Now could be the best time to become an investor or learn the craft of trading. Because as AI wipes out jobs, you’ll need a skill to generate income in a world that’s changing fast. Artificial Intelligence isn’t just an exciting tech trend; it’s becoming a real threat to jobs, and fast.

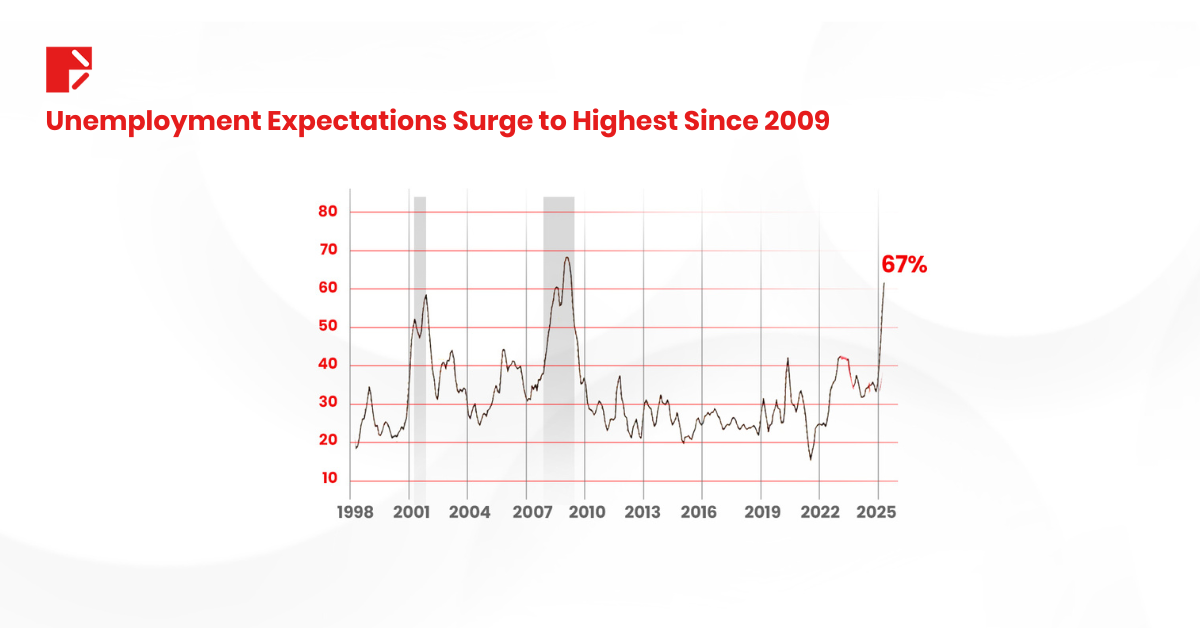

The latest warnings about AI unemployment are hard to ignore.

Anthropic’s CEO recently said AI could wipe out half of all entry-level white-collar jobs and drive unemployment to 10-20% within five years.

This isn’t your regular tech evolution. It’s an economic shockwave. So how should investors respond?

The AI Job Crash Won’t Wait for You

Technological disruption is nothing new. From steam engines to smartphones, innovation has always changed how we work. But what’s different now is the speed of change.

AI doesn’t just automate; it learns, adapts, and scales without fatigue. And that makes it uniquely dangerous for large swaths of the job market.

Dr. David Danks said it bluntly:

“If entire sectors are devastated, you will have 90% unemployment in two months. That’s not something we’ve ever seen before. We won’t have time to adjust.”

Industries like customer support, data entry, legal assistance, financial analysis, media and content creation are already feeling the pinch.

The threat is no longer theoretical. Companies are actively reducing headcount, not because they’re struggling, but because AI makes their operations leaner and faster.

The AI Unemployment Wave: A Reality Check

The integration of AI into business operations is leading to significant workforce reductions across major tech companies. These layoffs are not just numbers; they reflect a broader shift in how businesses are leveraging AI to streamline operations, often at the expense of human jobs.

Microsoft has recently laid off over 6,000 employees, including software engineers and project managers, as part of a restructuring to focus more on AI infrastructure.

LinkedIn, a Microsoft subsidiary, announced the layoff of 281 employees in California, affecting software engineers and machine learning specialists.

Dell Technologies has reduced its global workforce by 12,000 jobs, shrinking from 120,000 to 108,000 employees, as it pivots towards AI products and services.

Workday, known for its human resources software, laid off 1,750 employees, about 8.5% of its workforce, to invest more in AI-driven growth.

These examples underscore a growing trend: as companies adopt AI technologies, they often restructure their workforces, leading to job losses in certain areas while creating opportunities in others.

For investors, this shift presents both challenges and opportunities, emphasizing the need to stay informed and adaptable in an evolving market landscape.

What If AI Unemployment Spikes?

Historically, a rise in unemployment above 5% has been a strong warning sign for markets. Why? Because fewer jobs means:

- Less consumer spending

- Slower economic growth

- Lower corporate profits

- And ultimately, market corrections or recessions

If AI drives a massive employment shock, we could see a sharp downturn in economic activity. That’s the kind of thing markets price in fast.

So while today’s equity indexes are riding high on innovation hype, don’t be surprised if jobless claims become the next major market-moving data point.

Will the Fed Step In?

The Federal Reserve is watching the job market closely. If unemployment rises dramatically, history suggests the Fed will intervene.

Just like in 2020, the most likely tools are:

- Rate cuts

- QE-style liquidity injections

- Fiscal support packages

This could lead to a paradox: a weakening economy with rising unemployment, but a recovering or even booming stock market driven by stimulus.

It’s a setup similar to the COVID-era playbook. The market bounces before the economy does.

So yes, AI-induced unemployment may create pain, but also opportunity for investors who can think ahead.

The Silver Lining: Productivity and Profits

Despite the job risk, AI is also boosting productivity. For companies that embrace it early, margins can improve, speed goes up, and costs drop.

That could be bullish for:

- Big Tech stocks

- Cloud service providers

- Chipmakers like Nvidia and AMD

- AI infrastructure plays

- Select software firms

The key is to identify companies using AI to grow, not just to cut costs.

Sectors at Risk vs. Sectors to Watch

This isn’t the time to panic. It’s time to adapt.

Long-Term Outlook: Human Adaptation

Jobs will vanish. But new ones will emerge. For example:

- AI trainers

- Prompt engineers

- AI risk and ethics officers

- Automation consultants

Still, there will be a lag between job losses and job creation. That’s where the biggest social and economic risks lie.

Governments and corporations must stop sugarcoating the threat and start investing in retraining and adaptation programs today.

Investor Mindset: Be Ahead of the Curve

As an investor or trader, your job is to anticipate what others ignore.

If mass unemployment becomes the story of the next decade, the most prepared market participants will be those who:

- Understand macro shifts

- Follow the money (into AI winners)

- Hedge for volatility

- Stay flexible in uncertain times

In short: there is no need to fear AI unemployment. You just need to prepare for it.

AI Unemployment: Key Takeaways

AI unemployment is no longer a sci-fi scenario. It’s a fast-approaching reality that could reshape the job market, the economy, and your portfolio.

But every disruption carries opportunity.

The market will adjust. New leaders will emerge. And smart investors will use this moment not to panic, but to position themselves ahead of the curve.

Now is the time to skill up, get informed, and take control of your financial future.

Because while AI might take jobs, it can’t take your edge, unless you let it.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.