The recent boom of ChatGPT has undoubtedly triggered a frenzied pursuit of the artificial intelligence sector in the market, resulting in a wave of price increases for AI-related concept stocks due to the fluctuation in market sentiment.

However, as previously mentioned in our article “Riding The Wave Of ChatGPT’s Success: A Guide For Investors“, the booming AI industry carries a significant risk of a pullback.

Despite this, the underlying support tools and products of this emerging technology industry are better equipped to withstand such volatile cycles.

The ultimate success of any AI company remains uncertain, but the chip industry is a crucial necessity for the development of AI, and companies in this sector are likely to reap stable returns.

As a result, the recent boom in the AI industry has brought increased attention to the chip industry.

However, the chip industry itself is complex, and few investors possess a comprehensive understanding of it, especially when it comes to chips that are exclusively tailored to the AI industry’s needs.

In addition, not all chips are suitable for AI applications, and AI has specific requirements for chips. In this article, our focus will be on gaining a comprehensive understanding of the AI chip industry, as well as equipping investors with the knowledge necessary to capitalize on relevant market opportunities.

The Role Of AI Chips In Advancing Artificial Intelligence

The semiconductor chip industry has historically seen the emergence of breakthrough technology products as opportunities to usher in golden ages of growth. The PC personal computer, for example, popularized in the 1990s, spearheaded the development of the related computer chip industry.

In the 21st century, smartphones took the baton and became the new generation of game-changing products. Now, the emergence of ChatGPT suggests that artificial intelligence is poised to take over from smartphones and usher in a new era of development for the semiconductor chip industry.

To understand the type of AI chip needed for AI, we must first grasp its role.

Artificial intelligence involves simulating the human brain through neural networks, which entails machine learning. Machine learning comprises two critical aspects: training and inference, which are the two tasks that AI chips must undertake.

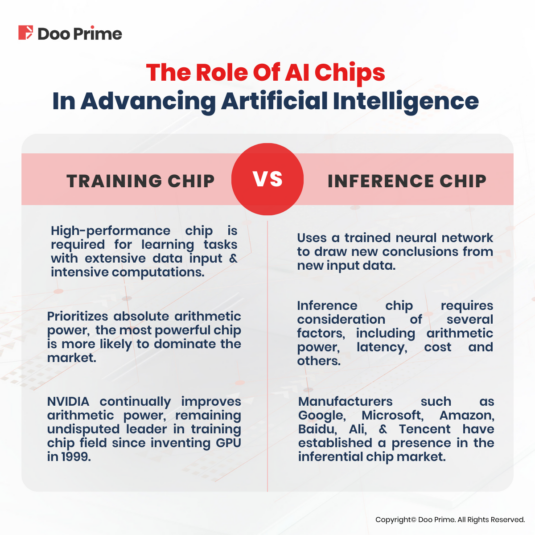

Training Chip:

During a training session for a complex deep neural network model, a vast amount of data is inputted, and numerous operations are performed. This process demands significant computing power and places high requirements on the chip’s computational performance and progress to complete various learning tasks.

Inference Chip:

Inference involves using a trained neural network model to make new conclusions based on new input data. It’s like taking a test after learning in class – the existing model is used to draw new inferences from the new data.

In summary, the training chip prioritizes absolute arithmetic power, meaning that the company with the most powerful chip is more likely to dominate the market.

On the other hand, the inference chip requires consideration of several factors, including arithmetic power, latency, and cost. Therefore, other factors must be taken into account beyond raw computational power.

When it comes to training chips, the emphasis is on absolute arithmetic power, meaning that the company with a more powerful chip in terms of arithmetic power is likely to dominate.

NVIDIA invented the GPU in 1999, and over the past two decades, its GPU chips’ arithmetic power has been continually updated and improved. As a result, NVIDIA’s GPU is currently the undisputed leader in the training chip field. The company’s stock price has also seen a significant increase of over 50% year-to-date, thanks to the growing popularity of artificial intelligence.

In contrast to training chips, the landscape of inferential chips is more crowded. These chips need to consider various factors beyond raw computing power, so dominance is not solely based on who has the most powerful chip.

Although NVIDIA also holds a significant share in the field of inferential chips, it has not established the same dominant position as in the training chip field. Other major manufacturers such as Google, Microsoft, Amazon, Baidu, Ali, and Tencent also have a presence in the inferential chip market.

Navigating The Maze Of AI Chips To Find The Best Fit

Based on the above, AI chips are required to perform both training and inference tasks, which raises the question: what type of chips are capable of handling these tasks? In order to answer this question, it is necessary to examine the various classifications of AI chips and determine which types are best suited for these tasks.

