Market Recap

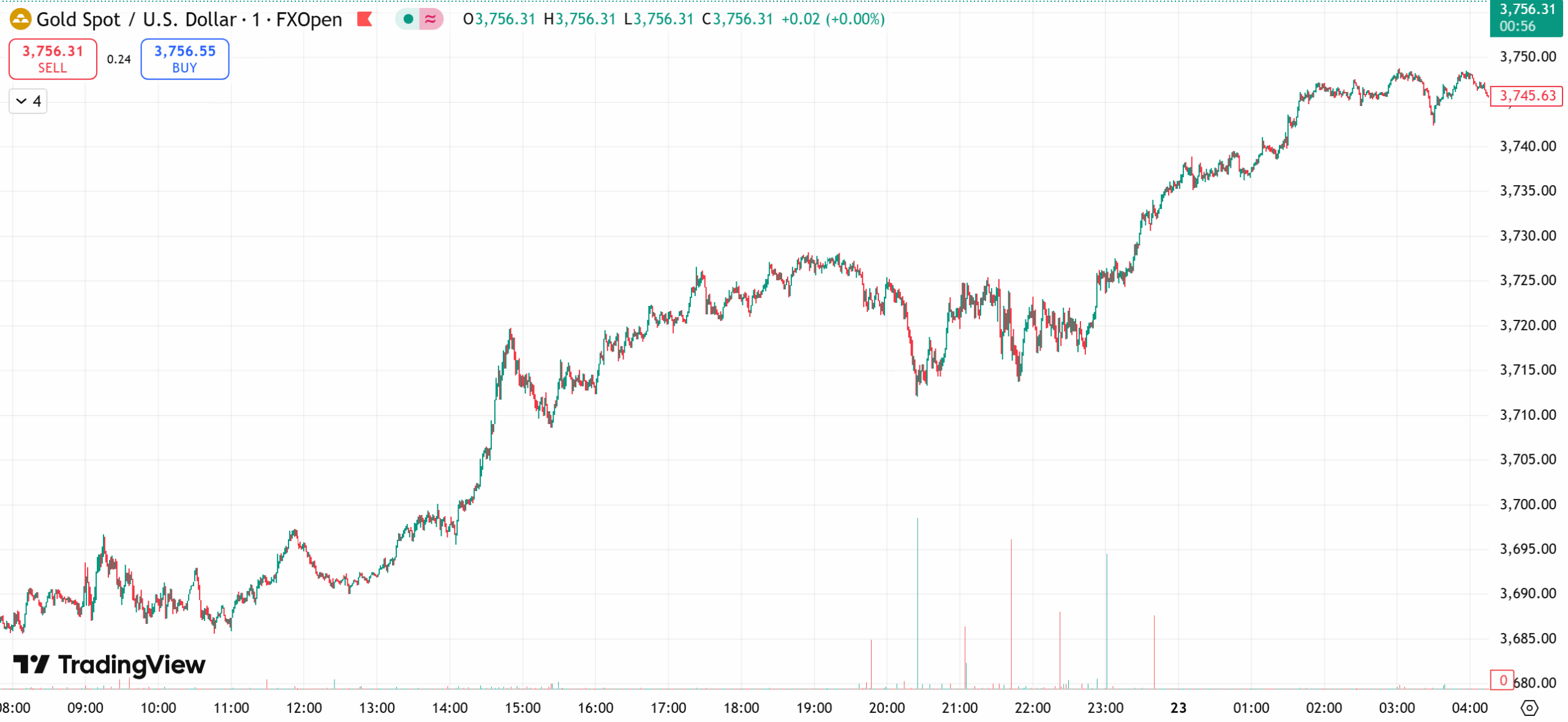

On Tuesday, spot gold climbed near $3,744.18 per ounce, supported by rising expectations of further Fed rate cuts and strong safe-haven demand amid ongoing geopolitical uncertainty. On Monday, gold had already set a fresh record high at $3,748.62.

