1. Forex Market Insight

EUR/USD

The euro fell 0.35% against the dollar to $1.0646 on Tuesday, 21st February 2023 extending losses after data showed a deterioration in manufacturing activity in the euro zone, although a subsequent survey showed a rebound in inflation-sensitive service sector activity, limiting losses.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0697 line today. If the EUR runs below the 1.0697 line, then pay attention to the support strength of the two positions of 1.0613 and 1.0529. If the strength of EUR rises over the 1.0697 line, then pay attention to the suppression strength of the two positions of 1.0729 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound gained a strong 0.6% against the dollar to $1.2111 after data showed a surprise rebound in U.K. business activity, indicating a narrowing risk of recession.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.1902 and 1.1762. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2117 and 1.2261.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices retreated on Tuesday, 21st February 2023, as the dollar strengthened and U.S. bond yields rose, with markets turning their attention to U.S. economic data later in the week for more clues about the Fed’s path to rate hikes.

The focus this week will be on the Federal Open Market Committee’s (FOMC) minutes from its January meeting to be released on Wednesday, with recent strong U.S. economic readings raising bets on further Fed rate hikes.

Money market participants believe the indicator rate will peak at 5.3% in July and will remain near that level throughout the year.

Separately, U.S. gross domestic product (GDP) data will be released on Thursday, and the core personal consumption expenditures (PCE) price index will be released on Friday.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1832-line today. If the gold price runs below the 1832-line, then it will pay attention to the support strength of the 1820 and 1808 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of 1845 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Brent crude fell more than 1% in choppy trading Tuesday, 21st February 2023, with ongoing concerns about global growth overshadowing the impact of subdued supply and prompting investors to take profits after the previous day’s gains.

Broader financial markets are focused on the minutes of the latest Federal Reserve meeting to be released on Wednesday, with recent data raising the risk that the Fed will raise rates to higher levels and keep them there for longer.

Russia plans to reduce crude oil production by 500,000 barrels per day, or about 5% of its output, in March after the West imposed price caps on Russian oil and oil products due to the invasion of Ukraine.

Russian Deputy Prime Minister Novak said Tuesday that the production cuts announced this month are now limited to March, according to the news agency.

Technical Analysis:

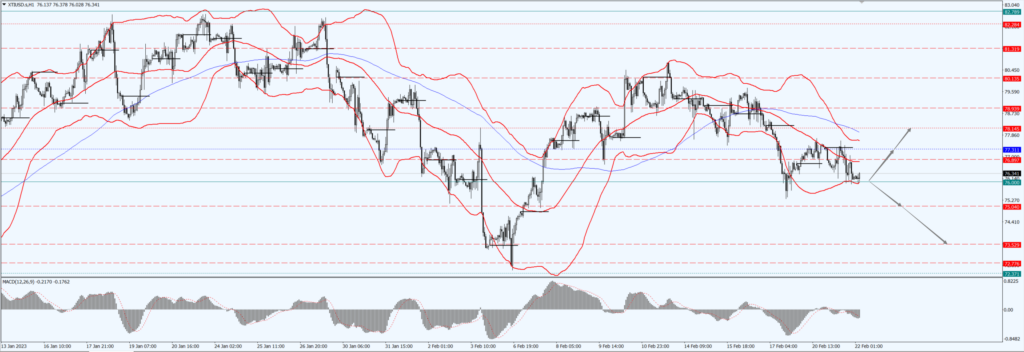

(Crude Oil 1-hour Chart)

Oil prices today focus on 76- line, if oil prices run at 76 – line above, then pay attention to 77.31 and 78.14 two positions of suppression strength; if oil prices run at 76 – line below, then pay attention to 74.04 and 73.52 two positions of support strength.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.