 3.2% year-on-year increase in July.

The UK’s CPI reached a peak year-on-year increase of 11.1% in October 2022, the highest in 40 years, before modestly declining. Predictions by the British Chambers of Commerce (BCC) suggest that CPI will hover around 5% in the fourth quarter of this year, potentially nearing the inflation target by late 2025.

Low Output:

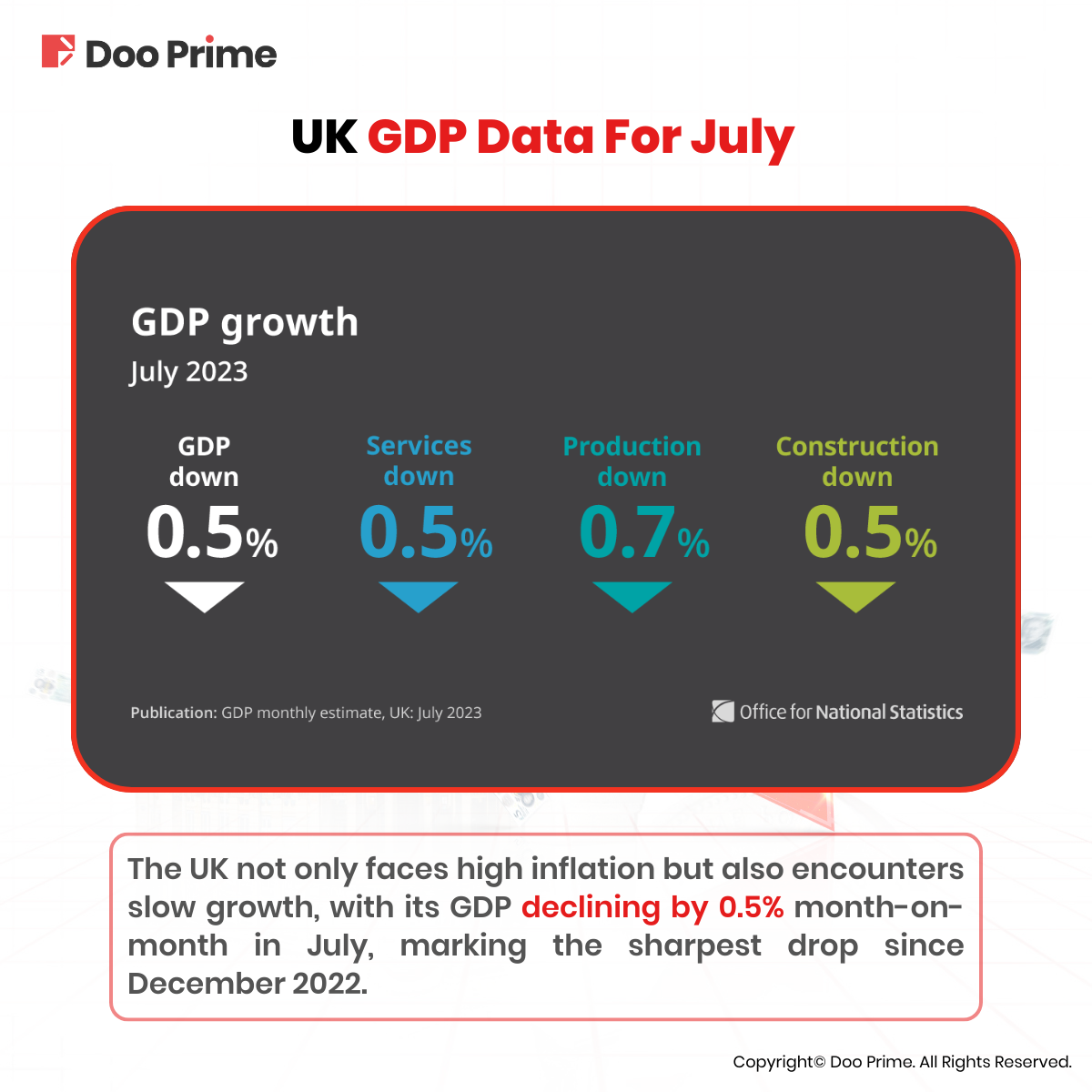

The UK currently grapples with stagflation, marked by high inflation and low growth. August’s UK Composite Purchasing Managers’ Index (PMI) was at 47.9, below the 50-mark that separates expansion from contraction. Both the services and manufacturing sectors contracted.

Additionally, data from the UK Office for National Statistics on September 13th showed a 0.5% month-on-month decline in GDP in July, the largest drop since December 2022 and below economists’ expectations of a 0.2% contraction.

How Does The UK Economy Affect The Pound Sterling?

Moody’s – one of the three major credit rating agencies globally – believes that prolonged high inflation and high borrowing costs will push the UK economy into a mild recession.

High inflation is the primary challenge facing the UK economy. To curb inflation, the Bank of England has raised interest rates 14 times since December 2021, bringing the benchmark rate to a 15-year high of 5.25%.

The market expects the Bank of England to follow the European Central Bank’s lead and raise rates by another 25 basis points on September 21st. On the same day, the Federal Reserve will announce its latest monetary policy decision, with rates expected to remain in the 5.25% to 5.50% range.

