The markets are in turmoil.

The stock market is crashing, the USD is dropping, and traders are panicking.

Headlines are filled with fear: Trump tariffs, global retaliation, USD crash, economic slowdown. It’s not the first time fear has taken over the market sentiment this year, but this time, even the mighty US dollar isn’t looking safe.

Markets hate uncertainty, and the current wave of mixed signals such as: aggressive tariff threats, sudden pauses and exemptions, and then swiftly removing those exemptions again, has everyone on edge.

When everything seems to be falling apart, one asset is stealing the spotlight and breaking new all-time highs. Is gold the only true safe haven left?

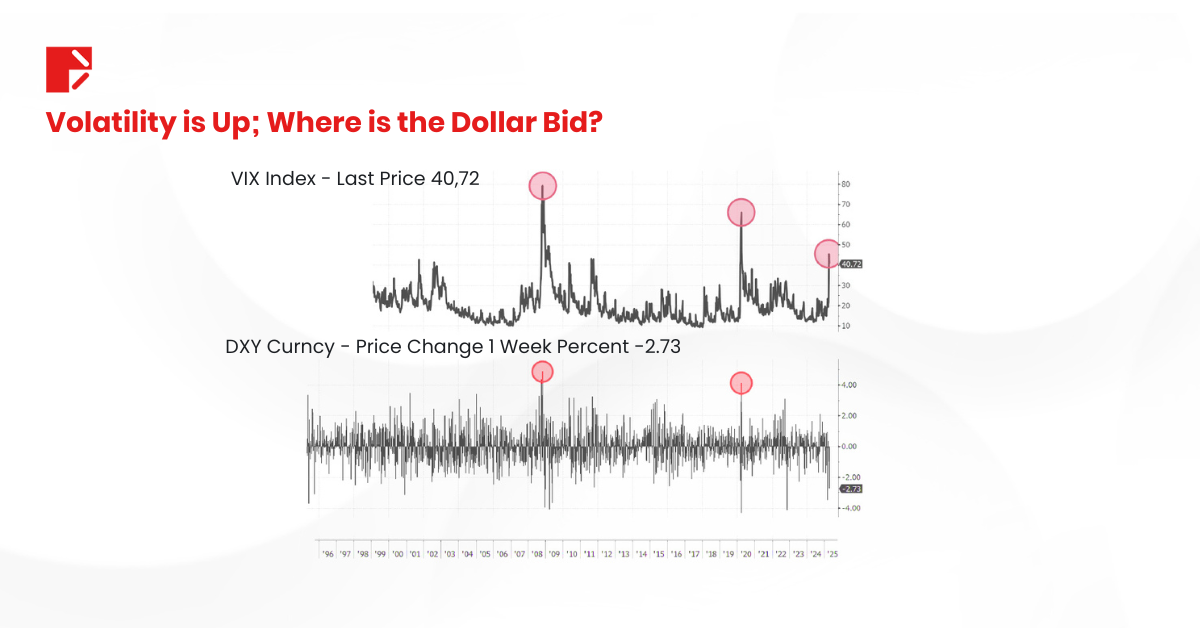

USD Crash: Where is the Dollar Bid?

After weeks of escalating trade war tensions, President Trump’s administration pushed out aggressive tariff plans on key imports, igniting fears of a global economic slowdown. The result? A brutal USD crash and a stock market selloff that erased trillions in value.

Risk appetite vanished. Investors pulled out of equities, and safe-haven flows didn’t go into the usual suspects like the dollar or treasuries.

Instead of rallying on risk-off sentiment, the greenback dropped likely due to mounting expectations of imminent rate cuts.

USD and Bond yields fell. And gold? Gold roared.

Extreme spikes in Volatility Index (VIX) are usually accompanied by a rush into the US Dollar. The exact opposite is happening to date.

But not everything is as gloomy as it seems. As the dust starts to settle, some surprising headlines are shifting sentiment.

Headlines You Might Have Missed

While the market was busy panicking, the narrative began to shift. The White House announced a 90-day pause on certain tariffs and introduced exemptions for electronics and semiconductors.

Few hours later, President Trump clarified that smartphones, computers and some other electronics will come under separate tariffs, along with semiconductors that may be imposed in a month or so.

Tech stocks, selling off for weeks, finally saw a bounce. Traders who were glued to the doom-and-gloom headlines might’ve missed this pivot, but it matters.

It tells us two things: First, this administration is reactive. Second, market pressure is forcing political recalibration.

Still, despite these glimpses of optimism, one asset kept climbing through it all.