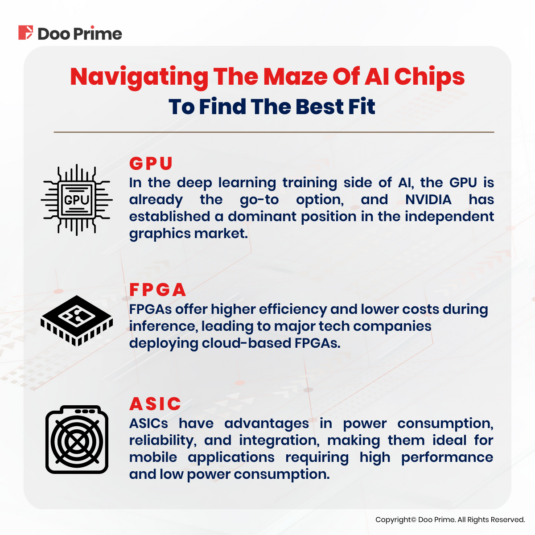

1)GPU:

The birth of GPU, or Graphics Processing Unit, is closely related to the development of modern computers and related industries. While the CPU serves as the brain of a computer, it also carries out other tasks such as storage reading, instruction analysis, and branch jumping.

As the task of data computation became increasingly heavy, the need for a specialized unit to carry out special calculations for graphics display, image rendering, and other computation-intensive tasks arose.

Hence, the GPU was created to enhance computing power and reduce pressure on the CPU. With its powerful computing power, the GPU has become a natural match for AI, an industry that requires extensive computation.

In the deep learning training side of AI, the GPU is already the go-to option, and NVIDIA has established a dominant position in the independent graphics market with a market share of around 70%.

2)FPGA:

FPGA (Field Programmable Gate Array) is a programmable logic device that is ideal for multi-instruction analysis, making it well-suited for the inference phase of AI. Due to their flexibility and efficiency, FPGAs are capable of achieving higher efficiency and lower costs during the inference phase, which is why major technology companies are deploying cloud-based FPGAs.

3)ASIC:

ASIC (Application Specific Integrated Circuits) is a custom chip designed for specific user needs, offering higher performance, smaller size, lower power consumption, lower cost, and higher reliability in mass production.

Despite this, the circuit design needs to be customized, the development cycle is long, and the functions are difficult to extend. ASICs are well-suited for mobile applications that require high performance and low power consumption.

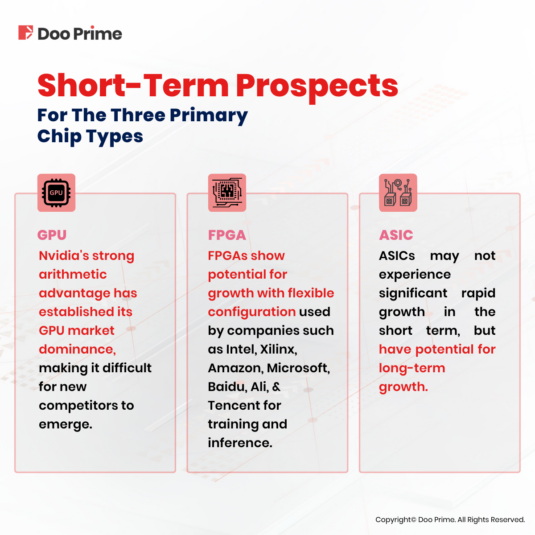

In the short term, GPU will maintain its leadership in the AI chip industry, and Nvidia’s share price will have a certain moat support. As long as the current AI boom continues, Nvidia’s leading position will remain unshakable with more AI-related products or services launching.

FPGAs also have a growth potential due to their configuration flexibility, practicality in rapid application iteration, and lower power consumption than GPUs, which helps companies effectively reduce the costs of the research and development process through FPGAs, and smoothly achieve product transition. Currently, Intel and Ceres have deployed FPGAs for training, while Amazon, Microsoft, Baidu, Ali, and Tencent have deployed FPGAs for inference.

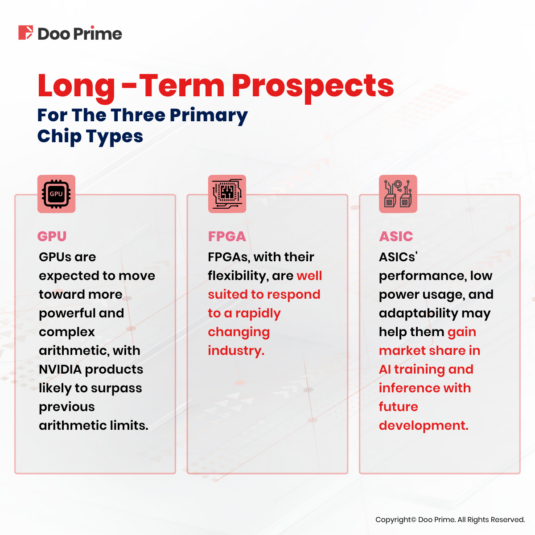

In the long run, each of the three technology paths – GPUs, FPGAs, and ASICs – has its own strengths, and the future of GPUs will inevitably involve more powerful and sophisticated computing capabilities.

