Market Recap

On Thursday, US equities closed mixed after the Federal Reserve cut its benchmark rate by 25 basis points, in line with expectations. Chairman Jerome Powell emphasized that the move does not mark the beginning of a long-term easing cycle.

The FOMC voted 11–1 in favor of lowering the federal funds target range to 4.00%–4.25%. The Fed’s updated “dot plot” suggests the possibility of two more rate cuts before year-end. Recent data shows US growth remains solid, with consumer spending stronger than expected, but the labor market is showing cracks. August nonfarm unemployment rose to 4.3%, the highest since October 2021, though still relatively low by historical standards.

Stock Highlights:

Amazon pledged over $1 billion to boost employee pay and lower healthcare costs. Workday rallied after activist investor Elliott disclosed a $2 billion stake.

US Stocks

Large-cap tech stocks were mixed: Nvidia fell more than 2%, Oracle lost over 1%, Netflix rose more than 2%, and Tesla gained over 1%.

Chinese ADRs were broadly higher, with the Nasdaq Golden Dragon China Index up 2.85%. Baidu surged over 11%, NIO rose more than 6%, while Alibaba, Bilibili, and Li Auto each advanced over 2%.

US Market Technical Analysis

Dow Jones: +260.42 points (+0.57%) to 46,018.32

Nasdaq: –72.63 points (–0.33%) to 22,261.33

S&P 500: –6.41 points (–0.10%) to 6,600.35

Hong Kong Stocks

Hong Kong markets ended mixed. Tech shares were uneven: Baidu rose over 4%, Meituan and Lenovo gained more than 1%, while Tencent slipped over 1%. The semiconductor sector outperformed, with Solomon Systech surging more than 10%. Apple-concept stocks led gains, as FIT Hon Teng jumped over 11%.

Real estate stocks continued to struggle, with Country Garden plunging more than 8%. Kaisa Capital soared more than 227%.

Apple-related names gained traction after Goldman Sachs reported that iPhone 17 pre-order delivery times are significantly longer than the previous model worldwide. In mainland China, wait times extended by an average of 17 days to 27 days, fueling expectations of an 8% year-on-year increase in iPhone revenue for Apple’s fiscal Q4.

