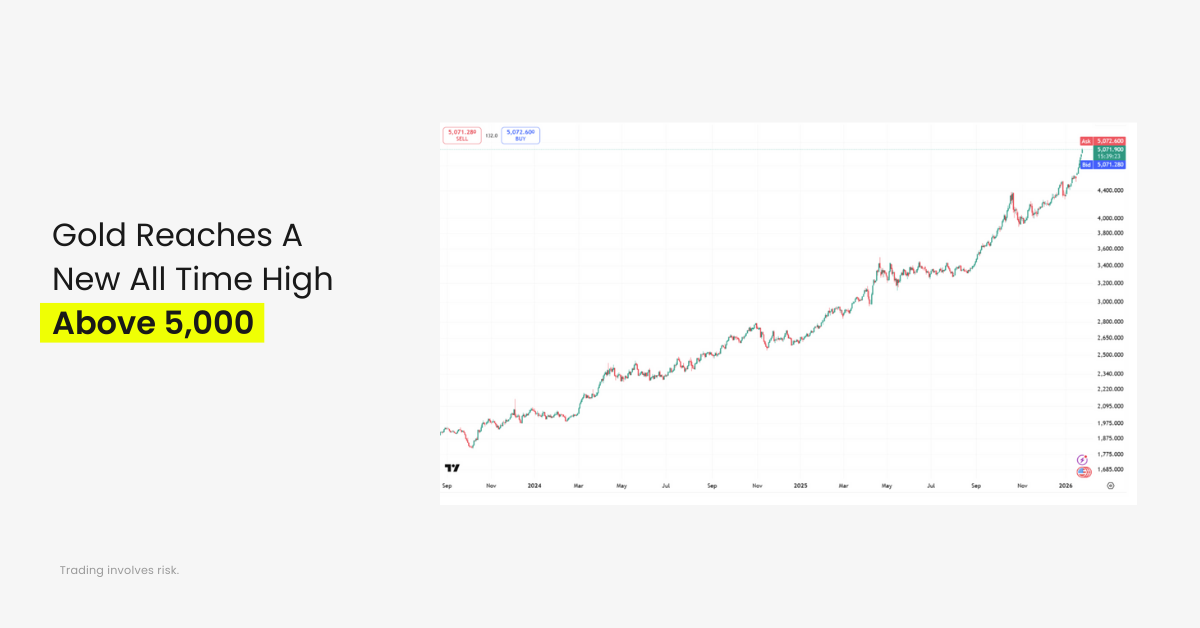

Gold has officially crossed $5,000 per ounce, quietly but decisively.

For an asset once dismissed as a “non-interest-bearing relic,” this move is forcing global investors to rethink one thing:

👉 Is the dominance of the US dollar starting to crack?

This rally is not random. It reflects deeper stress in the global financial system, rising US debt, and growing demand for assets that exist outside sovereign credit risk.

In this article, we break down three questions investors care about most:

Gold: The Original Hard Currency

Karl Marx once wrote in Capital:

“Gold and silver are not by nature money, but money consists by its nature of gold and silver.”

The idea still holds.

Gold became money not because governments declared it so, but because it is:

- scarce

- divisible

- durable

- resistant to decay

Paper money came later and is backed not by gold, but by government credit.

And that raises a critical question:

👉 What happens when confidence in sovereign credit weakens?