FPGAs, thanks to their flexibility, are well-suited to meet the rapidly changing demands of the industry.

Although ASICs are currently less commonly used, they will become increasingly suitable for the artificial intelligence industry in the long run. Due to their high performance and low power consumption, ASICs can be customized to optimize multiple AI algorithms for various environments.

With further advancements in the future, ASICs are expected to occupy a significant market position in both the training and inference stages.

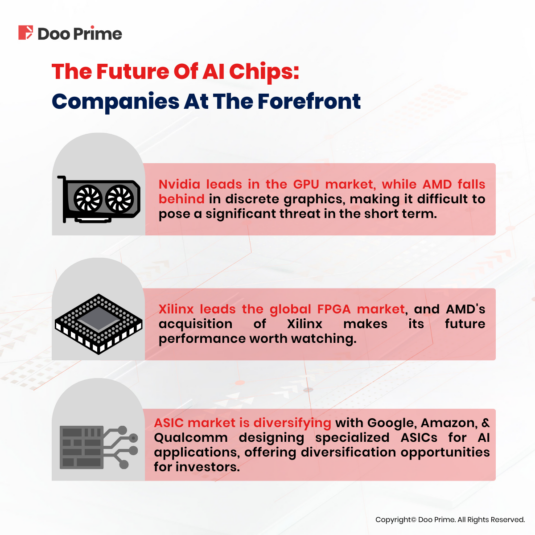

The Future Of AI Chips: Companies At The Forefront

Now that we have identified the types of chips required in the AI industry, let’s take a look at the companies that deserve market attention for each type of chip.

Currently, Nvidia dominates the GPU market due to its strong arithmetic advantage over competitors. This advantage creates a significant barrier to entry for other companies, making it difficult for them to compete with Nvidia in the short term.

As a result, it is unlikely that new challengers will emerge to threaten Nvidia’s dominance in the near future.

In contrast, AMD holds the second position in the market but is unable to match Nvidia’s discrete graphics performance. Instead, AMD relies on a cost-effective strategy to climb the ranks.

Despite its efforts, however, it is unlikely that AMD will pose a significant threat to Nvidia’s market share in the short term. Overall, Nvidia’s dominance in the global GPU market has contributed to the long-term success of its stock price.

NVIDIA’s dominant position in the GPU market is also reflected in its latest earnings announcement. According to its latest earnings report, the company’s data center business experienced a remarkable 41% year-over-year growth, generating a record USD 15.01 billion in total revenue. This growth was fueled by the next generation of its flagship product, the H100.

Despite the impressive capabilities of Nvidia’s A100 chip, which powers ChatGPT and is known to be nine times faster than the H100 in terms of training speed and 30 times faster in terms of inference speed, the H100 has surpassed it in generating revenue.

This underscores Nvidia’s position as a leading provider of cutting-edge technology, and suggests that it is likely to continue driving innovation in the AI industry. As a result, even as newer chips are developed, it is likely that Nvidia will remain at the forefront of the upgrade wave.

Xilinx, based in the United States, dominates the global FPGA market. However, AMD’s acquisition of Xilinx in February last year and its position as the second largest company in terms of GPUs after Nvidia, make its share price performance worth monitoring. This could be an indication of growth potential in the FPGA market and AMD’s future performance.

In its latest earnings report, AMD announced a full-year revenue of USD 23.601 billion in 2022, representing a 44% year-over-year increase.

AMD’s CEO, Lisa Su, stated that “2022 was a year of strong growth for AMD, driven by the strategic acquisition of Xilinx, a more diversified business, and a strengthened financial model.

Despite the complexity of the demand-side environment, AMD is confident in its ability to increase its market share and achieve long-term growth in 2023 based on its differentiated product portfolio.”

This suggests that AMD is poised for continued success and could present a competitive threat to Xilinx and other companies in the FPGA market.

While the GPU and FPGA markets have established dominant players, the ASIC market for AI has yet to form a unified pattern. Companies like Google, Amazon, and Qualcomm have begun designing specialized ASICs for their own AI applications.

Google, in particular, is making strides with its Bard project, which aims to benchmark against ChatGPT. If Bard is successfully launched and well-received, it will likely benefit Google’s TPU (Tensor Processing Unit) and could lead to a boost in Google’s stock price.

This underscores the potential for growth and innovation in the ASIC market, as companies continue to explore new ways to optimize AI performance.

At present, the short-term rise of AI chip companies’ shares depends largely on the launch of breakthrough-level applications and the chips used to power them.

Nvidia is already riding the wave of ChatGPT’s success and has a strong position in the GPU chip sector. However, investors should keep an eye on which company’s chips will power the next ChatGPT-like application.

To diversify their portfolios, investors should focus on companies related to the ASIC chip sector and await the emergence of the next star product. This could provide an opportunity for growth and innovation in the AI chip industry.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.