Central banks around the world have begun to cut interest rates, with the market now focusing on the U.S. Federal Reserve’s impending rate decision. In this article, we will explore the challenges of the Fed ‘s monetary policy in the current economic environment, and analyze the potential impacts of its decision to either maintain high interest rates or join the global trend of rate cuts on the U.S. stock market, bond market, and forex market, helping you better grasp market dynamics.

Global Central Banks Launch A Rate Cut Wave

Previously, the world’s central banks embarked on the most aggressive tightening cycle in decades, significantly raising interest rates at a rapid pace. However, the scenario has dramatically shifted, and the world’s major economies have begun their monetary easing policies.

- In March this year, the Swiss National Bank (SNB) surprisingly made the first move among developed nations by cutting its rate by 25 basis points to 1.50%.

- In May, Sweden’s central bank Sveriges Riksbank lowered its benchmark interest rate by 25 basis points to 3.75%, marking its first rate cut in eight years.

- On June 5th, the Bank of Canada cut its benchmark rate by 25 basis points to 4.75%, marking the first reduction in over four years and the first among the G7 nations to do so.

- On June 6th, the European Central Bank (ECB) made its first rate cut in five years, announcing a reduction of 25 basis points across its three major rates, bringing the main Refinance Rate, Marginal Lending Facility Rate, and Deposit Facility Rate to 4.25%, 4.50%, and 3.75% respectively.

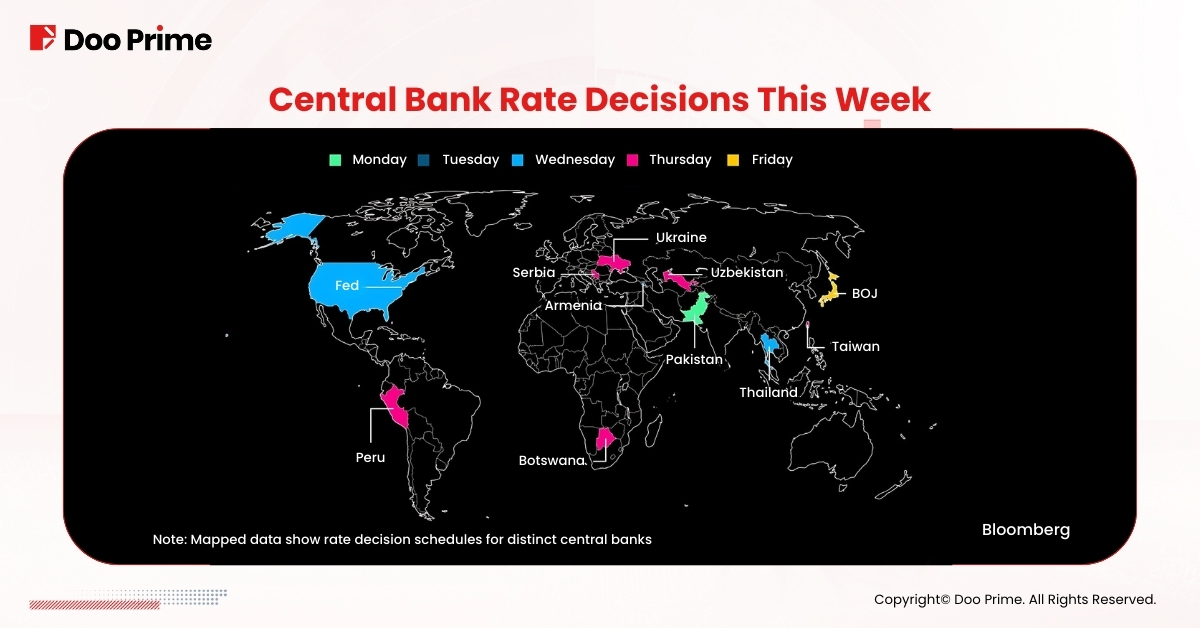

Image Source: Bloomberg

This week, several central banks around the globe, including those of Pakistan, Armenia, Thailand, Serbia, Ukraine, Uzbekistan, Peru, and Botswana, will conduct monetary policy meetings. The focus is particularly on the U.S. Federal Reserve and the Bank of Japan.

Following consecutive rate cuts in Sweden, Switzerland, Canada, and the Eurozone, a key question emerges: Will the Fed “take the baton”?

The Fed’s Dilemma

Investors are uncertain about the future direction of the Fed’s monetary policy, mainly because the Fed is currently facing a “dilemma” – with cooling inflation in spite of a strong labor market.