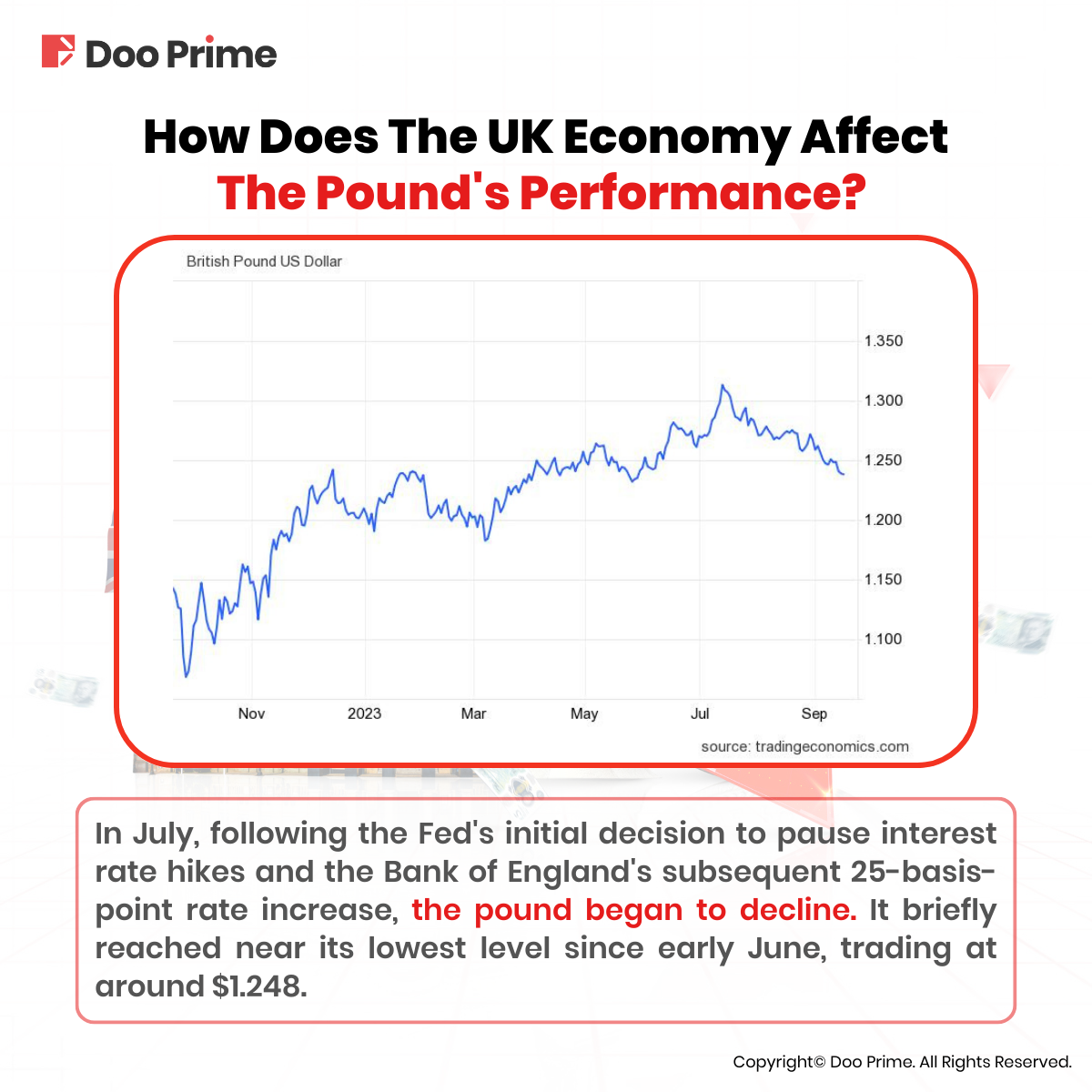

Historically, substantial rate hikes by the Bank of England led to a steady increase in the pound sterling against the U.S. dollar. However, when the Federal Reserve paused rate hikes in July, and the Bank of England raised rates by 25 basis points, the pound began to decline, nearing its lowest point since early June, around $1.248.

If market predictions for the September decisions of the Federal Reserve and the Bank of England prove accurate, the pound sterling may rebound against the U.S. dollar.

A reference point is the euro, which fell more than 5% against the U.S. dollar since mid-July but recently began rebounding from a five-month low, despite weekly declines.

Conversely, if the Federal Reserve unexpectedly announces rate hikes, even with simultaneous rate hikes by the Bank of England, the pound may come under pressure.

Will Birmingham End Its Bankruptcy?

Cities can both declare bankruptcy and “end” bankruptcy by restructuring local government debt efficiently through bankruptcy laws.

Detroit, known as the “Motor City,” declared bankruptcy at the end of 2013 and emerged from court protection less than a year later. It has since achieved several consecutive years of budget expenditures matching revenue, with a surplus of cash on hand. Will Birmingham, the “Workshop of the World,” follow suit? This largely depends on the overall performance of the UK economy.

Currently, the UK grapples with stagflation, marked by high inflation and low growth. The Bank of England continues to raise interest rates to tackle soaring inflation.

While higher interest rates may support the pound sterling, a strengthening U.S. dollar could exert pressure. Investors should closely monitor key UK economic data and central bank developments to seize optimal trading opportunities.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.