The US dollar, long seen as a symbol of global financial dominance, may be entering a new era, one where its value is being strategically weakened from the inside.

And the man at the center of it? Donald Trump.

As President Trump ramps up his agenda for the next four years, signs are emerging that Trump may be intentionally pressuring the Federal Reserve to weaken the dollar. Not just as an economic move, but as a political weapon.

So, is Trump crashing the US dollar on purpose? Let’s unpack the evidence.

A Weaker US Dollar Solves Multiple Trump Problems

A 25–30% devaluation in the US dollar over the next couple of years might sound extreme, but it may also be exactly what Trump wants.

Here’s why:

- Trade Deficits Shrink: A weaker dollar makes US exports cheaper and more competitive abroad. That means trade deficits narrow, helping Trump score easy wins on trade.

- Foreign Demand for Treasuries Increases: A lower dollar may entice central banks like the PBoC and CBI to accumulate more USD and Treasuries to support their currency pegs.

- Asset Prices Inflate: With USD losing purchasing power, stock prices, commodities, and crypto get repriced higher, making markets look stronger than they are.

- Currency-Zone Advantage: A weaker dollar might even push more global companies to shift operations inside the US, benefiting from reduced currency conversion risks.

In other words, weakening the USD checks several political and economic boxes at once.

Is the Market Already Pricing It In?

Interestingly, market behavior in 2025 reflects this theory. Here’s what we’ve seen since the recent lows:

- Bond yields are higher, yet stocks keep climbing.

- Bitcoin and other cryptocurrencies have surged to new record highs.

- Gold is trading around record highs.

- The US dollar is weakening steadily.

These aren’t disconnected events. They reflect a repricing of assets under a new regime: one of monetary debasement.

And that regime is quietly being orchestrated by the world’s biggest economies.

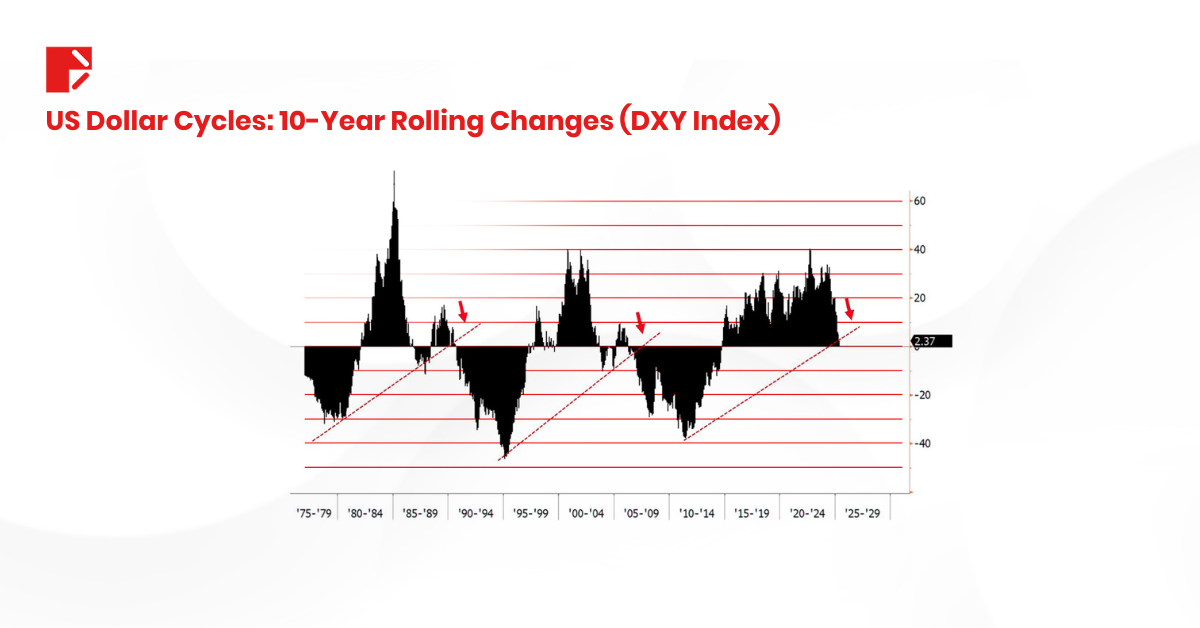

The US Dollar Multi-Year Cycle

This chart shows how the US dollar has followed a 10-year cyclical pattern. Every cycle ends with a sharp reversal. Today, the DXY appears to be at the early stage of another major downturn.

The implications? More room for dollar weakness, especially if Trump’s dollar-weakening policy gains momentum, and the Fed faces political pressure to cut rates.

