Market Recap

On Thursday, gold prices retreated as the U.S. dollar strengthened, while oil surged to a seven-week high on tighter supply concerns. Spot gold traded near $3,740.71/oz, slipping from record highs earlier in the week. U.S. crude traded around $64.71/barrel, gaining nearly 2% after an unexpected inventory draw and supply disruptions in Iraq, Venezuela, and Russia.

Gold

Gold pulled back on Wednesday as a stronger dollar weighed on demand, with traders awaiting key U.S. data later this week for clarity on the Fed’s policy path.

Phillip Streible, Chief Market Strategist at Futures, noted that gold is still digesting Fed comments and geopolitical tensions with Russia, adding that markets remain cautious until more data emerges.

Fed Chair Jerome Powell on Tuesday avoided new guidance on rate cuts, stressing the need to balance stubborn inflation risks with a slowing job market.

According to the CME FedWatch tool, markets expect another 25 bp rate cut this year, with a 94% probability in October and 77% in December. Attention now turns to Thursday’s weekly jobless claims and Friday’s PCE inflation index, the Fed’s preferred inflation gauge.

Technical Outlook:

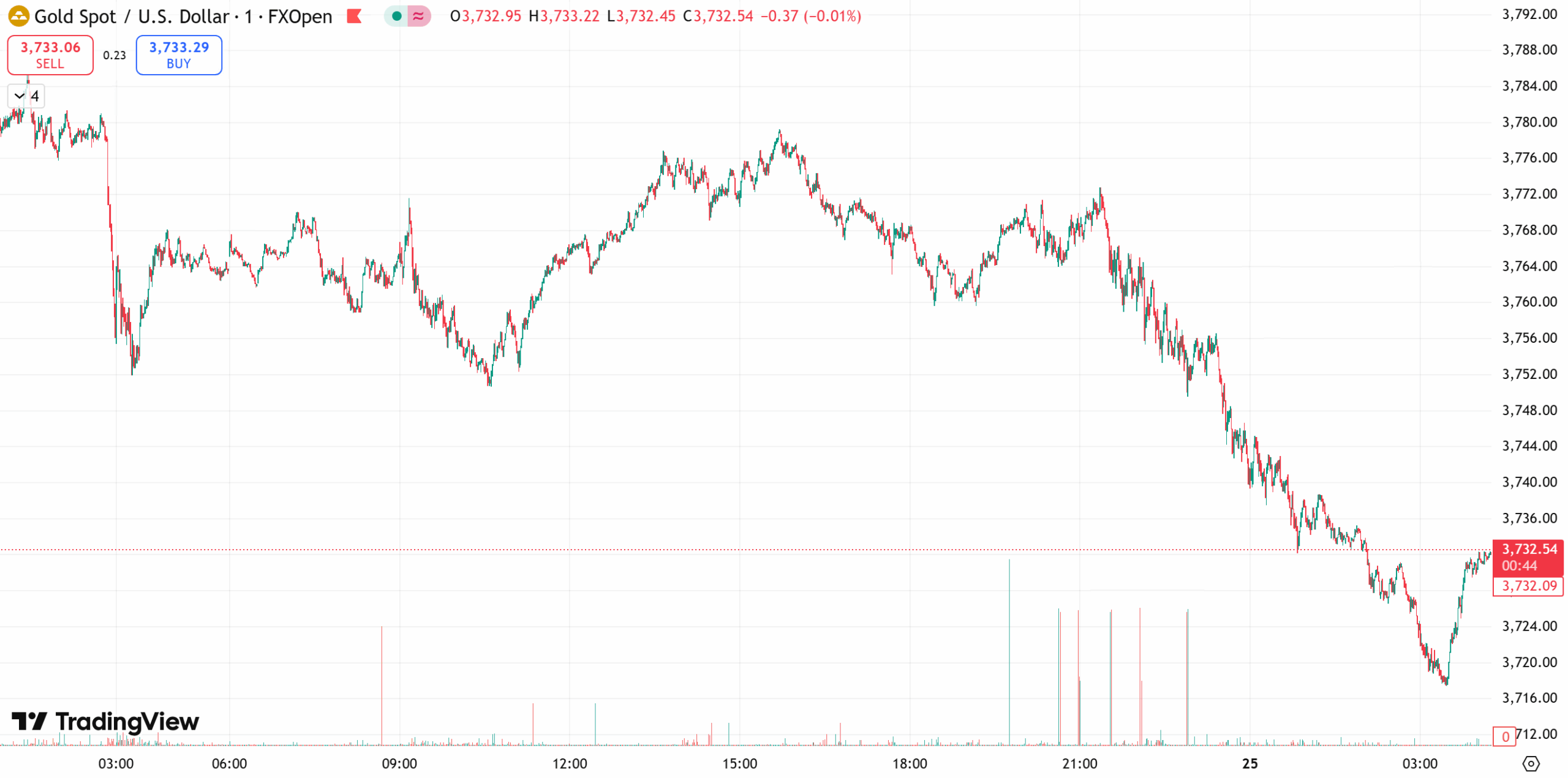

Gold remains in a bullish but choppy uptrend. After Tuesday’s surge to $3,792, prices corrected to $3,752 overnight, suggesting high-level consolidation. Traders are advised to follow a “buy on dips” approach rather than chasing rallies.

- Resistance: $3,760–$3,770

- Support: $3,720–$3,710

Oil

Oil prices surged to fresh multi-week highs. Brent crude +2.5% to $69.31/barrel (highest since August 1), and WTI crude +2.5% to $64.99/barrel (highest since September 2).

The U.S. EIA reported a surprise draw of 607,000 barrels last week, versus expectations for a build of 235,000. The API had also estimated a larger 3.8 million barrel drop. Inventories of crude, distillates, and gasoline all fell, providing further support.

Geopolitical tensions added fuel: Ukraine struck two Russian oil pumping stations overnight, while Novorossiysk, Russia’s key Black Sea port for oil and grain exports, declared a state of emergency.

Technical Outlook:

On the daily chart, oil remains in a mid-term consolidation range but shows short-term strength. The hourly trend has rebounded strongly, with moving averages aligned bullishly and MACD momentum expanding above zero. Near-term, crude is expected to maintain an upward bias within its range.

- Resistance: $66.0–$67.0

- Support: $63.0–$62.0

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.