The AI race just got even hotter.

After OpenAI announced fresh collaborations with major chipmakers, AMD stock shot to new highs, leaving investors wondering if it’s finally catching up to Nvidia (NVDA) in the trillion-dollar AI chip race.

The question now: is this just another short-term rally? Or a real shift in the balance of power inside the AI hardware world?

AMD’s Secret Advantage: The AI Infrastructure Play

When most people think of AMD, they think of CPUs and gaming GPUs.

But AMD’s next chapter goes far beyond that. The company is now positioning itself at the heart of AI infrastructure, the racks, chips, and systems that power data centers running models like ChatGPT.

At the center of that strategy lies the AMD Helios platform. It is a new rack-scale AI system designed to directly compete with Nvidia’s supercomputing setups. Helios integrates AMD AI chips, networking components, and memory in one unified package.

Why does that matter? Because the real AI race isn’t just about GPUs anymore. It’s about who can deliver entire systems faster and more efficiently.

Is the OpenAI Deal a Turning Point for AMD?

In early October, reports surfaced of a new AMD OpenAI partnership, marking a potential game-changer for the company’s AI ambitions.

OpenAI, the powerhouse behind ChatGPT, is diversifying its hardware dependencies, moving beyond Nvidia to ensure better supply and cost efficiency.

For AMD, that’s massive. Getting its chips inside OpenAI’s infrastructure signals growing trust in the chip’s AI data center solutions. And investors noticed.

AI Market Cap Added $630 Billion Overnight

When OpenAI’s partnerships were announced, the combined market cap of Broadcom, Oracle, Nvidia, and AMD surged by over $630 billion in a single trading day; a reflection of just how powerful the AI narrative remains.

Among them, AMD’s stock was the clear standout, soaring nearly 50% in just weeks.

The excitement wasn’t just about hype; it was about potential.

If OpenAI, the world’s most influential AI lab, starts using the chipmaker’s hardware, that could mark the beginning of a long-awaited balance in the AMD vs NVDA battle.

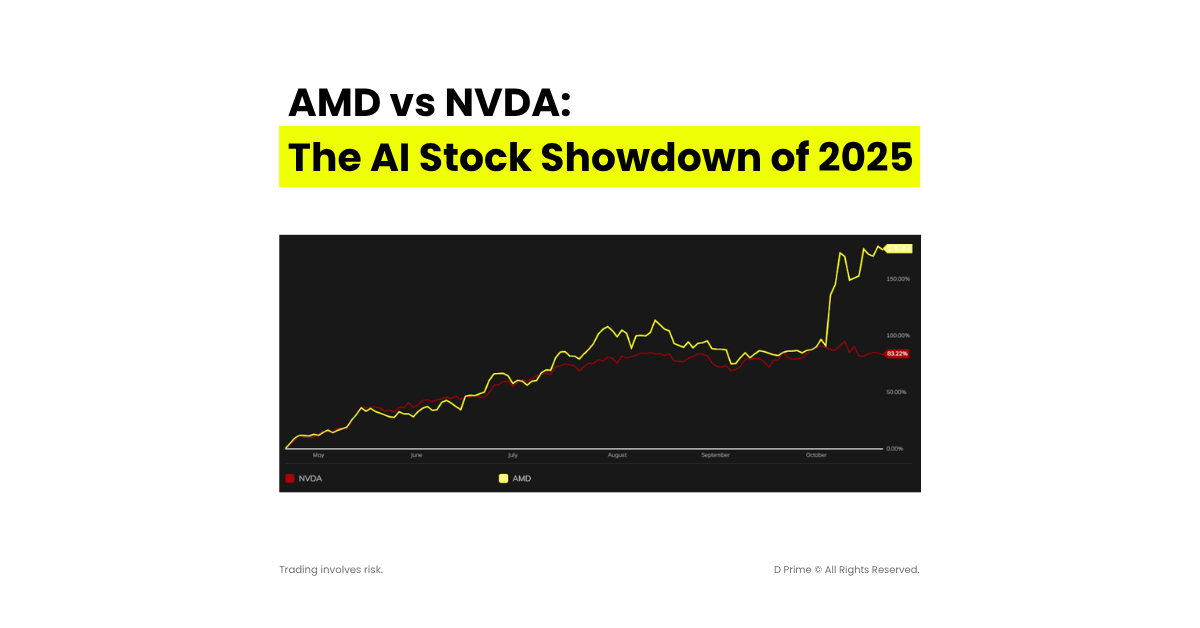

AMD vs NVDA: The Ultimate AI War

The AI stock war between AMD and Nvidia (NVDA) has officially gone to the next level.

Over the past six months, AMD has surged nearly 176%, far outpacing Nvidia’s 83% gain. A stunning reversal for a company that’s long been the underdog.

In market cap terms, Nvidia still dominates with roughly $2.8 trillion, compared to AMD’s $650 billion. However, the gap is starting to narrow.

