Today’s News

Image Source: PBS News

Iran launched a barrage of drones and missiles towards Israel, sparking concerns over geopolitical risks and potential war. However, the market’s response to this attack sheds light on investor sentiment, revealing a balance between high stock valuations and reasoned judgment. Despite initial jitters, investors showed resilience as they refrained from hastily dumping their portfolios, suggesting that the bubble fears might be premature.

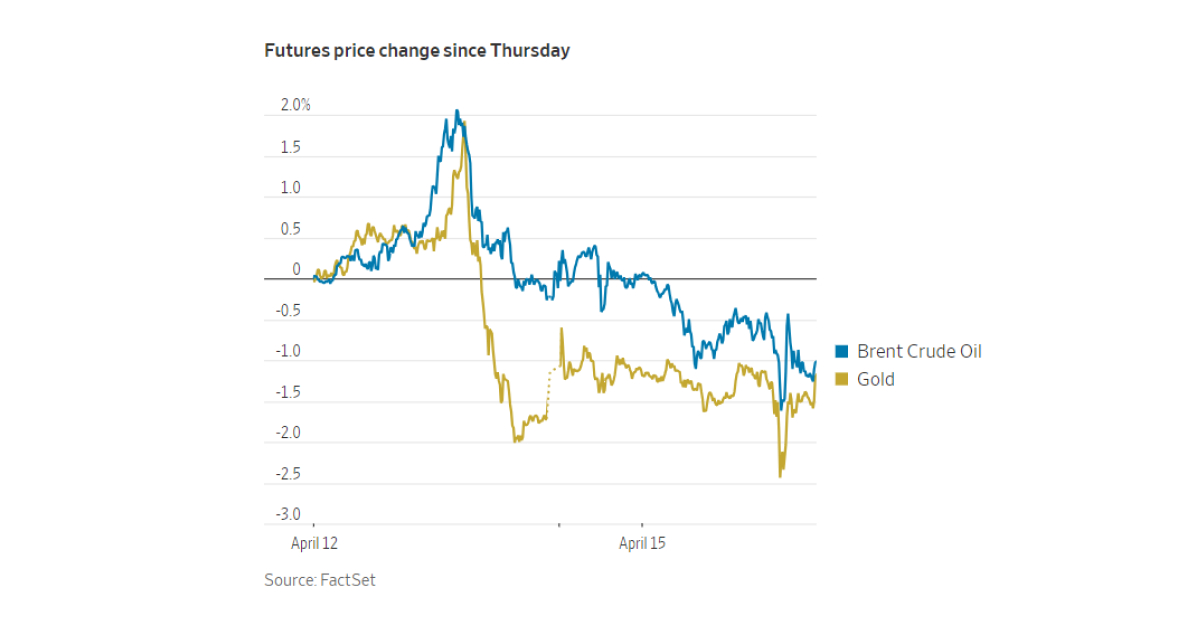

During the turmoil, stocks and bond yields dipped while oil and gold prices surged, reflecting apprehension about escalating tensions. Yet, as it became evident that Iran wasn’t seeking further escalation, markets rebounded, showcasing a logical response to unfolding events.

This resilience underscores a departure from irrational market behavior often associated with bubbles, where bad news is either disregarded or triggers significant upheaval. In contrast, this episode demonstrated a measured reaction, indicating a foundation of rational decision-making.

While the S&P 500 experienced its largest single-day drop since January, the scale of the sell-off remained modest compared to historical bubble bursts, offering some reassurance against current bubble concerns. Nonetheless, signs of volatility persist, reminiscent of past market bubbles fueled by exuberance in sectors like technology and meme stocks.

Evidence of extreme market movements, such as in Trump Media & Technology and smaller AI firms, along with heightened investor confidence, suggests pockets of excess. Surveys revealing bullish sentiment among investors further contribute to the cautious outlook, as euphoria levels approach levels reminiscent of previous market downturns.

Despite the unsettling backdrop of potential conflict in the Middle East, investors are urged to cautiously assess market froth rather than speculate on geopolitical outcomes for profit. Instead, the market’s reaction to the Iran attack serves as a barometer for evaluating the current state of stock valuations and underlying market sentiment.

Other News

Banorte’s Q1 Profits Up 9% on Loan Growth

Grupo Financiero Banorte sees a 9% rise in Q1 net profit to 14.21 billion pesos, driven by a growing loan book exceeding 1 trillion pesos, despite a 2.2% dip in government loans due to election-year restrictions.

BMO CEO Bullish On U.S. Economy

Bank of Montreal’s CEO, Darryl White, expresses optimism about the U.S. economy’s resilience and emphasizes California’s strategic importance, underlining the bank’s advantageous position to serve clients amidst evolving global dynamics.

Major Banks Cut Staff To Control Costs Amid Uncertainty

Leading U.S. banks, including Citigroup, Bank of America, Wells Fargo, and PNC Financial, collectively reduced headcount by about 2,000 jobs each in the first quarter, aligning with broader industry efforts to control costs.

Home

Home