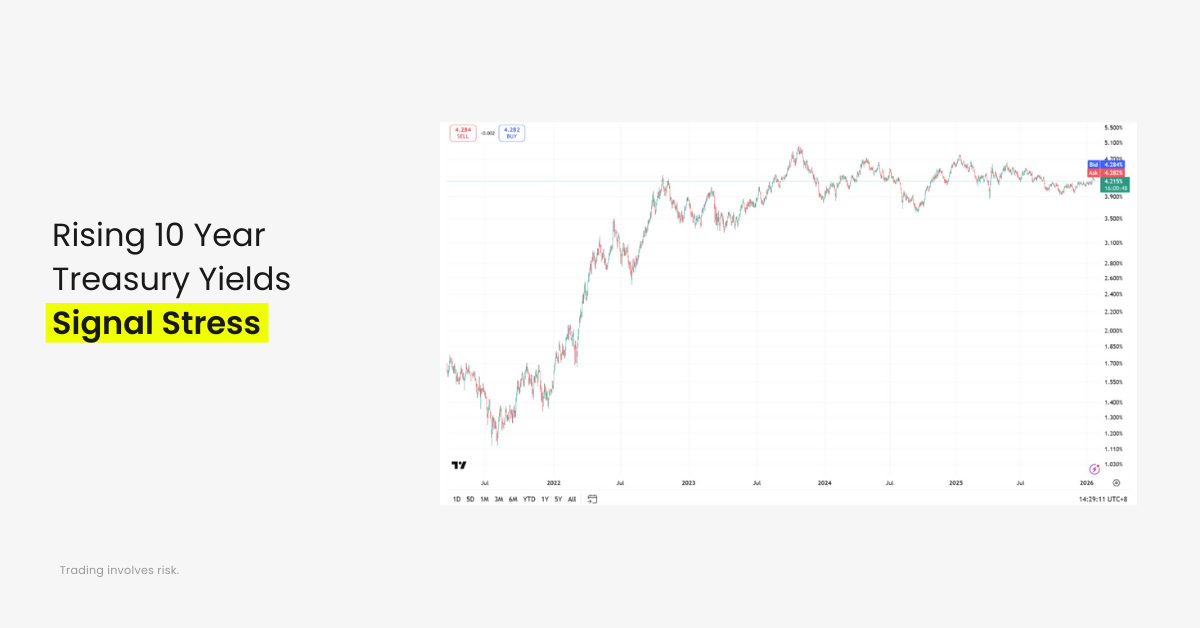

Rising US Debt and Treasury Yields: A Warning Signal

Look at 10-year US Treasury yields. They’ve surged sharply.

This is not a sign of strength. It is a sign of stress.

When investors lose appetite for government debt, yields must rise to attract buyers. And the numbers explain why:

- December 2025 US fiscal deficit: $145 billion (↑ 67% YoY)

- Cumulative deficit: $602 billion

- Deficit-to-GDP ratio: 6.4%

- Last time this level was seen: World War II

The US economy may still look resilient on the surface, but debt levels suggest hidden fragility.

If a recession hits:

- fiscal stimulus capacity is limited

- recovery will take longer

- confidence in US assets weakens further

For investors, this is a dangerous mix.

And when trust in the strongest sovereign borrower erodes, capital looks for alternatives.

Why Bitcoin Didn’t Replace Gold (Yet)

Bitcoin was supposed to be the answer.

With limited supply and decentralized design, it earned the nickname “digital gold.”

At one point, prices surged toward $120,000, delivering massive returns.

But in real-world stress tests, Bitcoin failed to behave like a true safe haven.

Since late 2024, Bitcoin has traded sideways near 80,000 dollars. During geopolitical shocks such as the Russia-Ukraine conflict and unrest in Iran and Venezuela, Bitcoin remained volatile rather than defensive.

Gold, meanwhile, did exactly what it has done for centuries.

👉 When fear rises, gold absorbs capital.

The Bigger Picture: Asset Revaluation and the Dollar System

Gold’s rally reflects something bigger than price action.

1. Gold Is an Alternative to Sovereign Credit

Gold is not backed by any government.

When sovereign balance sheets weaken, gold becomes financial insurance.

2. Global Demand for Safe Havens Is Rising

Geopolitical fragmentation and economic uncertainty have made capital more conservative.

