1. Forex Market Insight

EUR/USD

The minutes of the Fed’s March meeting released last week have shown that many of the policymakers in attendance are prepared to raise rates by 50 basis points in the coming months.

While the dollar rose, the euro fell to a one-month low of $1.0837. It was last down 0.05% at $1.0874, with the euro falling for seven consecutive trading days.

In the meanwhile, the minutes of the European Central Bank’s meeting on Thursday, 7th April 2022, showed policymakers were keen to act against inflation, but the eurozone has so far adopted a more cautious strategy than other central banks, which has weakened the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

We focus on the 1.0890-line today. If the euro runs steadily below the 1.0890-line, then pay attention to the support strength of the two positions of 1.0832 and 1.0776. If the strength of the euro breaks above the 1.0890-line, then pay attention to the suppression strength of the two positions of 1.0940 and 1.0986.

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP/USD fell 0.63% to 1.3026, its lowest level since 15th March 2022.

The bets on a quick rate hike by the Bank of England waned to be bearish for the pound.

In addition, the euro fell after the West said it needed to impose new sanctions on Russia which dragged down the pound too.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2991- line. If the pound runs above the 1.2991-line, it will pay attention to the suppression strength of the two positions of 1.3104 and 1.3186. If the pound runs below the 1.2991-line, it will pay attention to the support strength of the 1.2872-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fluctuated higher last Friday, 8th April 2022, as Ukraine and its allies said that the Russian army attacked a large number of casualties at the East Ukrainian railway station, which boosted the market’s risk aversion.

The dollar recorded its biggest weekly gain in a month despite a hawkish message from the Federal Reserve last week, weighing on gold prices.

The dollar recorded its biggest weekly gain in a month despite a hawkish message from the Federal Reserve last week, weighing on gold prices.

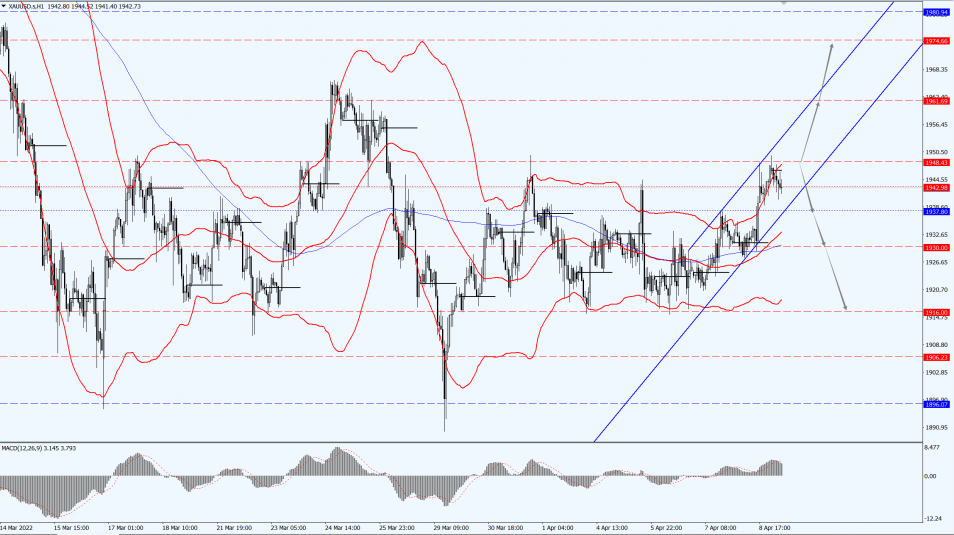

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1948-line today. If the gold price runs steadily below the 1948-line, then it will pay attention to the support strength of the 1937 and 1930 positions. If the gold price breaks above the 1948-line, it will open up further upward space. At that time, we will pay attention to the suppression strength of the two positions in 1961 and 1974.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower last week, mainly because the market continued to digest the news of the IEA’s announcement of a significant sale of crude oil reserves. Besides, the short-term supply increase in the crude oil market has put pressure on oil prices too.

Technical Analysis:

Trading Strategies:

Oil prices focused on the 93.57-line today. If the oil price runs above the 93.57-line, then focus on the suppression of 97.33 and 100.65. If the oil price runs below the 93.57-line, then pay attention to the support strength of 91.54 and 90.44.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.