Market Update

Spot gold traded near 4226 dollars per ounce on Wednesday, supported by the Federal Reserve’s expected 25-basis-point rate cut, while Powell avoided committing to another near-term cut but did not rule out further easing, which markets interpreted as keeping the door open for a potential January rate cut.

WTI crude hovered near 58.83 dollars per barrel, rising on supply concerns after the U.S. seized an oil tanker near Venezuela.

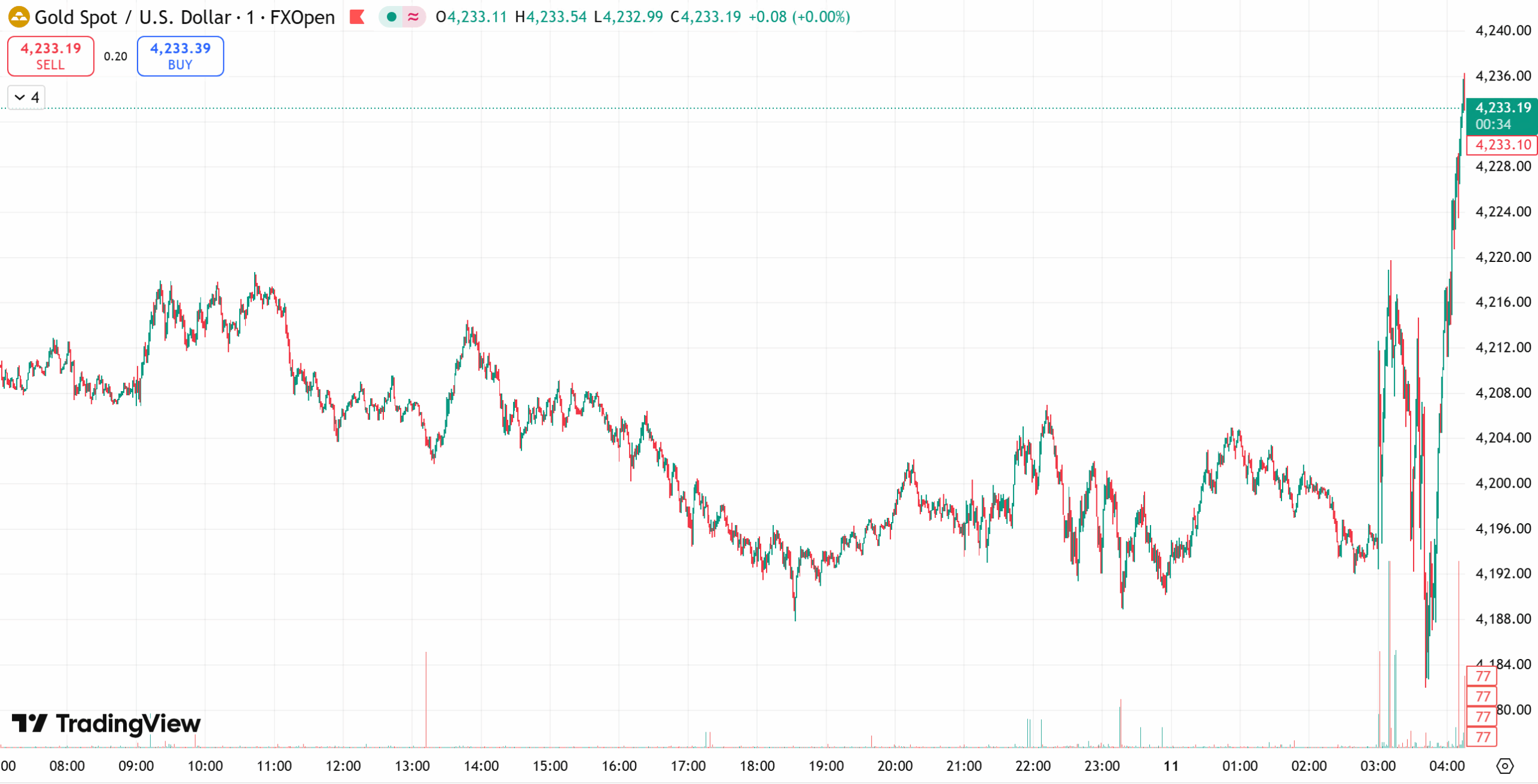

Gold

Gold posted gains on Wednesday as the Fed delivered its expected rate cut. After intraday swings, spot gold settled 0.7 percent higher, reaching 4238.59 dollars at the session high. Traders bought dips after early profit-taking, and the Fed’s split vote reinforced expectations that monetary policy will stay accommodative.

Silver surged sharply, hitting a record high of 61.85 dollars per ounce and extending its year-to-date gain to 113 percent. Strong industrial demand, falling inventories, and its designation as a critical mineral in the U.S. continue to support the metal.

Platinum fell 2.4 percent, while palladium dropped 2 percent.

Powell signaled caution, noting policy is already positioned for changing economic conditions but avoided committing to another rate cut. Markets still interpret the tone as leaving room for further easing, providing underlying support for gold.

Gold Technical Outlook

Gold extended its breakout, with spot prices last seen near 4228 dollars. The daily chart shows a clear upside bias, with a breakout candle, widening Bollinger bands, and strong bullish alignment across moving averages. MACD remains in a strong bullish phase and KDJ oscillators hold in overbought territory, confirming momentum.

Support is now seen at 4210 dollars (breakout retest) and deeper support at 4185–4170 dollars.