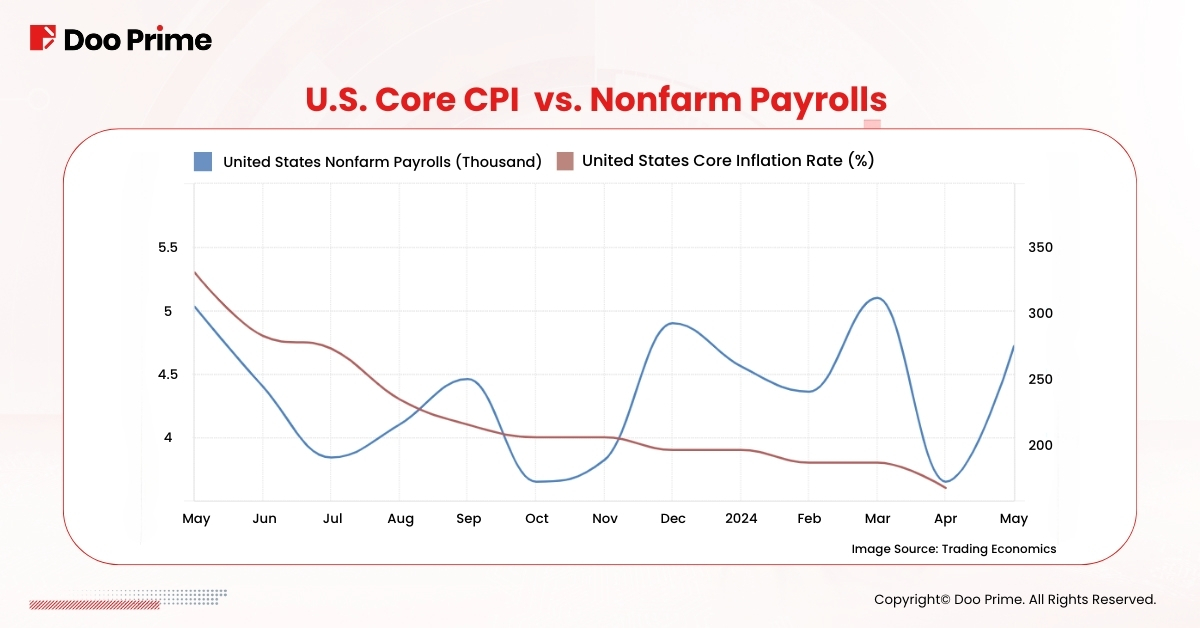

Image Source: Trading Economics

The Fed’s key inflation measure—the core Consumer Price Index (CPI) excluding food and energy prices—steadily declined, with April’s core CPI rising by 0.3% month-over-month and 3.6% year-over-year, the smallest increase in nearly three years.

However, nonfarm payrolls in May grew by 272,000, significantly rebounding from the previous figure of 175,000, well above the expected 185,000.

While the Fed’s use of high interest rates have somewhat successfully combated inflation, a robust labor market may prompt the Fed to slow its rate-cutting pace.

The Direction for U.S. Stocks, Bonds, and Forex

As global investors eagerly await the Federal Reserve’s monetary policy meeting on June 11th-12th, the anticipated bitmap will provide investors with more clues about its rate-cut plans.

According to CME Group’s “Fed Watch Tool”, markets are betting that there is less than a 1% chance of a rate cut in June, with only about a 37% likelihood of a 25 basis point cut this year.

If the Fed maintains high interest rates as scheduled, the U.S. stock bull market may end, U.S. bond yields could rise further, and the dollar may continue to strengthen. Conversely, if the Fed joins the global trend of rate cuts, U.S. stocks might continue to rise, U.S. bond prices could increase, and the dollar might start to decline.

| Market | Fed maintains high rates | Fed starts cutting rates |

| U.S. Stocks | Stocks may fall in the short term, with corporate earnings under pressure | Stocks could rise, with expectations for improved corporate earnings. |

| U.S. Bonds | Bond prices may decline, reducing the appeal of older bonds. | Bond prices may increase, enhancing the attractiveness of older bonds. |

| U.S. Dollar | The dollar could strengthen, offering higher returns due to high interest rates. | The dollar could weaken, reducing the advantage of interest rates and potentially increasing capital outflows. |

After several central banks announce their latest interest rate decisions this week, the global financial markets are expected to experience another round of volatility. The Doo Prime trading platform offers over 10,000 trading instruments across six major markets: securities, futures, forex, precious metals, energy, and stock indices, effectively helping you build a diversified investment portfolio and spread trading risks. Additionally, Doo Prime is rigorously regulated by multiple global financial regulatory authorities, including the FSA of Seychelles, FSC of Mauritius, and FSC of Vanuatu, ensuring a strictly controlled trading environment and comprehensive protection of your funds.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.