1. Forex Market Insight

EUR/USD

The euro earlier touched $1.0737, its highest since June 9, after the ECB announced its interest rate decision, before falling back to $1.0629, down 0.5% for the day.

The ECB also raised rates for the fourth straight time on Thursday, 15th December 2022 but by less than at its two previous meetings, with the central bank pledging to raise rates further and laying out plans to pull money out of the financial system as part of its efforts to fight runaway inflation.

ECB President Christine Lagarde said at a news conference that there is still a risk of upward inflation, which would require further tightening of policy.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.0568 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0734 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound fell sharply against the U.S. dollar yesterday as markets believed the Bank of England was nearing the end of a rate hike, ending the day down nearly 2% at $1.2183.

The Bank of England raised its key interest rate by 50 basis points on Thursday 15th December 2022 and said it may raise rates further, but investors are betting that the central bank may be nearing the end of its rate-hiking campaign.

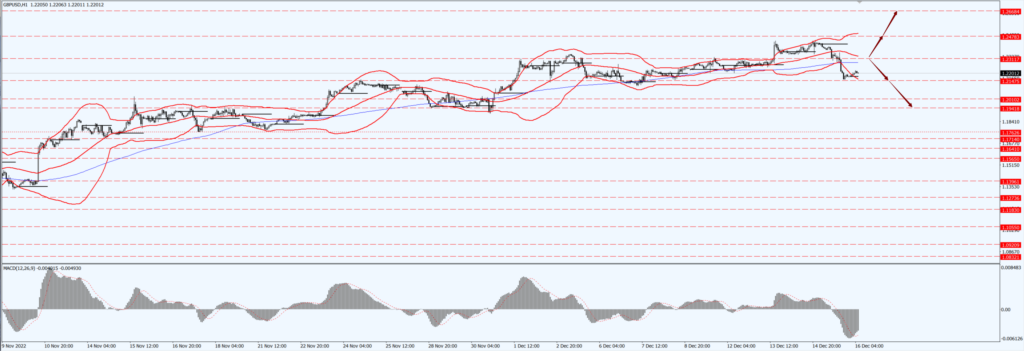

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2311-line today. If GBP runs below the 1.2311-line, it will pay attention to the suppression strength of the two positions of 1.2147 and 1.1941. If GBP runs above the 1.2311-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell as much as 2% at one point Thursday, 15th December 2022 touching their lowest in about a week, as the dollar climbed after the Federal Reserve said it would raise interest rates further next year. Spot gold fell 1.6% to $1,777.88 an ounce, after seeing a low of $1,771.89 earlier.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1783-line today. If the gold price runs below the 1783-line, then it will pay attention to the support strength of the 1768 and 1747 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of 1793 and 1816.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices slipped about 2% Thursday 15th December 2022 as a stronger dollar and further interest rate hikes by major global central banks worried the market about the outlook for fuel demand.

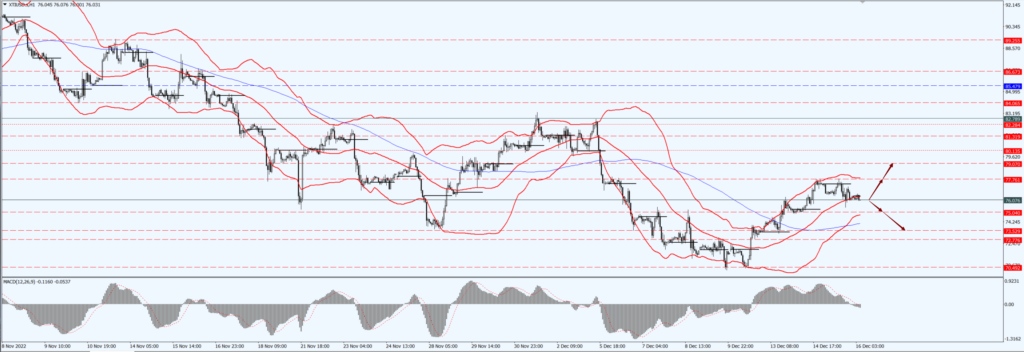

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 76.07- line today. If the oil price runs above the 76.07 -line, then focus on the suppression strength of the two positions of 77.76 and 79.07. If the oil price runs below the 76.07 -line, then pay attention to the support strength of the two positions of 75.04 and 73.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.