Resistance sits at 4248 dollars, with scope toward 4300 dollars if broken, and a medium-term target near 4580 dollars.

The preferred strategy remains buying on dips, avoiding emotional chasing at highs.

Today’s Gold Levels

• Resistance: 4250 – 4270

• Support: 4205 – 4185

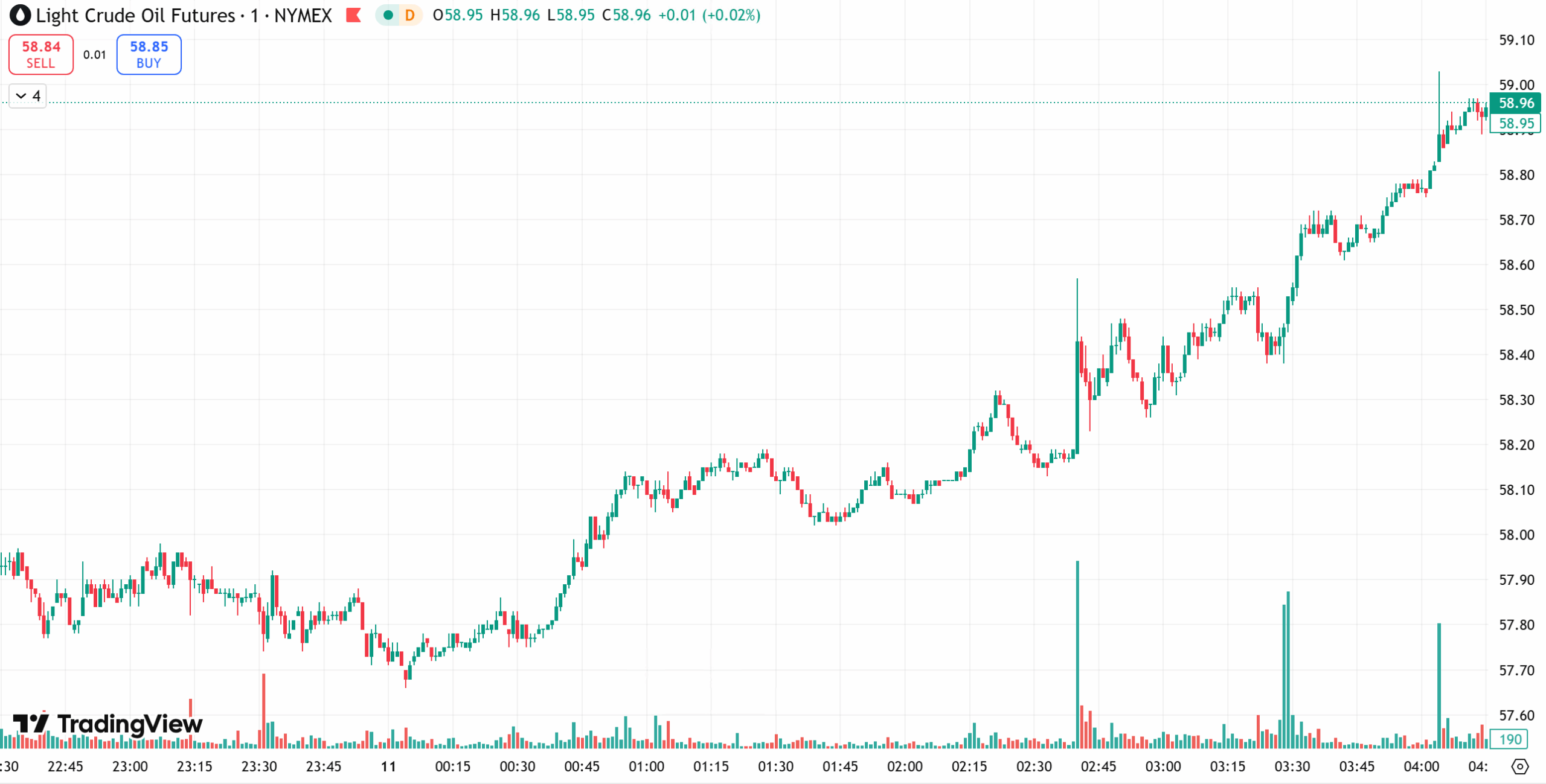

Crude Oil

Oil prices closed higher Wednesday after the U.S. Coast Guard seized an oil tanker near Venezuela, raising short-term supply concerns. Brent settled 0.4 percent higher at 62.21 dollars, while WTI also rose 0.4 percent to 58.46 dollars, with both extending gains in after-hours trading.

Analysts note that the tanker incident heightened worries about supply from sanctioned producers including Venezuela, Iran, and Russia. Additional disruptions could trigger sharper volatility.

U.S. crude inventories fell 1.8 million barrels, less than expected, while the Fed’s rate cut added a modest demand-side lift. However, Powell offered no explicit guidance on future cuts, keeping near-term sentiment mixed.

Technical Outlook

Oil remains in a secondary downtrend on the daily chart, repeatedly testing the 56-dollar support zone. MACD continues to drift weakly below zero, reflecting persistent bearish pressure.

Short-term charts show WTI breaking to new lows near 58.15 dollars, with moving averages aligned bearishly. Momentum favors continued downside, although intraday consolidation may occur.

Today’s Levels

• Resistance: 60.5 – 61.5

• Support: 57.5 – 56.6

Risk Disclosure

Trading Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.