Federal Reserve Chair Jerome Powell is set to address Congress this week, a pivotal moment for markets eager for insights into the central bank’s interest rate direction.

In recent months, there has been a shift in the relationship between financial markets and the Fed regarding the timing and pace of anticipated interest rate adjustments. The perception of a highly accommodative central bank has evolved into one characterized by caution and deliberation.

Powell faces the challenge of offering clarity without unsettling Wall Street during his mandated appearances before the House and Senate. The key question revolves around the Fed’s stance on inflation, which Powell must articulate. While recent remarks have indicated satisfaction with price trends, there remains a sense of caution, emphasizing the need to maintain current monetary policy.

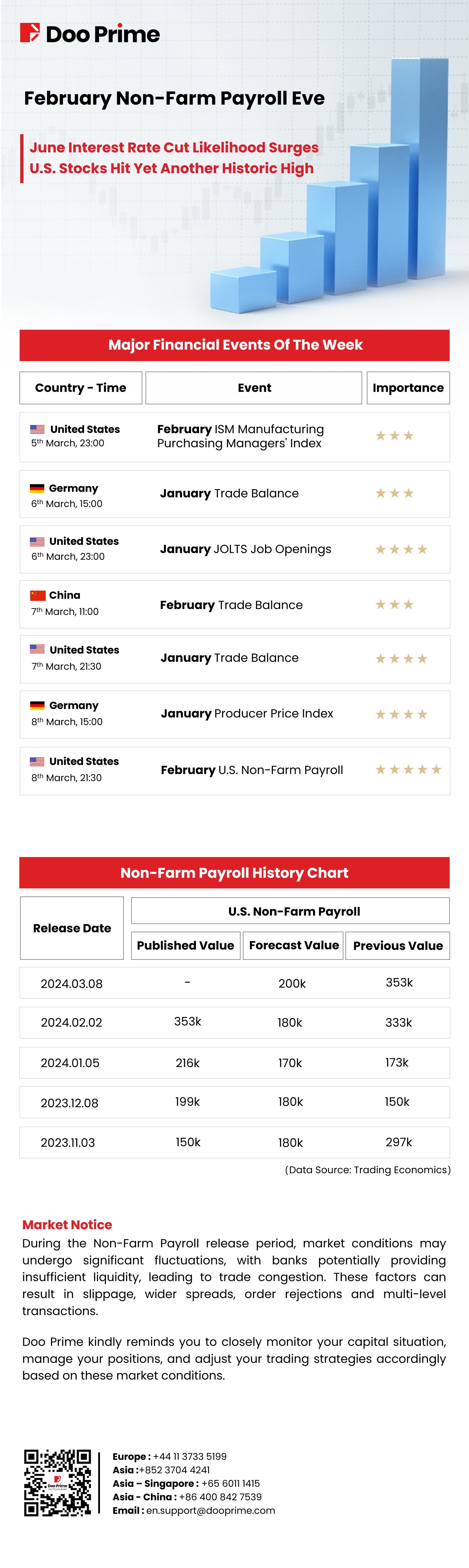

Market expectations, as indicated by futures market pricing from the CME Group, suggest anticipation of rate cuts starting in June, with a total of four quarter-point cuts expected throughout the year. However, policymakers have refrained from committing to a specific timeline, with December’s indications pointing to three cuts.

Powell’s testimony comes at a sensitive juncture for markets, with recent sell-offs following record highs. Concerns about future interest rate movements and uncertainty surrounding prominent tech stocks, which have been driving market gains, add complexity to the situation.

With the non-farm payroll data on the horizon, let’s delve into worldwide economic data release as a group to refine our investment approaches!