D Prime Market Snapshot | Jan 28–29

Markets moved fast between January 28–29 — and so did prices.

Gold hit a fresh all-time high, the Fed stayed on hold, and Big Tech earnings beat expectations, powered by AI and advertising recovery.

Here’s what matters 👇

Gold Hits Record High Above USD 5,600

Spot gold surged past USD 5,600 per ounce, reaching an intraday high of USD 5,626.80 — a new all-time high.

Why it matters

- Gold gained +12% in one week

- Prices jumped USD 600+ from below USD 5,000

- Multiple psychological resistance levels broken

What’s driving gold

- Weak US dollar

- Rising geopolitical and economic uncertainty

- Growing bets on a more dovish Federal Reserve

- Renewed demand for safe-haven assets

Signals from Washington suggest tolerance for a weaker dollar — and that’s adding fuel to gold’s momentum.

Fed Holds Rates, Flags Long-Term Risks

The Federal Reserve kept interest rates unchanged at 3.50%–3.75%, in line with expectations.

Key takeaways from Powell

- Inflation is cooling, but not fully neutralized

- Labor market remains stable

- Economic data distortions from the shutdown are easing

- Fiscal sustainability remains a long-term risk

Bottom line: the Fed is patient — but cautious.

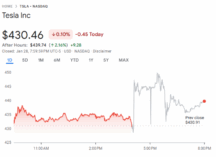

Tesla Beats Expectations Despite Revenue Dip

Tesla (TSLA) Q4 results

- Revenue: USD 24.9B (-3.1% YoY, but above estimates)

- EPS: USD 0.50 (vs. USD 0.45 expected)

Segment snapshot

- Automotive: -11% YoY (delivery pressure)

- Energy & Storage: +25% YoY (key growth engine)

- Services & Other: +18% YoY

Why investors care: energy, autonomy, and AI are increasingly offsetting slower EV demand.

Microsoft Powered by Cloud + AI

Microsoft (MSFT) Q2 highlights

- Revenue: USD 81.3B (+16.8% YoY)

- EPS: USD 4.14 (beat estimates)

Growth drivers

- Productivity & Business: +16%

- Intelligent Cloud: +28.8%

- Personal Computing: -2.7%

Takeaway: AI + cloud adoption continues to reshape Microsoft’s revenue mix.

Meta Rides Advertising Recovery

Meta (META) Q4 results

- Revenue: USD 59.9B (+23.8% YoY)

- EPS: USD 8.88 (beat expectations)

What stood out

- Ads rebound lifted core apps (+24.5%)

- Reality Labs still under pressure (-11.9%)

- AI investment set at USD 115–135B for 2026

Meta is doubling down on AI to future-proof its social and advertising ecosystem.

What Markets Are Watching Next

Keep an eye on:

- Fed leadership and policy signals

- US dollar direction

- Gold’s ability to hold record levels

- AI-driven earnings momentum

- Fiscal and geopolitical risks

Bottom line:

Safe-haven demand is rising, AI remains the growth engine, and policy expectations are moving markets fast.

Disclaimer

This content is provided for informational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy or sell any financial instrument. Market conditions may change at any time. Trading involves risk, and past performance is not indicative of future results.