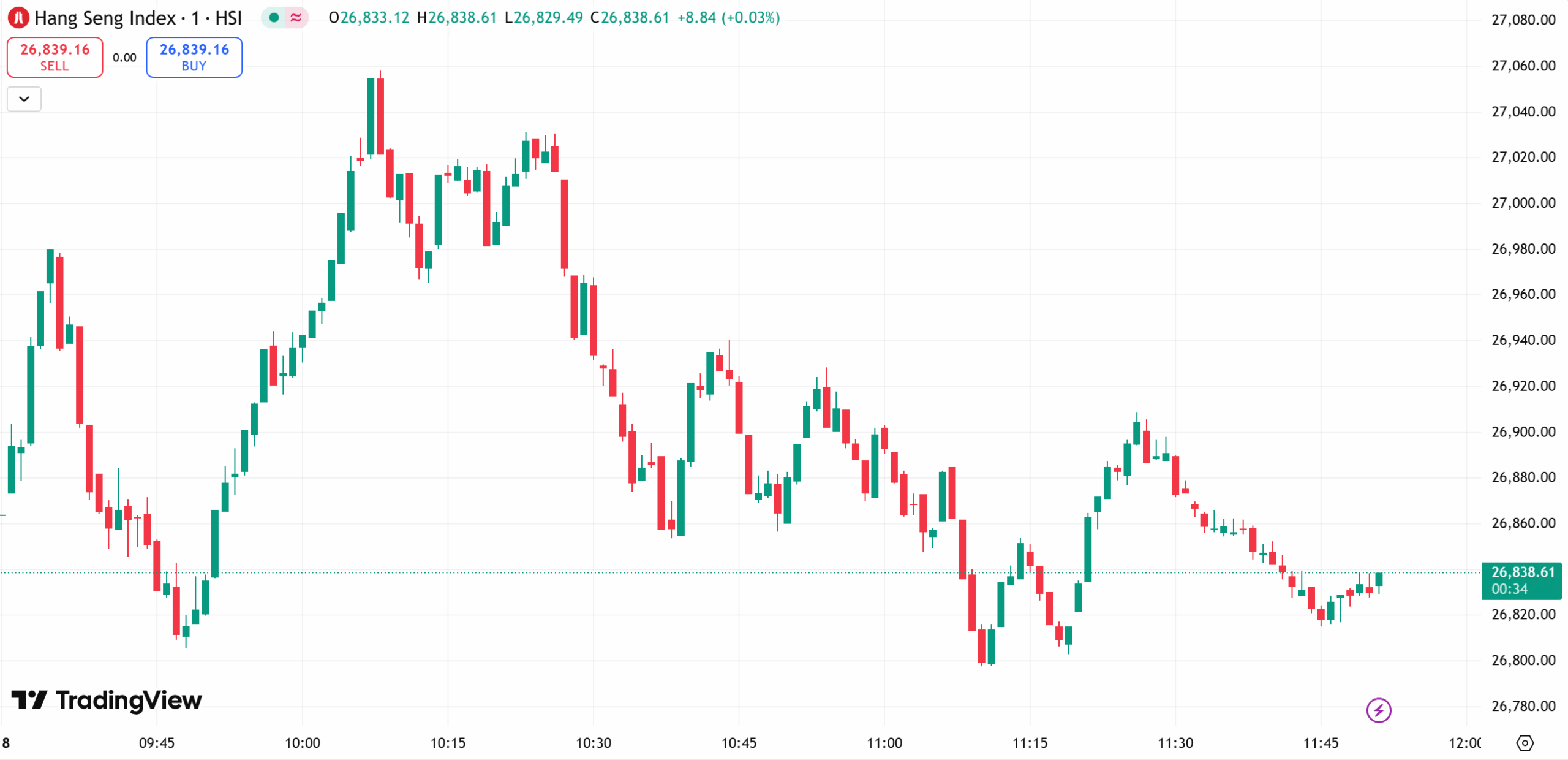

HK Market Technical Analysis

Hang Seng Index: –0.18% at 26,860.61

Hang Seng Tech Index: +1.04% at 6,400.17

China Enterprises Index: –0.11% at 9,586.04

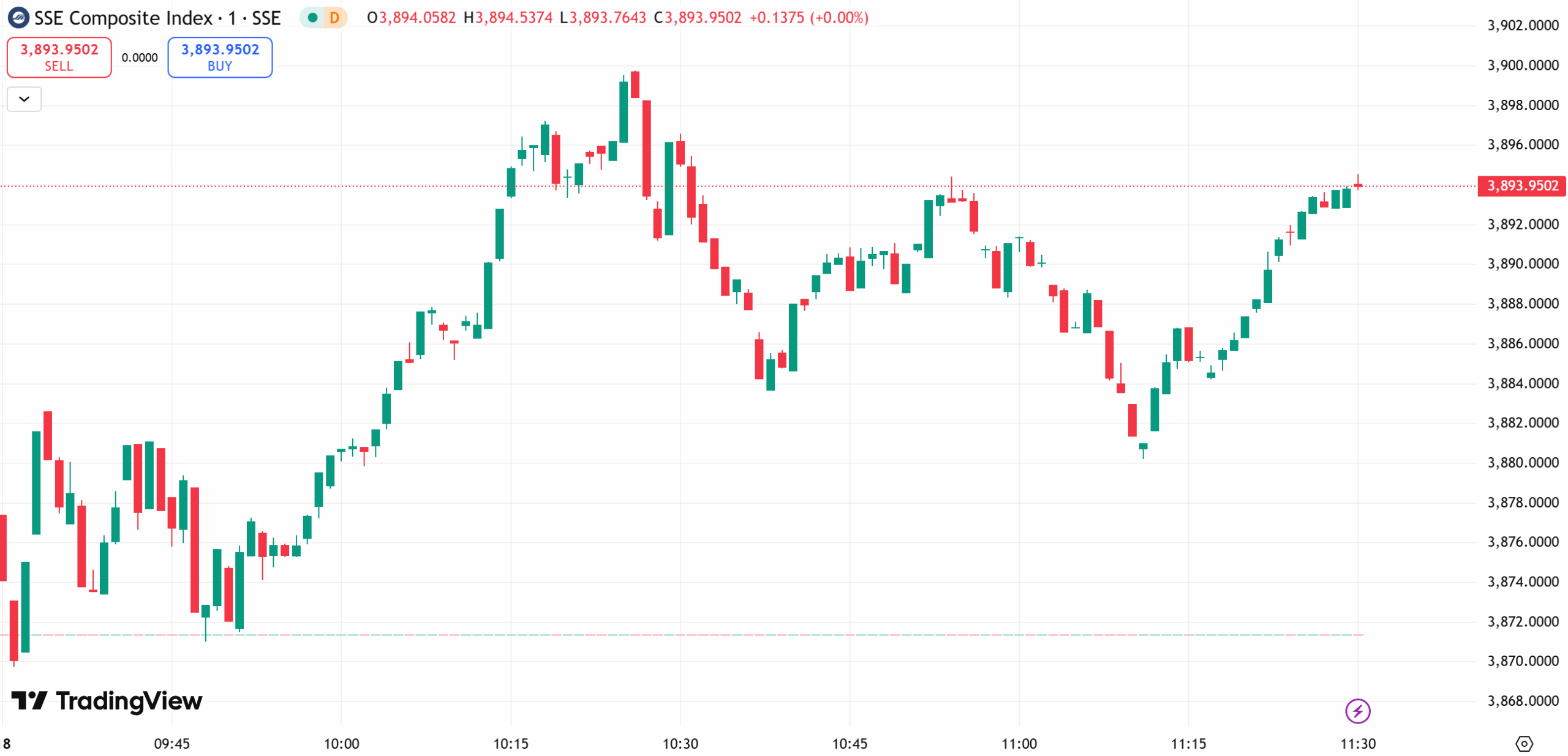

A50 & A-Shares

Mainland Chinese markets opened higher, with all major indexes advancing by midday. The Shanghai Composite rose 0.45%, the Shenzhen Component gained 0.79%, and the ChiNext Index added 0.49%. The Beijing 50 climbed 1.05%, while the STAR 50 surged 3.4%. Combined half-day turnover across Shanghai, Shenzhen, and Beijing reached RMB 1.72 trillion, up RMB 158.4 billion from the previous session, with over 2,700 stocks in positive territory.

Sector performance was led by photolithography, semiconductors, liquid-cooled servers, high-speed copper connectivity, wind power equipment, and robotics. On the downside, non-ferrous metals, financials, pork, coal, and airport/aviation lagged.

China Market Technical Analysis

Shanghai Composite: +0.45% at 3,893.95

Shenzhen Component: +0.79% at 13,319.70

ChiNext Index: +0.49% at 3,162.90

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.