The Federal Reserve just shifted its tone. September’s FOMC meeting could be the turning point. Powell’s latest comments weren’t just dovish; they opened the door to the first rate cut in over two years.

Historically, gold thrives when the Fed cuts rates.

But this time, the stakes are higher. Inflation’s cooling, liquidity is primed to return, and gold is already flirting with record highs.

The question traders are asking: Could this setup push gold toward $4,000?

Powell’s Dovish Pivot

For most of the past two years, Powell’s playbook was simple: keep rates high, crush inflation, and tighten financial conditions. But markets are forward-looking, and they just got a signal.

In his latest remarks, Powell acknowledged slowing growth and hinted at policy easing ahead. Fed funds futures now price in a 80% chance of a September cut. That shift isn’t minor; it changes the entire macro map for commodities.

Lower rates mean:

- A weaker US dollar, making gold cheaper globally.

- Falling real yields, reducing the opportunity cost of holding gold.

- More liquidity, pushing investors toward hard assets.

It’s the kind of setup that often brings volatility, and historically, gold has tended to respond during these periods.

Gold’s History Doesn’t Lie

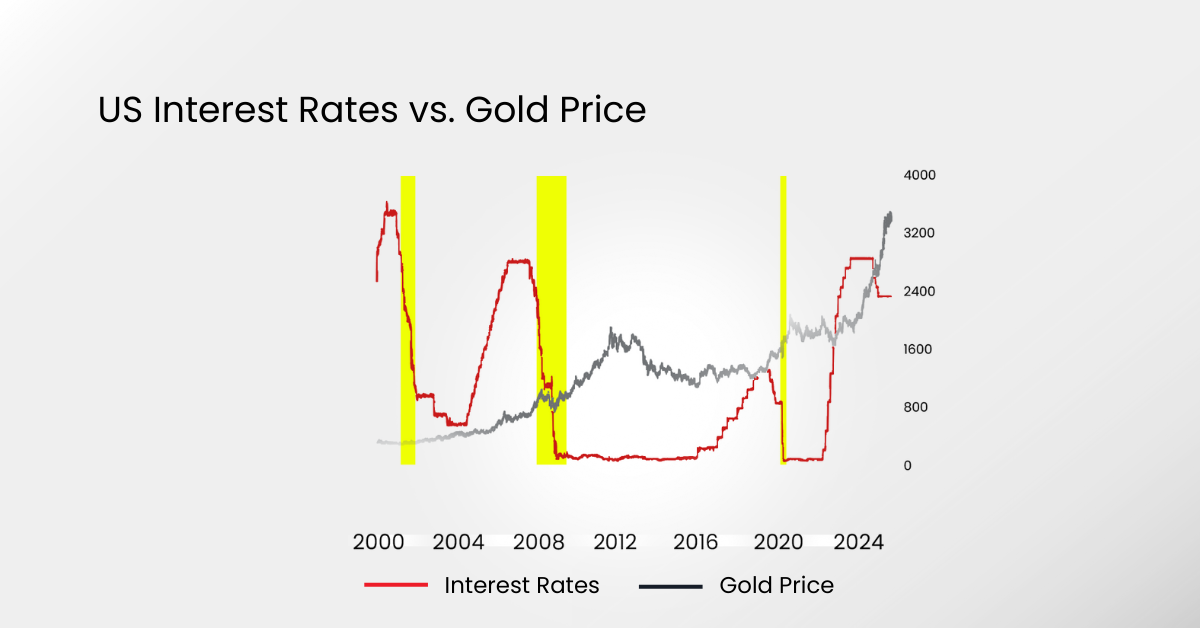

Look at the chart. Every major Fed cutting cycle in the past two decades has triggered massive gold rallies:

- 2001–2003: The Fed slashed rates, and gold nearly doubled.

- 2008–2011: In the aftermath of the financial crisis, gold ran from $700 to $1,900.

- 2020 pandemic cuts: The Fed went zero-bound, and gold smashed through $2,000 for the first time ever.

This isn’t a coincidence. It’s pattern recognition. When liquidity returns, money floods into scarce assets and gold shines brightest.

The 2025 Gold Setup: Why This Time Feels Different

Gold isn’t starting from the bottom this time. It’s already trading around $3,350, sitting on all-time highs. Yet, here’s the kicker: speculative positioning hasn’t gone parabolic. Traders are cautious, waiting for confirmation.

That’s the fuel. If the Fed delivers a cut, sidelined capital could pour in fast. With demand rising from central banks and ETFs already stockpiling reserves, even a small sentiment shift could set off a chain reaction.

The $3,500 Level: The Line in the Sand

For traders, the chart couldn’t be clearer. $3,500 is the ceiling. That’s where sellers step in, and buyers hesitate. But if gold breaks and holds above this level, momentum algorithms, hedge funds, and institutions could all trigger fresh inflows.

From there, the next psychological milestone is $4,000. Based on historical behavior and the macro backdrop, that target is not a fantasy. It’s a possibility supported by years of cutting-cycle data.

Market Psychology: Why Everyone’s Watching Gold

This isn’t just about fundamentals. This is sentiment. In times of easing, gold isn’t just a hedge, it’s a narrative asset.

- Investors see safety.

- Traders see breakout setups.

- Institutions see portfolio protection.

That trifecta attracts capital across the board. And when all three overlap, you get momentum-driven rallies, the kind that break records.

Risks to the Gold’s Bull Case

Of course, there’s no straight line up. Traders need to watch three things:

- The September FOMC decision: A surprise pause could crush short-term momentum.

- The US dollar index (DXY): If the dollar strengthens sharply, gold’s upside may stall.

- Real yields: Higher real yields historically cap gold rallies.

The path to $4,000 isn’t guaranteed. But history says it’s worth keeping on your radar.

What to Watch Next

- Positioning Data: Are funds adding exposure?

- ETF Flows: A spike in inflows often signals breakout conviction.

- Liquidity Trends: More liquidity equals more upside, simple as that.

If the Fed delivers, gold isn’t just trading on price anymore. It trades on narrative, flows, and momentum, all pointing in the same direction.

Key Takeaways from Rate Cuts and Gold

Rate cuts are coming, and gold’s playbook hasn’t changed. History shows every major easing cycle pushes prices higher. But this setup is bigger: liquidity, positioning, and technicals are all aligning.

The breakout level is $3,500. If gold clears it with conviction, $4,000 is on the table this cycle.

For traders, this isn’t about guessing headlines. It’s about recognizing when the market’s macro fuel is lining up. And right now, gold has a full tank.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.