Bitcoin is setting new records, smashing past $123,000 and pulling traders back into full risk-on mode. But is this just another hype-driven run, or has something fundamentally changed?

Under the surface, two major forces are lining up at the same time, and most people aren’t connecting the dots.

One is unfolding right in Washington. The other is quietly building in the global money system, flashing the kind of early signal that’s powered Bitcoin’s biggest rallies before.

Put them together, and you’ve got the perfect recipe for why Bitcoin is rising now and why this could be more than just another short-lived spike.

New Crypto Bills Change the Game

For years, Bitcoin investors have had to wrestle with a giant question mark hanging over the industry: what exactly does the US want to do about crypto?

Between the SEC taking shots at exchanges, debates over whether ETH or stablecoins are securities, and a total lack of unified rules, institutional money has mostly stayed cautious. That’s changing now.

The House is pushing through several major crypto bills, most notably the Financial Innovation and Technology for the 21st Century Act. It’s designed to finally spell out who regulates what, give the CFTC clearer oversight of Bitcoin and other digital commodities, and create real federal licensing paths for exchanges and stablecoins.

Why Bitcoin Loves the Crypto Bills

Bitcoin isn’t just popping higher because some bill might pass. It’s about what regulatory clarity does: it removes the fear premium.

For years, big funds have loved Bitcoin’s thesis: limited supply, digital gold narrative, inflation hedge, global settlement network. But they hated the regulatory ambiguity. If your compliance department can’t tell whether the SEC might crack down tomorrow, it’s hard to justify allocating serious client money.

Clear laws mean big players can finally step in. Pension funds, insurance companies, sovereign wealth, the massive pools that have tiptoed around crypto. They want to know that if they buy BTC, they won’t wake up to news their custodian got sued or their ETF got frozen.

That’s why Bitcoin’s rally right now isn’t just retail FOMO. It’s about the US hinting that crypto might finally get the regulatory clarity it’s been missing.

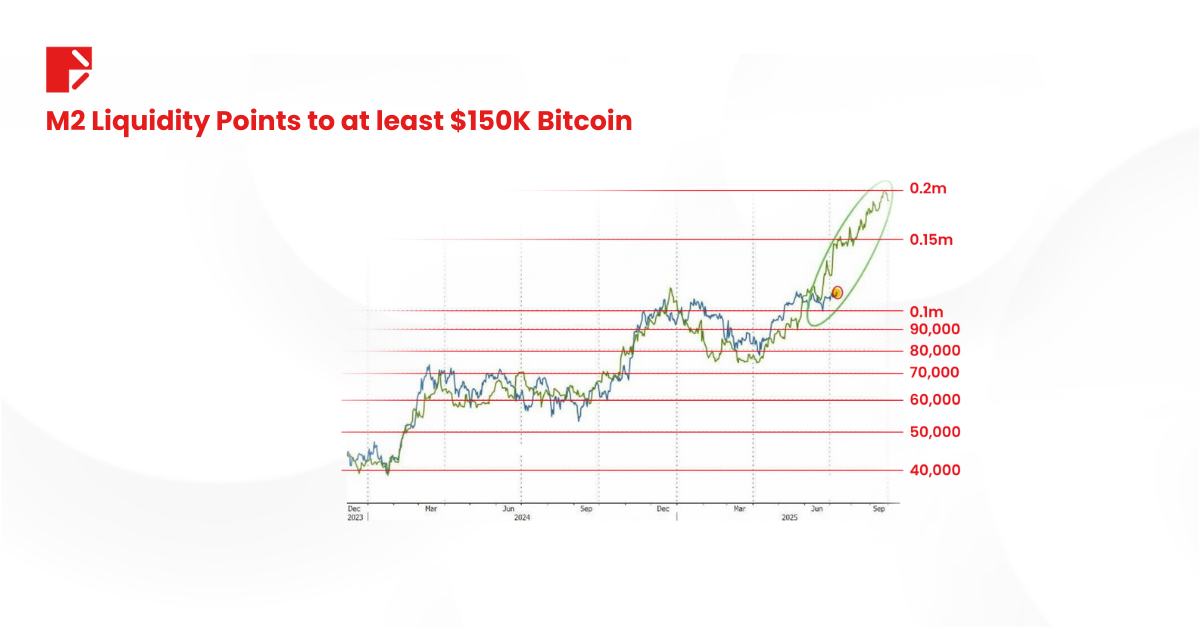

The M2 Global Liquidity is Leading Bitcoin

Now for the second, less talked-about force: global liquidity.

Bitcoin’s biggest moves often come down to simple liquidity trends. When central banks pump money into the system or global M2 money supply grows, risk assets like Bitcoin tend to surge. It’s not magic; more liquidity means more fuel for everything from stocks to gold to crypto.

The M2 chart has been acting like a 12-week leading indicator for Bitcoin. Whenever M2 moves up, Bitcoin usually follows. Right now, it points to a possible path toward at least $150,000. Traders are watching this closely, and it’s adding more fuel to the rally we’re seeing today.

So, while headlines focus on the US crypto bills, smart money is also watching the liquidity backdrop. That combo is what’s really powering BTC’s breakout.

The Bitcoin Technical Breakout Helps Too

Of course, there’s also a technical element here. Bitcoin’s broken out above key resistance around $112,000 with strong volume. That’s unleashed momentum traders and algos chasing the move.

Add in short liquidations and it’s easy to see how BTC ripped past $123,000 almost effortlessly.

This is classic crypto: when narrative (regulatory hope) meets a chart breakout, it creates a powerful cocktail. That’s why we’re seeing Bitcoin put in such explosive candles right now.

To confirm this as the start of a bigger rally, Bitcoin could retest the breakout zone near $112,000 and if it holds, it could trigger a continuation higher.

What about Altcoins?

A lot of traders are asking: does this mean alt-season is back? It’s complicated.

Bitcoin is rallying partly because it’s the cleanest bet under the proposed US crypto bills. It’s almost certainly a commodity in US eyes. Altcoins, especially smaller ones, still face more uncertainty. However, if Congress establishes clear frameworks for secondary markets, that could unlock big moves in Ethereum and even smaller-cap tokens.

In other words: Bitcoin is the first beneficiary of this shift. But longer term, solid rules could create room for a broader alt rally.

Two Catalysts, One Powerful Rally

It’s rare to get these two forces lined up at the same time:

- Major regulatory progress that could trigger institutional demand

- A rising global liquidity tide that’s historically been Bitcoin’s best friend

That’s why Bitcoin is surging, and why this run might still have room to stretch. Keep your eyes on the House votes in the coming weeks, but also watch that M2 curve. Because together, they’re telling a story that’s hard for any trader to ignore.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements may result in substantial losses, potentially exceeding your initial investment within a short period of time.

Please make sure that you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This material constitutes general market commentary and has not been prepared in accordance with legal requirements designed to promote the independence of investment research. As such, it is not subject to any prohibition on dealing ahead of the dissemination of investment research. This article is not intended to constitute investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. Any price levels or market references discussed are for illustrative purposes only and do not constitute a forecast or advice.

The information provided herein is not intended for use by residents of any jurisdiction where its distribution or use would violate local laws or regulations. It does not take into account any specific recipient’s investment objectives or financial situation, or particular needs. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties as to the accuracy or completeness, or reliability of this information provided and accept no liability for any losses or damages resulting from the use of this material or from any investments made based on it.

The above information should not be used or considered as the basis for any trading or investment decisions nor as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report/material and assumes no responsibility for any losses resulting from the use of this report/material. You should not rely on this report/material to replace your independent judgment. The market is risky, and investments should be made with caution.