1. Forex Market Insight

EUR/USD

Last week, the euro underperformed against the dollar, closing down by 0.58%, interrupting the previous four weeks of gains to close at 1.1345.

It was difficult for the euro to rebound sharply against the dollar ahead of the FOMC meeting. Pressured by policy differences between Europe and the United States, the European Central Bank President Lagarde’s dovish remarks and the safe-haven dollar weighed on the exchange rate.

Plus, the difference between the ECB and the more hawkish Federal Reserve continues to weigh on the euro against the dollar.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1357-line. If the euro runs steadily below the 1.1357-line, we will pay attention to the support strength of 1.1315 and 1.1267 below. If the euro strength breaks above the 1.1357-line, we will pay attention to the suppression strength of the two positions of 1.1378 and 1.1401.

GBP Intraday Trend Analysis

Fundamental Analysis:

UK inflation soared to a 30-year high. Market surveys expect the Bank of England, the first major central bank to raise interest rates since the outbreak, to continue to advance the tightening cycle next month.

The survey shows the central bank raised interest rates in February with a 25 basis point probability of 87%, and the forecast for the rate hike in 2022 is more than 100 basis points.

Strong interest rate hike is expected to support the strong rise in the pound, once hitting a 23-month high against the euro, but the poor performance of retail sales data put the pound under pressure.

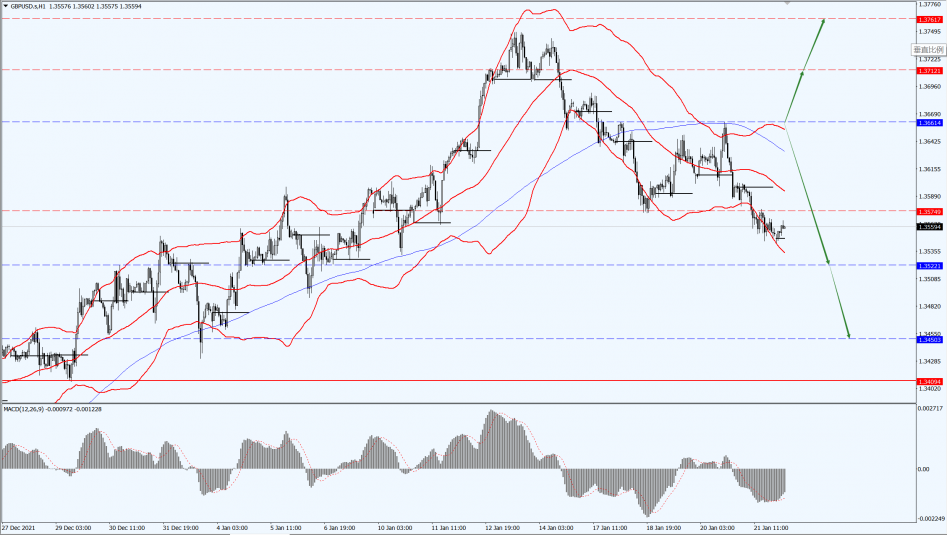

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3661-line today. If the pound runs above the 1.3661-line, it will pay attention to the suppression strength of the 1.3712 and 1.3761 positions. If the pound runs below the 1.3661-line, it will pay attention to the support strength of the 1.3522 and 1.3450 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Last week, gold prices fell slightly for the second day in a row, affected by a general pullback in asset prices.

However, the stock market selloff and the dollar pullback both limited gold’s decline, and the geopolitical crisis between Russia and Ukraine also put gold in favor.

This week, we will focus on Thursday, 27th January 2022, morning’s Federal Reserve resolution. In addition, the U.S. PCE price index and four-quarter GDP are also worth focusing on.

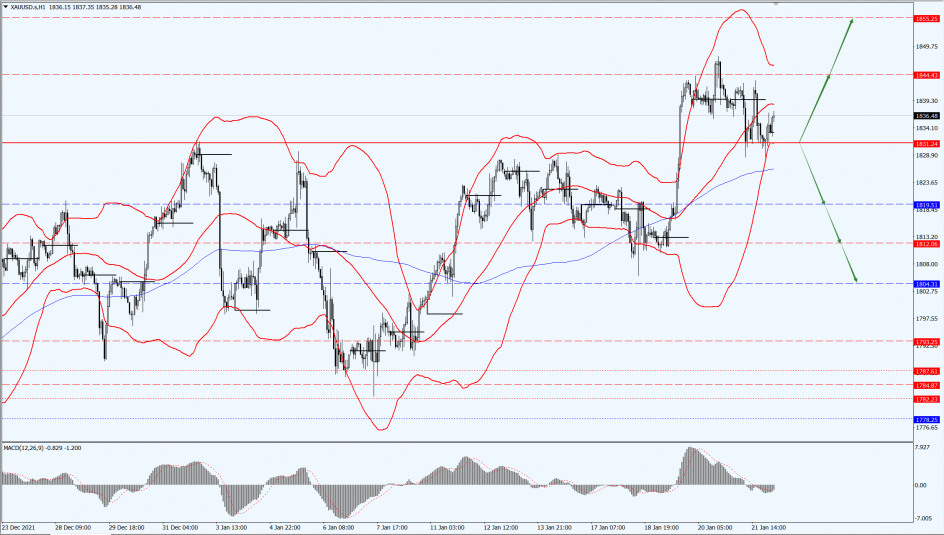

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1831-line today. If the gold price runs steadily above the 1831-line, then pay attention to the suppression strength of the 1844 and 1855 positions. If the gold price falls below the 1831-line, it will open up further callback space. At that time, pay attention to the strength of 1819 and 1804.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices retreated on Friday, 21st January 2022, after hitting a seven-year high last week as investors closed out profits, coupled with increased inventories and lower U.S. stocks.

However, market sentiment remains bullish on oil prices, with OPEC+ production cut agreement implementation rates rising and U.S. Treasury Secretary Yellen also optimistic about the U.S. economy.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

The oil price is focused on the 85-line today. If the oil price runs below the 85-line, then it will pay attention to the support strength of the 82.83 and 80 positions. If the oil price runs above the 85-line, then pay attention to the suppression of the 87-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home