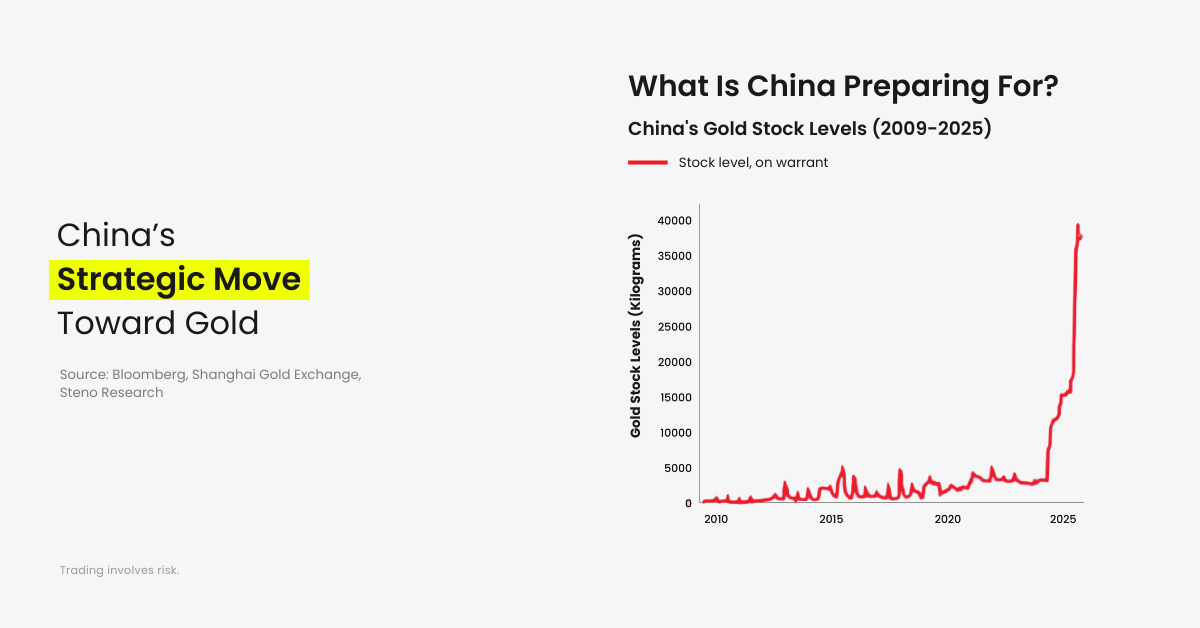

3. China Is Actively Reducing Dollar Exposure

China is now the largest buyer of gold.

Historically:

- China exported goods

- earned US dollars

- reinvested into US Treasuries

That cycle is breaking.

As US–China relations shift from cooperation to confrontation, China has:

- reduced Treasury purchases

- increased gold reserves

This explains why Treasury yields and gold prices are rising at the same time.

When a buyer that large changes strategy, global markets feel it.

Can Gold Keep Rising — or Is This the Peak?

The long-term logic for gold remains intact:

- geopolitical instability persists

- US debt risks remain unresolved

- China continues accumulating gold

- the Federal Reserve has begun cutting rates

A weaker dollar typically supports higher inflation-adjusted asset prices, including gold.

Some analysts are now projecting $6,000 gold over the medium term.

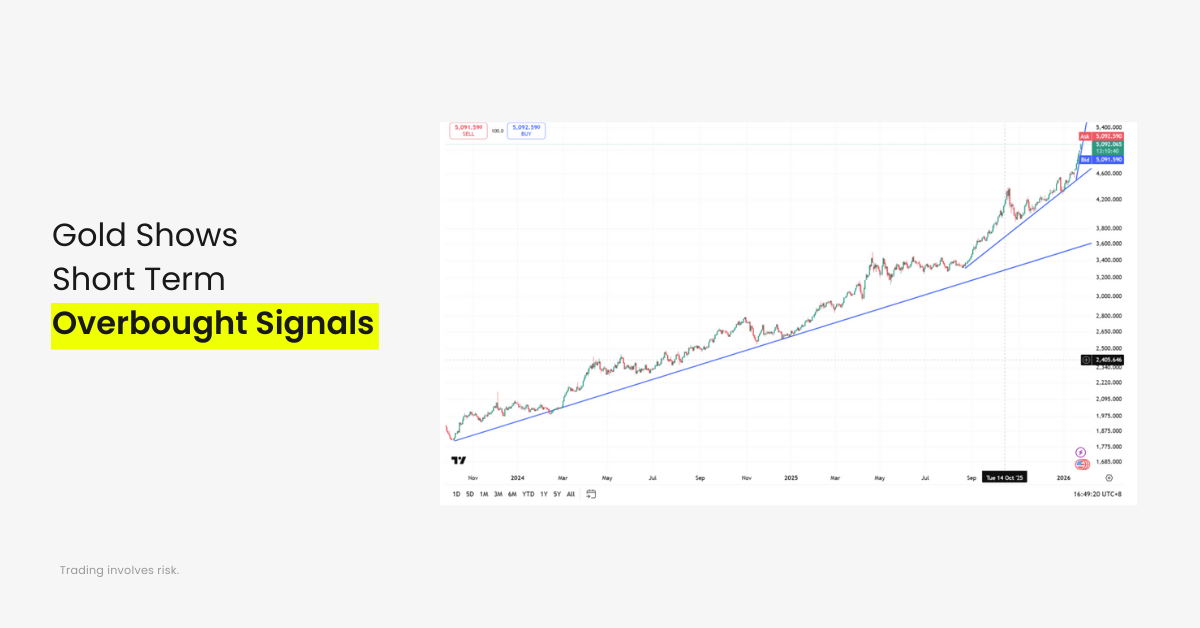

But short term? Caution matters.

