Today’s News

Nasdaq rockets to new heights as meme stocks GameStop and AMC lead a pre-CPI surge, setting the stage for an eagerly anticipated economic report.

Image Source: Investopedia

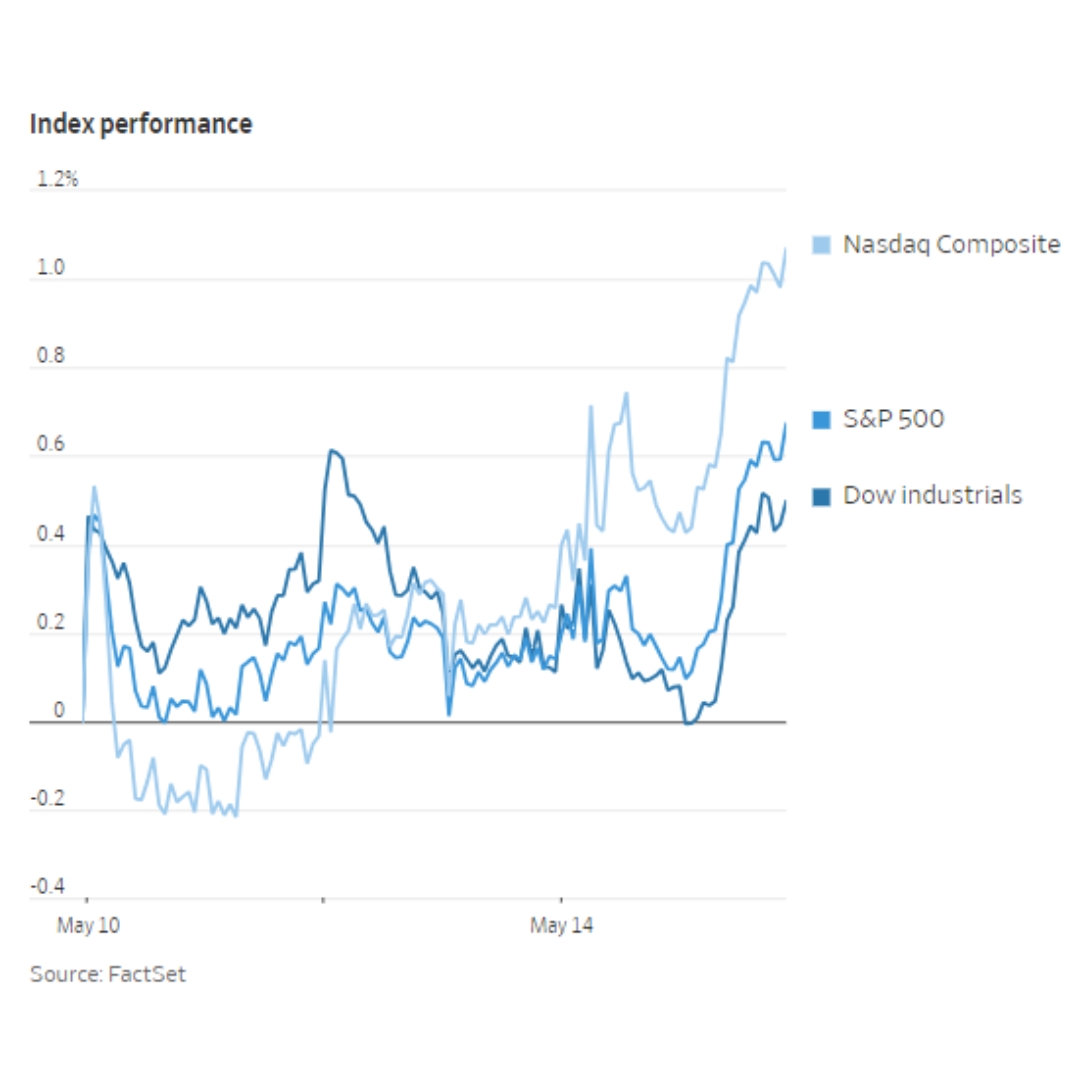

Stock indexes surged to record highs on Tuesday as investors digested a mix of economic reports and looked ahead to the forthcoming consumer price index (CPI) data. While the producer-price index exceeded economists’ expectations for April, it was revised downward for March, leaving investors uncertain about the Federal Reserve’s inflation-fighting strategy.

Nevertheless, the optimism prevailed, propelling the Nasdaq Composite to a remarkable 0.8% increase, marking its first record close since April 11. The S&P 500 also edged up by 0.5%, nearing its own record, while the Dow Jones Industrial Average climbed by 0.3%.

The anticipation loomed large over Wednesday’s CPI release, with economists projecting a 3.4% year-over-year increase in inflation. Richard Ratner, an investment adviser at Bel Air Investment Advisors, cautioned that a higher-than-expected CPI could lead to increased volatility as expectations for interest-rate cuts diminish.

Federal Reserve Chair Jerome Powell maintained a cautious stance on interest rates, emphasizing the need to monitor inflation data closely during a discussion in Amsterdam on Tuesday.

Despite a retreat in April, stock indexes rebounded this month, fueled by renewed hopes of interest-rate cuts in 2024. Notably, the S&P 500 has seen a remarkable 10% increase for the year.

Investor sentiment remained bullish, with surveys indicating growing risk appetite among investment managers. The surge in meme stocks GameStop and AMC Entertainment harked back to the frenzy of pandemic-era trading in 2021, with both witnessing substantial increases in trading activity.

Image Source: Wall Street Journal

Meanwhile, Alibaba reported a decline in profit despite a rise in revenue, leading to a drop in its American depositary receipts. Walmart shares also faltered following reports of corporate job cuts.

In commodities, copper prices continued their upward trajectory, reaching a record high as front-month futures surged by 3.1%, the most in over a year.

Other News

Roaring Kitty’s Return Sparks Meme Stock Craze

GameStop’s market value surged by USD 9.6 billion in just two days, reigniting the frenzy around meme stocks as ‘Roaring Kitty’ makes a comeback, prompting a surge in shares and amateur trader activity.

Big Investors Pivot to Real Estate Debt

Major investors like PGIM and LaSalle are boosting commercial property debt investments, seizing opportunities as banks withdraw, and focusing on sectors like logistics, data centers, and multi-family rentals.

Citi Executive that Oversees Restructuring Departs

Titi Cole, responsible for executing Citigroup’s restructuring plan, is leaving the bank after 30 years, alongside Mike Whitaker, with Tim Ryan stepping in as new head of technology and business enablement.