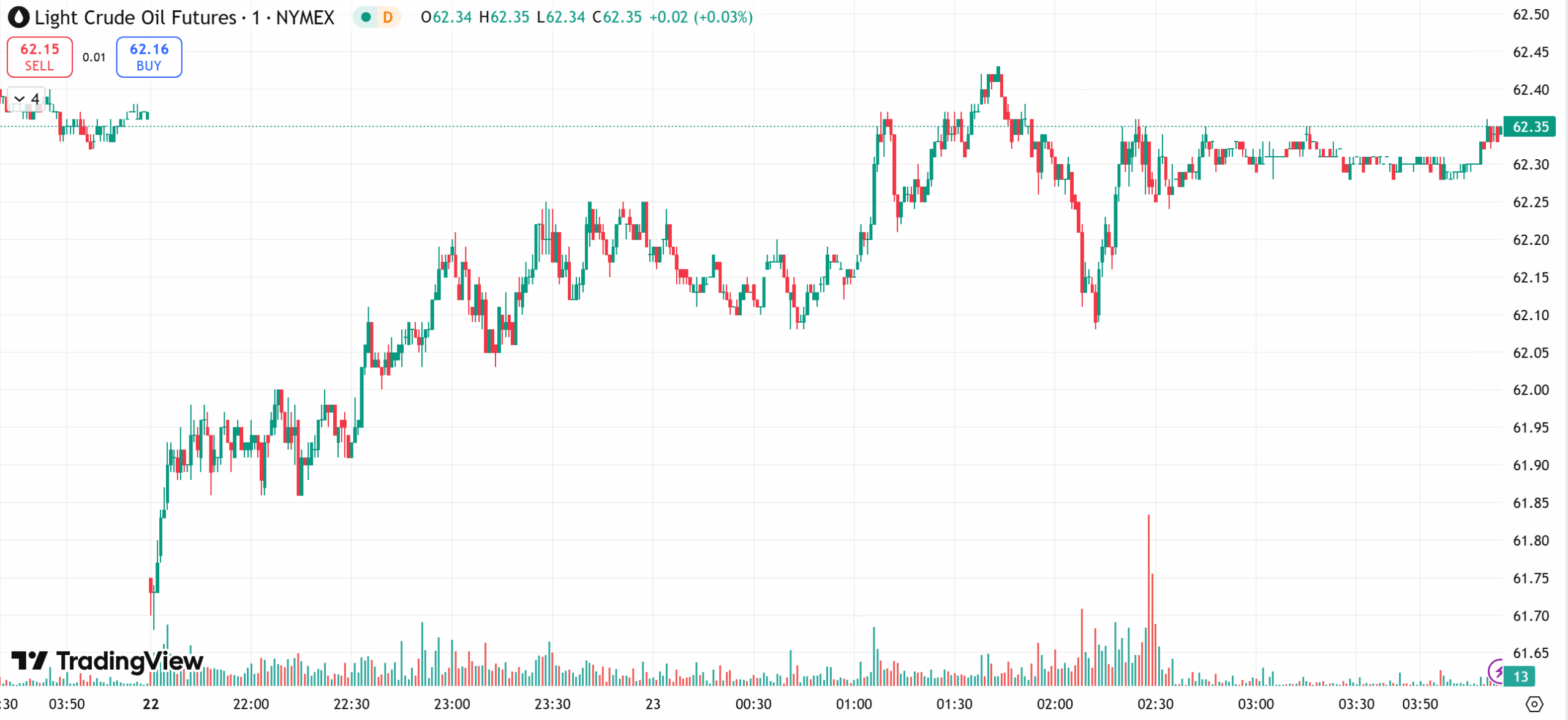

Meanwhile, US crude traded near $62.30 per barrel, edging lower as oversupply concerns outweighed geopolitical risks stemming from Russia and the Middle East.

Gold

Gold surged nearly 2% on Monday to a new record high of $3,748.62 per ounce. Spot gold gained 1.7%, while December US gold futures rose 1.9% to $3,775.10.

Fed Governor Milan said the central bank should act aggressively with rate cuts to mitigate economic risks. Last week’s 25-basis-point reduction was the first since December, with the Fed signaling willingness to ease further.

Jim Wyckoff, Senior Analyst at Kitco Metals, noted that safe-haven demand remains robust against a backdrop of global uncertainty, including the Russia–Ukraine war. “The Fed’s recent cut, along with the likelihood of more before year-end, is also a supportive factor,” he said.

Han Tan, Chief Market Analyst at Nemo.money, added that silver could have further upside as investors look beyond record gold levels.

Technically, gold showed choppy but bullish action last week. After swings earlier in the week, Friday saw a sharp rebound above $3,630, breaking a two-day losing streak and extending a five-week winning run on the weekly chart. Data from the world’s largest gold ETF showed an inflow of more than 18 tons in September, underscoring bullish sentiment. With expectations of a Fed easing cycle taking hold and geopolitical risks intensifying in the Middle East and Eastern Europe, the medium-to-long-term outlook for gold remains strongly supported.

Gold Technical Outlook:

- Strategy: Buy on dips, sell on rebounds

- Resistance: $3,760–$3,770

- Support: $3,730–$3,720

Oil

Crude oil futures slipped, with Brent closing down 0.2% at $66.57 per barrel. WTI’s expiring October contract settled at $62.64 (–0.1%), while the more active November contract fell 0.2% to $62.28. Oil has remained range-bound between $65.50 and $69 since early August.

Dennis Kissler, Senior VP of Trading at BOK Financial, warned that oversupply fears are resurfacing unless the US and EU impose stricter tariffs on nations buying Russian crude.

Iraq’s state oil marketer SOMO confirmed rising exports in line with OPEC+ commitments, expecting September shipments between 3.40–3.45 million barrels per day. Kuwait’s Oil Minister Tariq Al-Roumi added that the country’s production capacity has reached 3.2 million barrels per day, the highest in over a decade.

Technically, oil remains weak. Daily charts show a narrow base forming after consecutive down days, with repeated failures to hold above key averages. On the hourly chart, WTI broke below $62.30 support, extending its slide with moving averages aligned bearishly. Short-term trend signals point lower.

Oil Technical Outlook:

- Strategy: Sell on rebounds, buy selectively on dips

- Resistance: $63.5–$64.5

- Support: $61.0–$60.0

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.