Technical Reality: Why a Pullback Is Likely

On the daily chart, gold has broken above its original steady uptrend and entered a steeper acceleration phase.

Experienced traders recognize this pattern.

Late-stage rallies are often driven by:

- investors who missed earlier moves

- emotional FOMO entries

- vertical price spikes near resistance

This creates an overbought condition.

Early buyers begin to take profits, increasing selling pressure and triggering corrections.

Importantly:

- the bullish structure is still intact

- a correction does not mean the trend is broken

Key support levels to watch:

- $4,300–$4,500 (primary support)

- $3,400 (major downside support if volatility expands)

Patience matters more than prediction here.

If Not Gold, Where Else Are Opportunities?

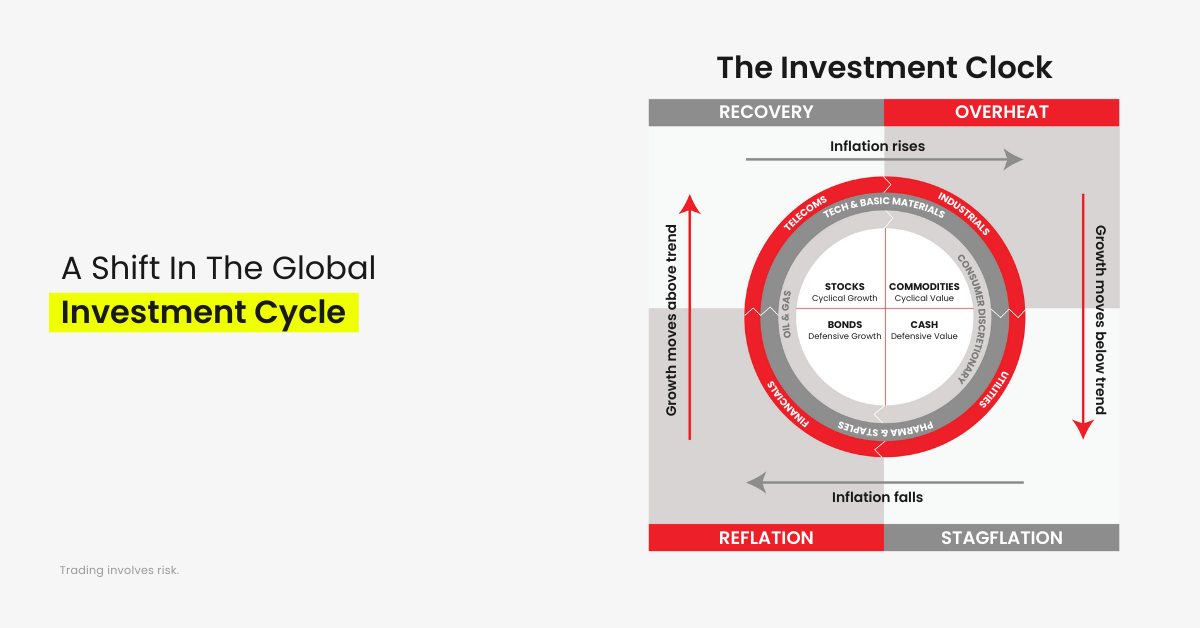

Risk does not disappear — it rotates.

Despite global uncertainty, macro data suggests the US economy is not collapsing:

- US CPI (Dec 2025): 2.65%

- Inflation: under control

- Q3 2025 GDP growth: 2.3%

Stagflation fears have faded.

AI-driven productivity gains, expectations of rate cuts, and stable growth point toward a soft landing, not a deep recession.

