Markets saw mixed action on Tuesday as gold surged on safe-haven demand following a surprise US credit rating downgrade by Moody’s. Meanwhile, oil prices edged up slightly, supported by optimism over potential ceasefire talks between Russia and Ukraine and ongoing nuclear negotiations with Iran.

Gold Market Recap

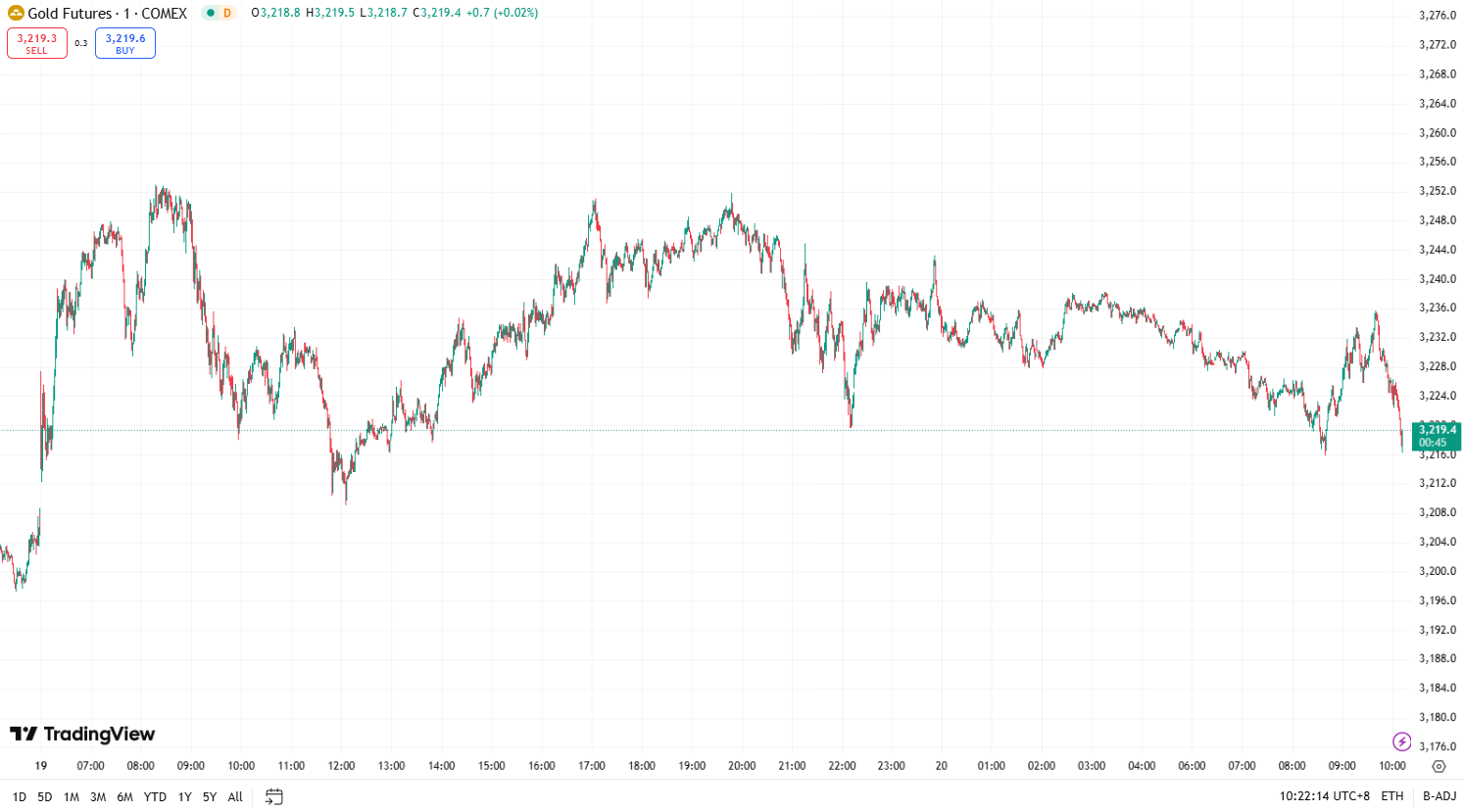

Gold prices briefly spiked toward the $3,250 level on Monday before settling at $3,230.07, lifted by a weaker dollar and renewed safe-haven buying after Moody’s downgraded the US government’s credit rating.

The global financial community was rattled after Moody’s Investors Service cut the US sovereign credit rating from “Aaa” to “Aa1”, citing “a debt and interest burden far exceeding that of peer nations.” The move dealt a blow to the dollar’s dominance and spurred immediate demand for gold.

The US Dollar Index dropped 0.6%—its lowest since May 8. US equities came under pressure while gold surged, with spot prices approaching $3,250 per ounce.

“In the context of the US downgrade, gold remains a safe bet,” said Bob Haberkorn, senior strategist at RJO Futures.

Gold – Technical Overview

Gold opened with a slight gap-up during the Asia session and extended gains through the morning. In the European session, it briefly pierced the $3,248 level before pulling back. During the US session, prices came under pressure near $3,245 and retreated to close around $3,230, ending the day in a consolidation pattern.

Gold – Today’s Strategy

Wait patiently for key levels before entering new positions.

- Resistance to watch: $3,250–$3,255

- Support to watch: $3,180–$3,185

Crude Oil Market Recap

Oil prices closed slightly higher as investors tracked developments in peace talks and nuclear negotiations.

President Trump said Monday that Russia and Ukraine would “immediately” begin ceasefire negotiations following a call with President Putin. The news boosted sentiment and helped oil hold onto gains.

Brent crude settled around $65.50 per barrel, while WTI crude futures rose 0.3% to close at $62.69.

Meanwhile, uncertainty around the Iran nuclear deal kept volatility elevated. Iran’s President Masoud Pezeshkian stated on national TV that Tehran will not abandon its pursuit of civilian nuclear energy under any circumstances, further clouding diplomatic progress.

Crude Oil – Technical Overview

WTI held steady above the $61 level, supporting continued bullish momentum. After a mild pullback in the Asia-European session, prices regained strength and broke through the $62 mark in the US session. A late-session surge saw prices touch $62.70 before retreating slightly into the close. The daily chart closed with a small bullish candle, signaling steady upward momentum.

Crude Oil – Today’s Strategy

Maintain a bullish bias and trade with the prevailing trend.

- Resistance to watch: $61.8–$62.0

- Support to watch: $61.5–$61.3

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.