A week ago, markets were bracing for the worst. Oil spiked. Gold surged. Headlines screamed about escalation. But in classic market fashion, things flipped fast.

Now, with Trump pushing hard for a peace deal between Iran and Israel (just as we anticipated in last week’s article), the tone has shifted. The war risk premium is coming out of the market. Oil is pulling back. Safe havens are cooling. And stocks? They’re perking up.

So the big question now: Will peace talks send stocks to fresh all-time highs?

Let’s find out.

From War Fears to Rate-Cut Hopes

Markets hate uncertainty. War headlines are the ultimate uncertainty. That’s why stocks were stuck in choppy ranges last week. But with peace talks gaining traction, a path is opening.

Now the focus is no longer “Will war break out?” It’s shifting to “How soon will Powell cut rates?”

That is key because the sooner those rate cuts arrive, the stronger the stock market could perform.

Why Peace Talks Could Be the Perfect Trigger for Stocks

A credible ceasefire would pull a lot of pressure out of the system:

- Oil prices could stabilize below $70

- Inflation fears could ease

- The Fed could have room to pivot faster

- Corporate confidence could rise

In other words, a peace deal could clear the runway for a broad equity rally. The S&P 500 is already flirting with its recent highs. The Nasdaq remains strong. With the war risk fading, bulls could seize control.

Trump vs Powell: The Next Market Catalyst?

Trump has made it no secret: He wants lower rates. He’s been publicly bashing Powell for being too slow to cut.

Powell, on the other hand, is walking a tightrope. The end of the war makes it somewhat easier for him to move toward rate cuts. But Trump’s new tariffs and lingering inflation risks still complicate the path forward. The market now waits to see when he will finally act.

The sooner the cuts start, the faster this market can run.

Market Setup: Can Stocks Break Out?

Technically, US stocks are primed for a breakout.

The S&P 500 is hovering just below record highs and looks ready for a breakout.

The volatility index (VIX) is falling below 20, which is great news for stocks.

Now add peace headlines and the prospect of a more dovish Powell, and you’ve got the perfect fuel for new highs.

Historically, markets love peace pivots. Whenever geopolitical fears fade, capital rotates back into equities fast.

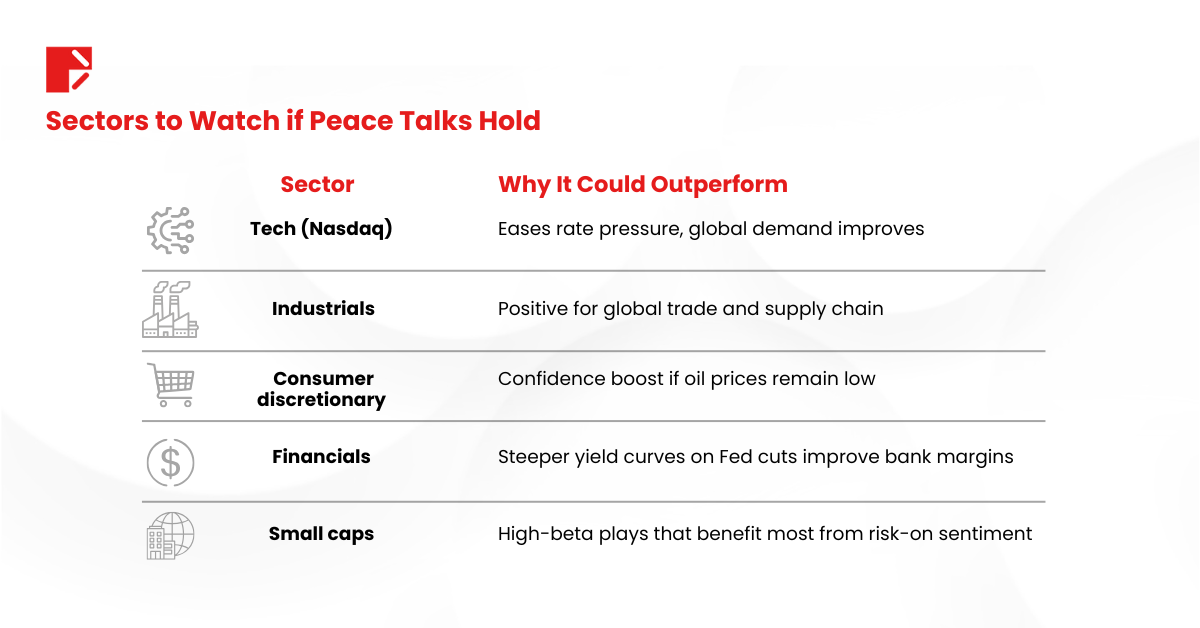

Sectors to Watch if Peace Talks Hold

If peace talks progress, watch these areas:

What Really Matters for Stocks Now

Let’s zoom out:

- The Fed needs to cut rates soon.

- A peace deal removes a major inflation risk.

- Trump will keep pressuring Powell.

- The market loves two things: falling rates and fading geopolitical tensions.

Put it all together: Stocks could be on the verge of a breakout.

Key Takeaways for Traders After Peace Talks

The shift is happening. The market narrative is no longer “Are we going to war?”

Now it’s: “Will Powell cut soon enough to send stocks to new highs?”

Peace talks are giving bulls momentum. If those rate cuts land this summer, we could see the S&P 500, and maybe even global markets, push to fresh records.

As always, stay adaptable. Follow the headlines. Watch the Fed. And trade what’s happening, not what you think should happen.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This material constitutes general market commentary and is not prepared in accordance with legal requirements designed to promote the independence of investment research. As such, it is not subject to any prohibition on dealing ahead of the dissemination of investment research. This article is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. Any price levels discussed are illustrative only and do not constitute a forecast or advice.

The information provided herein is not intended for residents of any jurisdiction where its distribution or use would violate local laws or regulations. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.