Global Central Banks Are All In

It’s not just the US that’s debasing its currency. The Eurozone, China, and Japan are all taking steps to stimulate their economies:

- Yield suppression

- Currency interventions

- Liquidity injections

- Debt-fueled stimulus programs

This coordinated move has pushed global markets into a broad risk-on regime. Equities rise, bond demand slips, and safe-haven currencies decline.

It’s no coincidence. The dollar is part of a bigger game now.

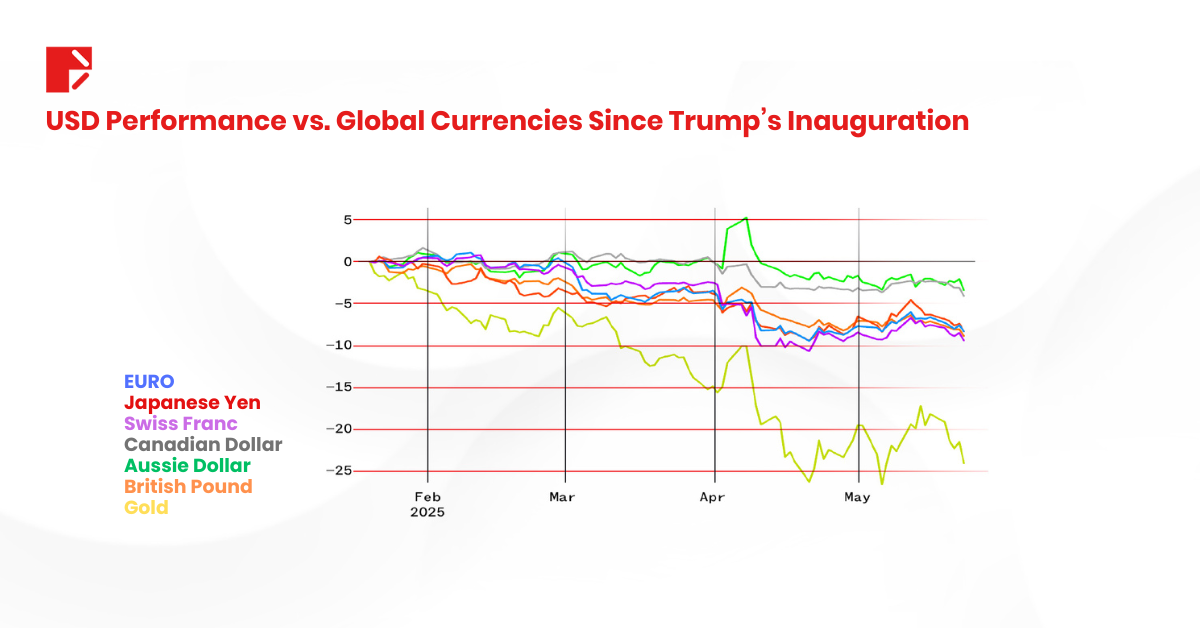

USD vs Major Global Currencies

As seen in the chart above, the USD is losing strength across the board, not just against emerging market currencies, but also against major developed ones.

The message? The global market is quietly de-risking from dollar exposure, expecting continued weakness.

The winner? Gold by a landslide. If the dollar continues to slide, we could see even more capital rotating into commodities, crypto, and non-dollar assets.

The US Dollar Technical Picture

So far, we’ve covered the narrative and macro forces at play. But what does the technical analysis say?

Turns out, it’s confirming the story.

The dollar index (DXY) is now trading near a critical long-term support zone around 98–99. If this level fails, it could open the door for a deeper decline toward the 90 support level.

In technical terms, this means the dollar bull cycle is on the edge of collapse. A break below that support could confirm a multi-year downtrend.

And if that happens while Trump continues to push for lower rates? The dollar may fall faster than most people expect.

What Happens to Other Asset Classes?

Let’s play out the domino effect:

- Stocks: Earnings of multinational companies might get inflated when converted back to weaker USD. The market appears to be stronger.

- Gold: As fiat weakens, gold becomes more attractive. A weaker dollar could be fuel for a gold rally.

- Crypto: Bitcoin, often seen as an anti-fiat asset, benefits from the debasement narrative.

- Commodities: Oil and agricultural prices may rise as global producers adjust to dollar weakness.

In other words, Trump may not just be weakening the dollar. He may be fueling an asset revaluation disguised as an economic boom.

Final Thoughts: Is It All by Design?

While it’s hard to prove intent, the signals are loud and clear:

- Trump consistently pressuring the Fed to lower rates.

- His economic vision thrives under a weaker dollar.

- Current market dynamics align with this thesis.

So, is Trump crashing the US dollar on purpose?

If not crashing, he’s certainly not trying to save it.

Whether it’s to boost US competitiveness, inflate earnings, or simply juice asset markets under his administration, everything points to strategic debasement.

And the market isn’t fighting it. It’s embracing it.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.

© 2025 Doo Prime. All Rights Reserved.