Gold Breaks $3,000: A Historic Milestone

You read that right. Gold is now trading above $3,000 for the first time in history.

This isn’t just a number on a chart. It’s a symbol of where global confidence is shifting. While stocks are swinging and the USD crash spooks currency traders, gold continues to shine. Even Bitcoin, often seen as a digital alternative, couldn’t hold its ground amid the chaos.

Why is gold behaving like this? Because in times of systemic doubt, investors crave something with history, weight, and resilience.

Even Goldman Sachs raised their year-end price target for gold to $4,000 for mainly 2 reasons: rising tariffs uncertainty and increased central bank buying.

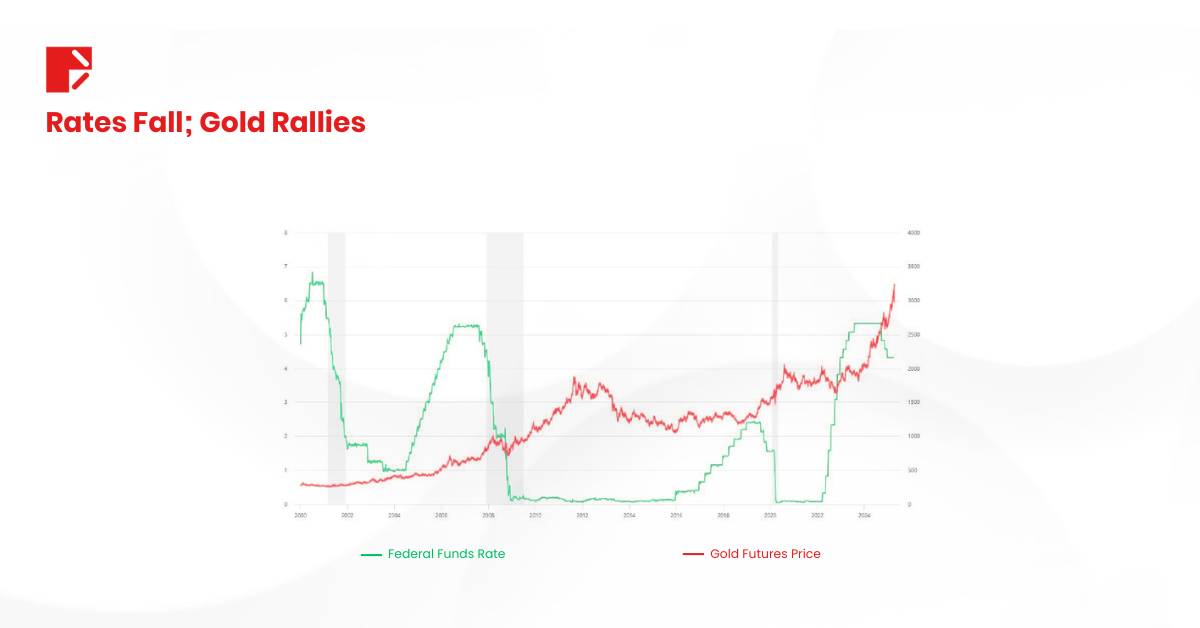

From Rate Hikes to Cuts: A Golden Pattern

If you think this rally on gold is just emotion, think again. History backs it up. Every major cycle where the Federal Reserve paused its tightening and moved toward rate cuts, gold rallied.

The correlation is obvious. When interest rates drop, gold gains.

With the Fed now shifting tone and possibly entering a new easing cycle, the conditions for a possible bullish continuation are great. Add geopolitical noise and fiat fragility, and gold could become more than just a hedge.

Where Does Bitcoin Fit In?

For years, Bitcoin has tried to claim the “safe haven” title. And in some cases, it’s acted like one, especially during inflation scares or banking stress.

But in this current environment of policy chaos and macro uncertainty, Bitcoin faltered. Why? Because it’s still a risk asset in the eyes of institutional capital.

Gold, meanwhile, has centuries of credibility. It doesn’t require internet access nor rely on miners. It just sits, shines, and stores value.

That doesn’t mean Bitcoin is out of the picture. But it does suggest gold isn’t ready to hand over its throne just yet.

In Uncertain Times, Clarity has Weight

So where does that leave us?

A USD crash, a stock market breakdown, and yet, gold keeps climbing higher. While the headlines may shift and the panic may pass, one thing is clear: gold is doing its job.

It’s not about choosing between tech, crypto, or metals. It’s about balance. And in a world with rising risk and falling confidence, gold deserves its place.

Is it the ultimate safe haven? Time will tell.

But in this cycle, it’s certainly the one leading the charge.

“When trust disappears, gold reappears.”

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.