D Prime’s View: Two Assets to Watch Besides Gold

1. US Equities

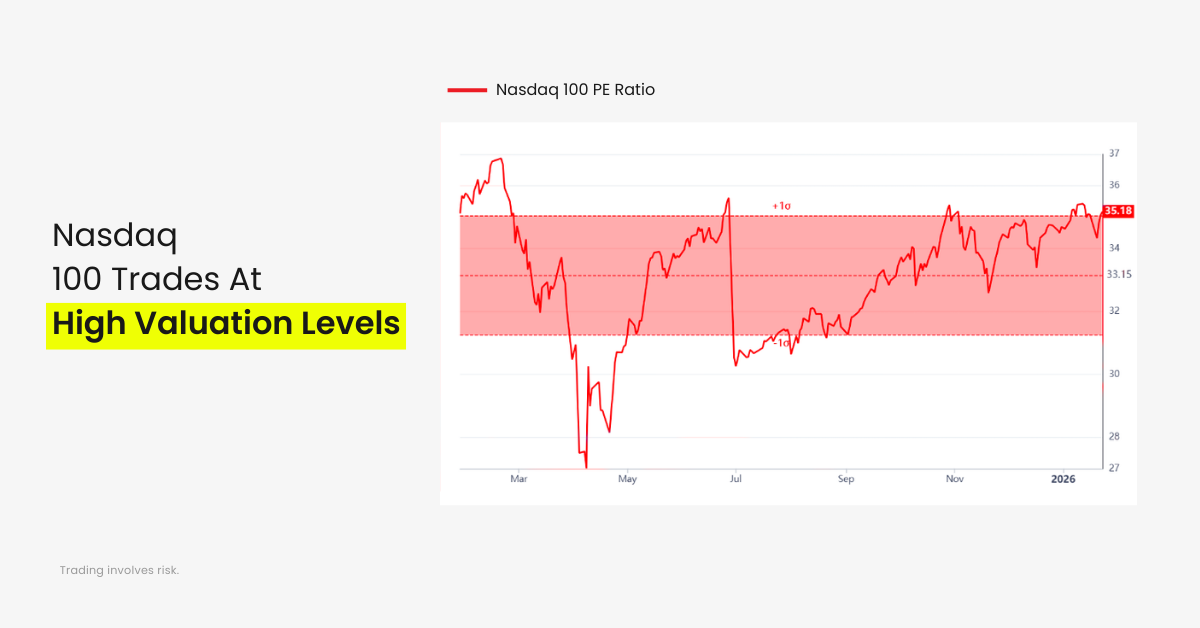

The Nasdaq 100 PE ratio is elevated at 35.18, but momentum remains strong.

Markets have absorbed:

- geopolitical headlines

- trade threats

- political noise

If a slowdown occurs, equities may pull back — but that would likely create buy-the-dip opportunities, not systemic collapse.

Innovation-led growth, especially from AI, continues to support valuations.

2. US Treasuries

High yields mean bond prices are depressed.

If economic growth slows sharply:

- bond prices may rise

- Treasuries can act as a defensive hedge

However, investors must assess whether current prices reflect:

- a value opportunity

- or deeper structural risk

There is no universal answer — positioning matters.

Final Thoughts

Gold breaking $5,000 is not just a price milestone.

It’s a signal.

A signal that:

- trust in sovereign balance sheets is weakening

- global capital is becoming more defensive

- the dollar-centric system is being challenged

For traders, the goal isn’t to chase headlines — it’s to understand cycles, manage risk, and stay flexible.

Markets are changing.

Positioning should change with them.

Disclaimer

The information contained herein is provided for general informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, a recommendation, or an offer or solicitation to buy or sell any financial instruments or engage in any trading strategy.

Trading in leveraged products such as contracts for difference (CFDs) involves a significant risk of loss and may not be suitable for all investors. Past performance is not indicative of future results. Any references to market trends, asset performance, price levels, or forward-looking statements reflect opinions or general market commentary as at the date of publication and are subject to change without notice.

This article does not take into account any individual investor’s objectives, financial situation, or risk tolerance. Readers should conduct their own independent research and seek professional advice before making any investment or trading decisions.

“D Prime” is a brand name of D Prime Vanuatu Limited, a company incorporated and regulated by the Vanuatu Financial Services Commission (Company Number: 700238). The availability of products and services may vary depending on jurisdiction and applicable regulatory requirements.