While Nvidia remains the go-to name for AI chips, AMD’s recent OpenAI partnership and the rollout of its Helios platform are giving investors fresh reasons to believe it can capture a bigger share of the booming AI data center market.

If this momentum continues, 2025 could mark the first time the chipmaker truly challenges Nvidia’s long-standing dominance in AI hardware.

Can AMD Really Compete With Nvidia’s AI Dominance?

Let’s be real, Nvidia still rules the AI chip kingdom.

Its GPUs, software stack (CUDA), and developer ecosystem give it a massive lead. But AMD is no longer just playing catch-up; it’s attacking from a different angle.

Through the AMD Helios platform, the company aims to offer flexible, open-source, and cost-efficient alternatives to Nvidia’s closed ecosystem.

In other words, while Nvidia builds “walled gardens,” AMD is building an “open field”. One that cloud providers and AI startups can customize and scale.

That’s exactly why the AI market in 2025 could look very different from today.

How the AI Market 2025 Is Shaping Up

Analysts expect global AI infrastructure spending to exceed $400 billion by 2025.

That includes chips, servers, networking, and full-stack systems. AMD is aiming to claim a much bigger slice of that pie.

Its newest AMD AI chips, including the MI450 series, are designed for massive AI workloads like model training and inference.

Paired with its Helios racks and growing AI data center partnerships, AMD is no longer the “alternative”; it’s becoming a serious contender.

The AMD OpenAI deal is just the first spark. If the AI chipmaker can secure follow-up contracts with other hyperscalers, like Amazon, Google, or Meta, its revenue mix could shift dramatically toward AI.

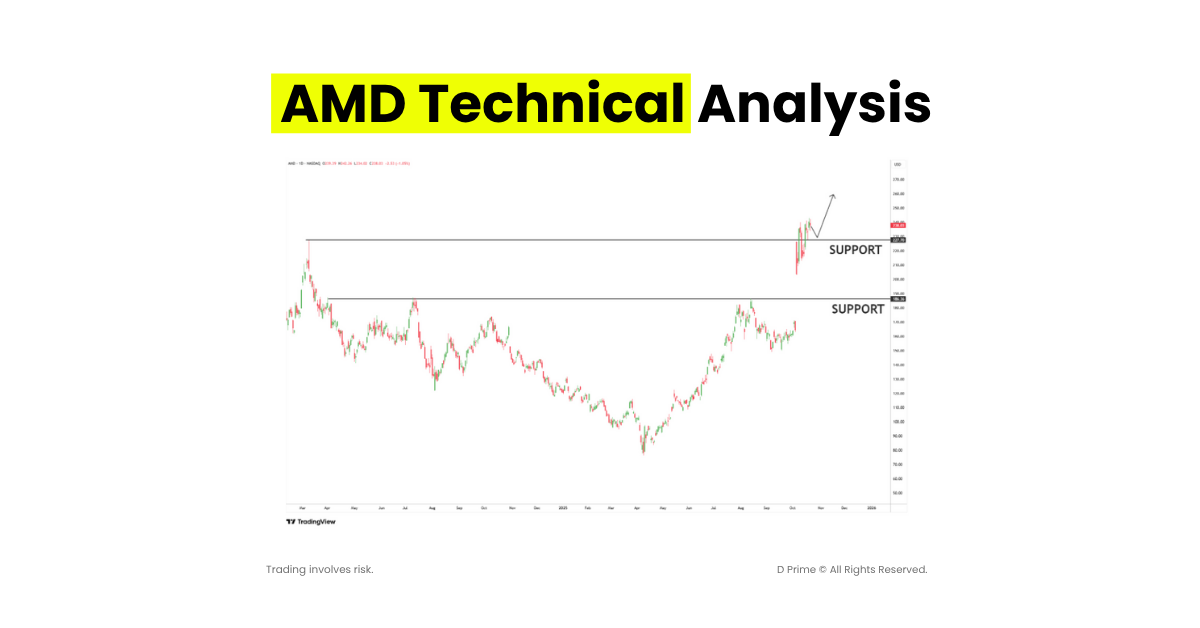

Technical Analysis: AMD Stock at a Breakout Zone

From a technical perspective, AMD stock has broken above a key resistance zone around the $180 level towards an all-time high supported by strong volume.

If momentum stays strong, the rally could continue breaking record highs in the coming weeks and months.

Short-term traders might watch for a retest of the $227 and the $200 psychological level.

Any dip back below $180 could trigger further pullback, but the overall trend remains positive for now.

The Bottom Line: A New Era for AMD

The OpenAI partnership could mark the start of something big for AMD, not just another chip cycle, but a transformation into a full-scale AI infrastructure leader.

The company’s Helios platform, expanding partnerships, and surging AI data center presence position it well for the booming AI market of 2025.

Still, the race isn’t over. Nvidia’s lead remains deep, and execution will determine whether AMD can truly turn this breakthrough into long-term market share gains.

For now, one thing’s certain, AMD’s story has entered a new chapter, and investors around the world are paying close attention.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.